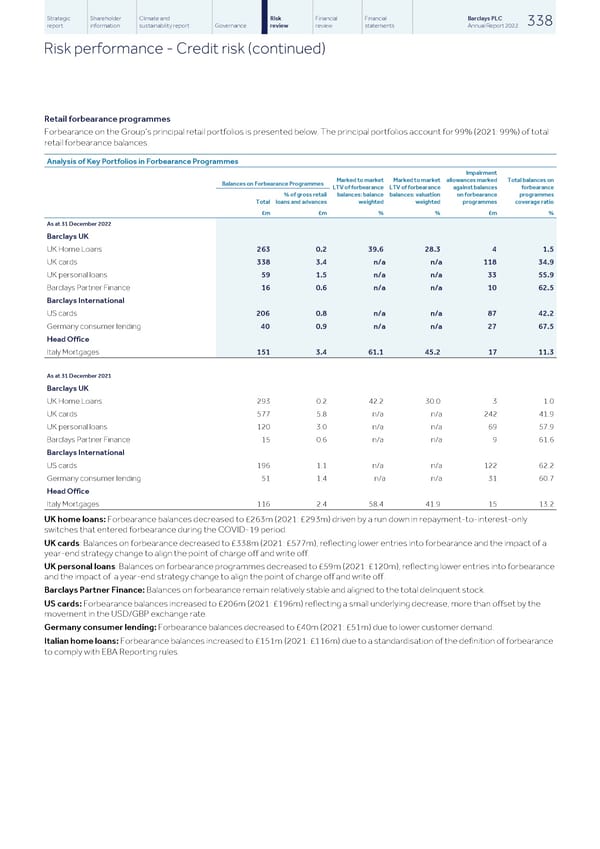

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 338 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Credit risk (continued) Retail forbearance programmes Forbearance on the Group’s principal retail portfolios is presented below. The principal portfolios account for 99% (2021: 99%) of total retail forbearance balances. Analysis of Key Portfolios in Forbearance Programmes Impairment Marked to market Marked to market allowances marked Total balances on Balances on Forbearance Programmes LTV of forbearance LTV of forbearance against balances forbearance % of gross retail balances: balance balances: valuation on forbearance programmes Total loans and advances weighted weighted programmes coverage ratio £m £m % % £m % As at 31 December 2022 Barclays UK UK Home Loans 263 0.2 39.6 28.3 4 1.5 UK cards 338 3.4 n/a n/a 118 34.9 UK personal loans 59 1.5 n/a n/a 33 55.9 Barclays Partner Finance 16 0.6 n/a n/a 10 62.5 Barclays International US cards 206 0.8 n/a n/a 87 42.2 Germany consumer lending 40 0.9 n/a n/a 27 67.5 Head Office Italy Mortgages 151 3.4 61.1 45.2 17 11.3 As at 31 December 2021 Barclays UK UK Home Loans 293 0.2 42.2 30.0 3 1.0 UK cards 577 5.8 n/a n/a 242 41.9 UK personal loans 120 3.0 n/a n/a 69 57.9 Barclays Partner Finance 15 0.6 n/a n/a 9 61.6 Barclays International US cards 196 1.1 n/a n/a 122 62.2 Germany consumer lending 51 1.4 n/a n/a 31 60.7 Head Office Italy Mortgages 116 2.4 58.4 41.9 15 13.2 UK home loans: Forbearance balances decreased to £263m (2021: £293m) driven by a run down in repayment-to-interest-only switches that entered forbearance during the COVID-19 period. UK cards: Balances on forbearance decreased to £338m (2021: £577m), reflecting lower entries into forbearance and the impact of a year-end strategy change to align the point of charge off and write off. UK personal loans: Balances on forbearance programmes decreased to £59m (2021: £120m), reflecting lower entries into forbearance and the impact of a year-end strategy change to align the point of charge off and write off. Barclays Partner Finance: Balances on forbearance remain relatively stable and aligned to the total delinquent stock. US cards: Forbearance balances increased to £206m (2021: £196m) reflecting a small underlying decrease, more than offset by the movement in the USD/GBP exchange rate. Germany consumer lending: Forbearance balances decreased to £40m (2021: £51m) due to lower customer demand. Italian home loans: Forbearance balances increased to £151m (2021: £116m) due to a standardisation of the definition of forbearance to comply with EBA Reporting rules.

Barclays PLC - Annual Report - 2022 Page 339 Page 341

Barclays PLC - Annual Report - 2022 Page 339 Page 341