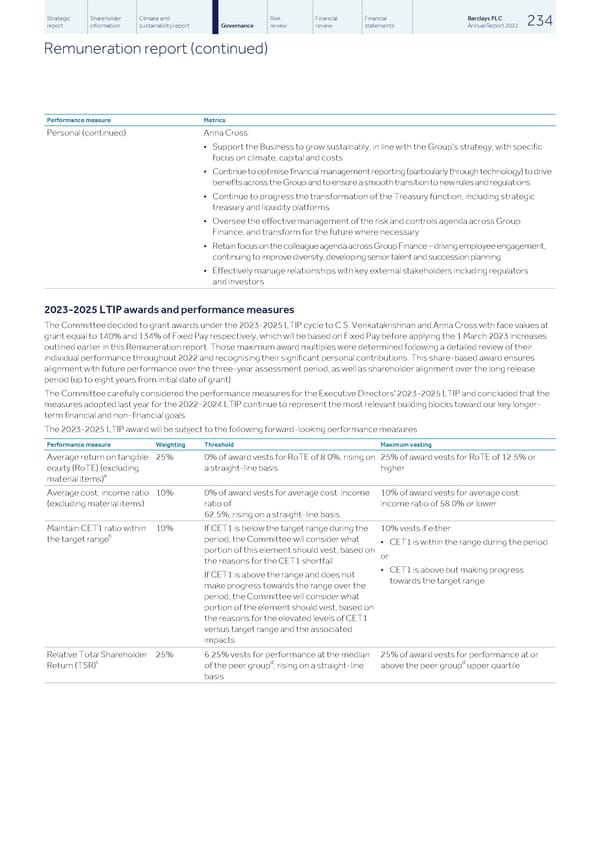

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 234 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Performance measure Metrics Personal (continued) Anna Cross: • Support the Business to grow sustainably, in line with the Group’s strategy, with specific focus on climate, capital and costs • Continue to optimise financial management reporting (particularly through technology) to drive benefits across the Group and to ensure a smooth transition to new rules and regulations • Continue to progress the transformation of the Treasury function, including strategic treasury and liquidity platforms • Oversee the effective management of the risk and controls agenda across Group Finance, and transform for the future where necessary • Retain focus on the colleague agenda across Group Finance – driving employee engagement, continuing to improve diversity, developing senior talent and succession planning • Effectively manage relationships with key external stakeholders including regulators and investors 2023-2025 LTIP awards and performance measures The Committee decided to grant awards under the 2023-2025 LTIP cycle to C.S. Venkatakrishnan and Anna Cross with face values at grant equal to 140% and 134% of Fixed Pay respectively, which will be based on Fixed Pay before applying the 1 March 2023 increases outlined earlier in this Remuneration report. Those maximum award multiples were determined following a detailed review of their individual performance throughout 2022 and recognising their significant personal contributions. This share-based award ensures alignment with future performance over the three-year assessment period, as well as shareholder alignment over the long release period (up to eight years from initial date of grant). The Committee carefully considered the performance measures for the Executive Directors' 2023-2025 LTIP and concluded that the measures adopted last year for the 2022-2024 LTIP continue to represent the most relevant building blocks toward our key longer- term financial and non-financial goals. The 2023-2025 LTIP award will be subject to the following forward-looking performance measures. Performance measure Weighting Threshold Maximum vesting Average return on tangible 25% 0% of award vests for RoTE of 8.0%, rising on 25% of award vests for RoTE of 12.5% or equity (RoTE) (excluding a straight-line basis higher a material items) Average cost: income ratio 10% 0% of award vests for average cost: income 10% of award vests for average cost: (excluding material items) ratio of income ratio of 58.0% or lower 62.5%, rising on a straight-line basis Maintain CET1 ratio within 10% If CET1 is below the target range during the 10% vests if either: b the target range period, the Committee will consider what • CET1 is within the range during the period portion of this element should vest, based on or the reasons for the CET1 shortfall • CET1 is above but making progress If CET1 is above the range and does not towards the target range make progress towards the range over the period, the Committee will consider what portion of the element should vest, based on the reasons for the elevated levels of CET1 versus target range and the associated impacts Relative Total Shareholder 25% 6.25% vests for performance at the median 25% of award vests for performance at or c d d Return (TSR) of the peer group , rising on a straight-line above the peer group upper quartile basis

Barclays PLC - Annual Report - 2022 Page 235 Page 237

Barclays PLC - Annual Report - 2022 Page 235 Page 237