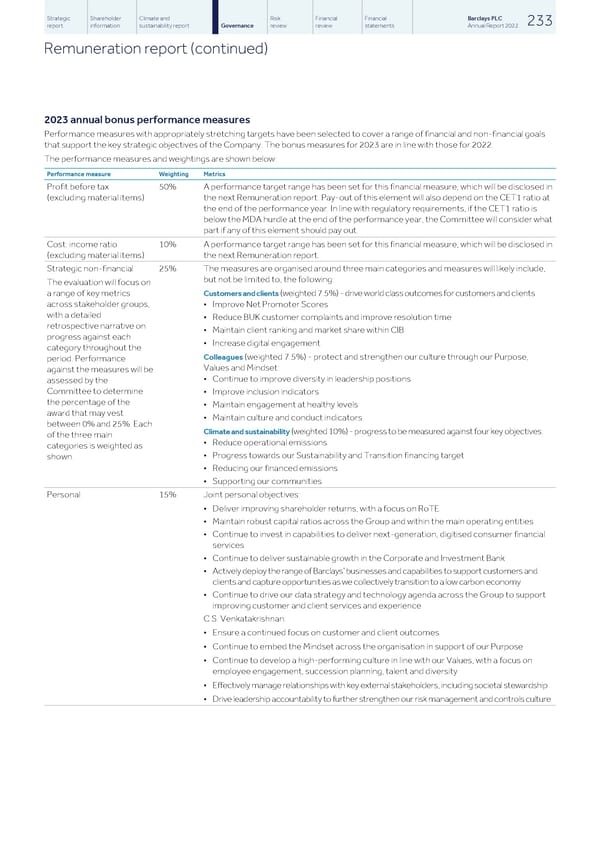

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 233 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) 2023 annual bonus performance measures Performance measures with appropriately stretching targets have been selected to cover a range of financial and non-financial goals that support the key strategic objectives of the Company. The bonus measures for 2023 are in line with those for 2022. The performance measures and weightings are shown below: Performance measure Weighting Metrics Profit before tax 50% A performance target range has been set for this financial measure, which will be disclosed in (excluding material items) the next Remuneration report. Pay-out of this element will also depend on the CET1 ratio at the end of the performance year. In line with regulatory requirements, if the CET1 ratio is below the MDA hurdle at the end of the performance year, the Committee will consider what part if any of this element should pay out. Cost: income ratio 10% A performance target range has been set for this financial measure, which will be disclosed in (excluding material items) the next Remuneration report. Strategic non-financial 25% The measures are organised around three main categories and measures will likely include, but not be limited to, the following: The evaluation will focus on a range of key metrics Customers and clients (weighted 7.5%) - drive world class outcomes for customers and clients across stakeholder groups, • Improve Net Promoter Scores with a detailed • Reduce BUK customer complaints and improve resolution time retrospective narrative on • Maintain client ranking and market share within CIB progress against each • Increase digital engagement category throughout the Colleagues (weighted 7.5%) - protect and strengthen our culture through our Purpose, period. Performance Values and Mindset: against the measures will be • Continue to improve diversity in leadership positions assessed by the Committee to determine • Improve inclusion indicators the percentage of the • Maintain engagement at healthy levels award that may vest • Maintain culture and conduct indicators between 0% and 25%. Each Climate and sustainability (weighted 10%) - progress to be measured against four key objectives: of the three main • Reduce operational emissions categories is weighted as • Progress towards our Sustainability and Transition financing target shown. • Reducing our financed emissions • Supporting our communities Personal 15% Joint personal objectives: • Deliver improving shareholder returns, with a focus on RoTE • Maintain robust capital ratios across the Group and within the main operating entities • Continue to invest in capabilities to deliver next-generation, digitised consumer financial services • Continue to deliver sustainable growth in the Corporate and Investment Bank • Actively deploy the range of Barclays’ businesses and capabilities to support customers and clients and capture opportunities as we collectively transition to a low carbon economy • Continue to drive our data strategy and technology agenda across the Group to support improving customer and client services and experience C.S. Venkatakrishnan: • Ensure a continued focus on customer and client outcomes • Continue to embed the Mindset across the organisation in support of our Purpose • Continue to develop a high-performing culture in line with our Values, with a focus on employee engagement, succession planning, talent and diversity • Effectively manage relationships with key external stakeholders, including societal stewardship • Drive leadership accountability to further strengthen our risk management and controls culture

Barclays PLC - Annual Report - 2022 Page 234 Page 236

Barclays PLC - Annual Report - 2022 Page 234 Page 236