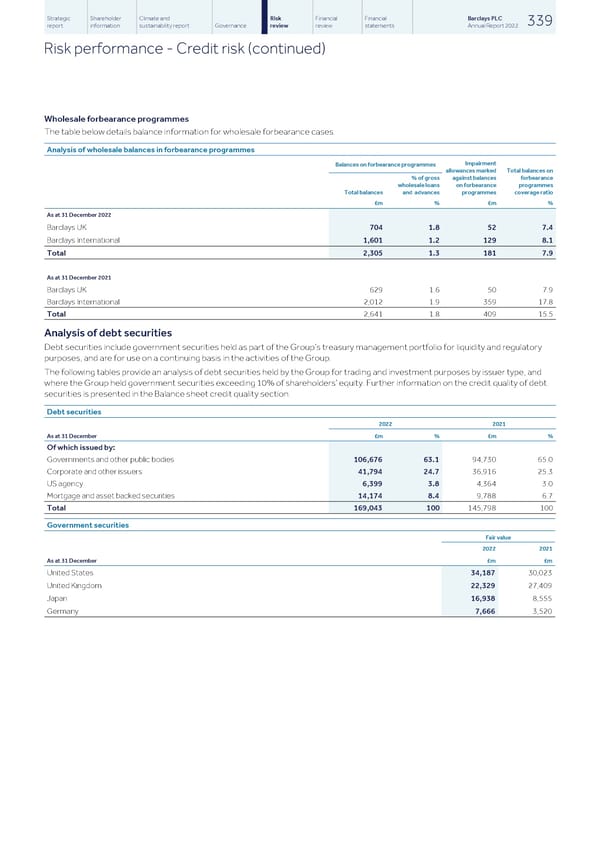

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 339 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Credit risk (continued) Wholesale forbearance programmes The table below details balance information for wholesale forbearance cases. Analysis of wholesale balances in forbearance programmes Impairment Balances on forbearance programmes allowances marked Total balances on % of gross against balances forbearance wholesale loans on forbearance programmes Total balances and advances programmes coverage ratio £m % £m % As at 31 December 2022 Barclays UK 704 1.8 52 7.4 Barclays International 1,601 1.2 129 8.1 Total 2,305 1.3 181 7.9 As at 31 December 2021 Barclays UK 629 1.6 50 7.9 Barclays International 2,012 1.9 359 17.8 Total 2,641 1.8 409 15.5 Analysis of debt securities Debt securities include government securities held as part of the Group’s treasury management portfolio for liquidity and regulatory purposes, and are for use on a continuing basis in the activities of the Group. The following tables provide an analysis of debt securities held by the Group for trading and investment purposes by issuer type, and where the Group held government securities exceeding 10% of shareholders’ equity. Further information on the credit quality of debt securities is presented in the Balance sheet credit quality section. Debt securities 2022 2021 As at 31 December £m % £m % Of which issued by: Governments and other public bodies 106,676 63.1 94,730 65.0 Corporate and other issuers 41,794 24.7 36,916 25.3 US agency 6,399 3.8 4,364 3.0 Mortgage and asset backed securities 14,174 8.4 9,788 6.7 Total 169,043 100 145,798 100 Government securities Fair value 2022 2021 As at 31 December £m £m United States 34,187 30,023 United Kingdom 22,329 27,409 Japan 16,938 8,555 Germany 7,666 3,520

Barclays PLC - Annual Report - 2022 Page 340 Page 342

Barclays PLC - Annual Report - 2022 Page 340 Page 342