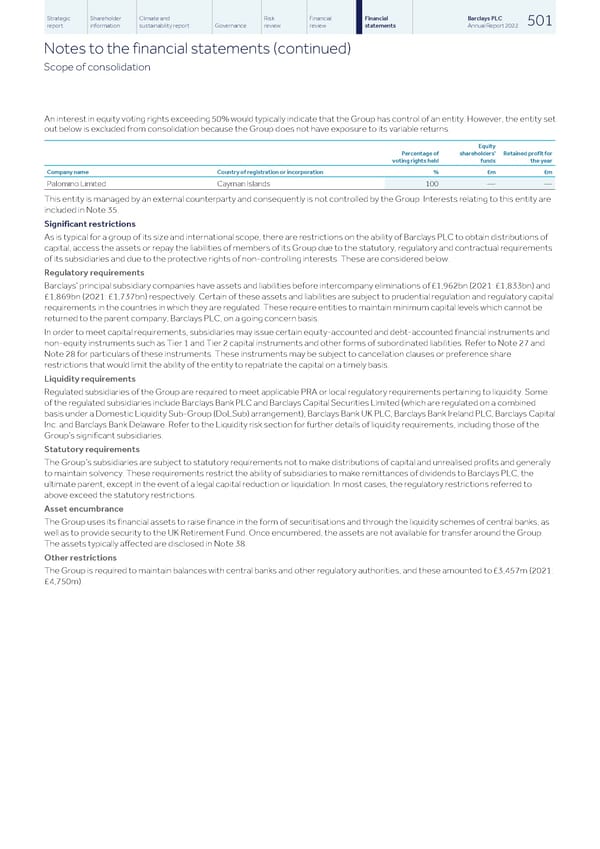

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 501 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Scope of consolidation An interest in equity voting rights exceeding 50% would typically indicate that the Group has control of an entity. However, the entity set out below is excluded from consolidation because the Group does not have exposure to its variable returns. Equity Percentage of shareholders' Retained profit for voting rights held funds the year Company name Country of registration or incorporation % £m £m Palomino Limited Cayman Islands 100 — — This entity is managed by an external counterparty and consequently is not controlled by the Group. Interests relating to this entity are included in Note 35. Significant restrictions As is typical for a group of its size and international scope, there are restrictions on the ability of Barclays PLC to obtain distributions of capital, access the assets or repay the liabilities of members of its Group due to the statutory, regulatory and contractual requirements of its subsidiaries and due to the protective rights of non-controlling interests. These are considered below. Regulatory requirements Barclays’ principal subsidiary companies have assets and liabilities before intercompany eliminations of £1,962bn (2021: £1,833bn) and £1,869bn (2021: £1,737bn) respectively. Certain of these assets and liabilities are subject to prudential regulation and regulatory capital requirements in the countries in which they are regulated. These require entities to maintain minimum capital levels which cannot be returned to the parent company, Barclays PLC, on a going concern basis. In order to meet capital requirements, subsidiaries may issue certain equity-accounted and debt-accounted financial instruments and non-equity instruments such as Tier 1 and Tier 2 capital instruments and other forms of subordinated liabilities. Refer to Note 27 and Note 28 for particulars of these instruments. These instruments may be subject to cancellation clauses or preference share restrictions that would limit the ability of the entity to repatriate the capital on a timely basis. Liquidity requirements Regulated subsidiaries of the Group are required to meet applicable PRA or local regulatory requirements pertaining to liquidity. Some of the regulated subsidiaries include Barclays Bank PLC and Barclays Capital Securities Limited (which are regulated on a combined basis under a Domestic Liquidity Sub-Group (DoLSub) arrangement), Barclays Bank UK PLC, Barclays Bank Ireland PLC, Barclays Capital Inc. and Barclays Bank Delaware. Refer to the Liquidity risk section for further details of liquidity requirements, including those of the Group’s significant subsidiaries. Statutory requirements The Group’s subsidiaries are subject to statutory requirements not to make distributions of capital and unrealised profits and generally to maintain solvency. These requirements restrict the ability of subsidiaries to make remittances of dividends to Barclays PLC, the ultimate parent, except in the event of a legal capital reduction or liquidation. In most cases, the regulatory restrictions referred to above exceed the statutory restrictions. Asset encumbrance The Group uses its financial assets to raise finance in the form of securitisations and through the liquidity schemes of central banks, as well as to provide security to the UK Retirement Fund. Once encumbered, the assets are not available for transfer around the Group. The assets typically affected are disclosed in Note 38. Other restrictions The Group is required to maintain balances with central banks and other regulatory authorities, and these amounted to £3,457m (2021: £4,750m).

Barclays PLC - Annual Report - 2022 Page 502 Page 504

Barclays PLC - Annual Report - 2022 Page 502 Page 504