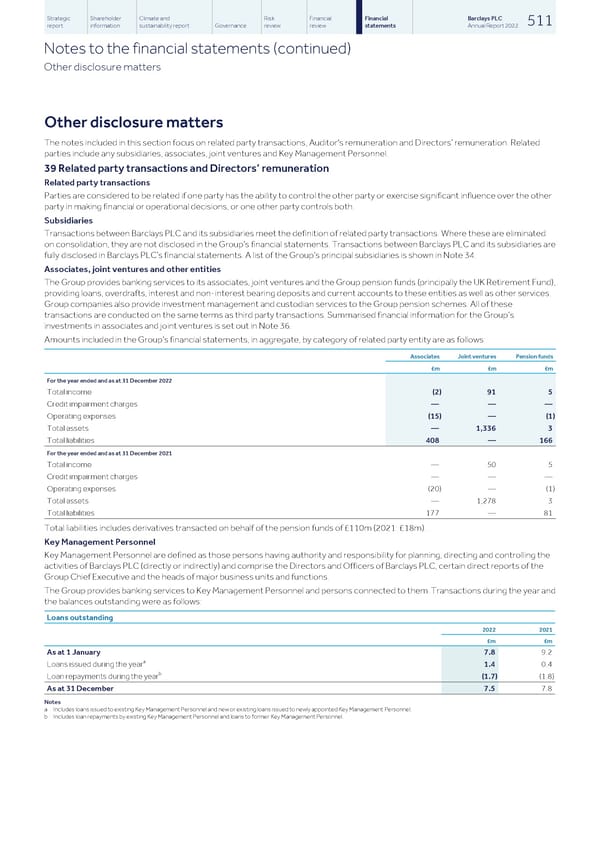

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 511 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Other disclosure matters Other disclosure matters The notes included in this section focus on related party transactions, Auditor's remuneration and Directors’ remuneration. Related parties include any subsidiaries, associates, joint ventures and Key Management Personnel. 39 Related party transactions and Directors’ remuneration Related party transactions Parties are considered to be related if one party has the ability to control the other party or exercise significant influence over the other party in making financial or operational decisions, or one other party controls both. Subsidiaries Transactions between Barclays PLC and its subsidiaries meet the definition of related party transactions. Where these are eliminated on consolidation, they are not disclosed in the Group’s financial statements. Transactions between Barclays PLC and its subsidiaries are fully disclosed in Barclays PLC’s financial statements. A list of the Group’s principal subsidiaries is shown in Note 34. Associates, joint ventures and other entities The Group provides banking services to its associates, joint ventures and the Group pension funds (principally the UK Retirement Fund), providing loans, overdrafts, interest and non-interest bearing deposits and current accounts to these entities as well as other services. Group companies also provide investment management and custodian services to the Group pension schemes. All of these transactions are conducted on the same terms as third party transactions. Summarised financial information for the Group’s investments in associates and joint ventures is set out in Note 36. Amounts included in the Group’s financial statements, in aggregate, by category of related party entity are as follows: Associates Joint ventures Pension funds £m £m £m For the year ended and as at 31 December 2022 Total income (2) 91 5 Credit impairment charges — — — Operating expenses (15) — (1) Total assets — 1,336 3 Total liabilities 408 — 166 For the year ended and as at 31 December 2021 Total income — 50 5 Credit impairment charges — — — Operating expenses (20) — (1) Total assets — 1,278 3 Total liabilities 177 — 81 Total liabilities includes derivatives transacted on behalf of the pension funds of £110m (2021: £18m). Key Management Personnel Key Management Personnel are defined as those persons having authority and responsibility for planning, directing and controlling the activities of Barclays PLC (directly or indirectly) and comprise the Directors and Officers of Barclays PLC, certain direct reports of the Group Chief Executive and the heads of major business units and functions. The Group provides banking services to Key Management Personnel and persons connected to them. Transactions during the year and the balances outstanding were as follows: Loans outstanding 2022 2021 £m £m As at 1 January 7.8 9.2 a Loans issued during the year 1.4 0.4 b Loan repayments during the year (1.7) (1.8) As at 31 December 7.5 7.8 Notes a Includes loans issued to existing Key Management Personnel and new or existing loans issued to newly appointed Key Management Personnel. b Includes loan repayments by existing Key Management Personnel and loans to former Key Management Personnel.

Barclays PLC - Annual Report - 2022 Page 512 Page 514

Barclays PLC - Annual Report - 2022 Page 512 Page 514