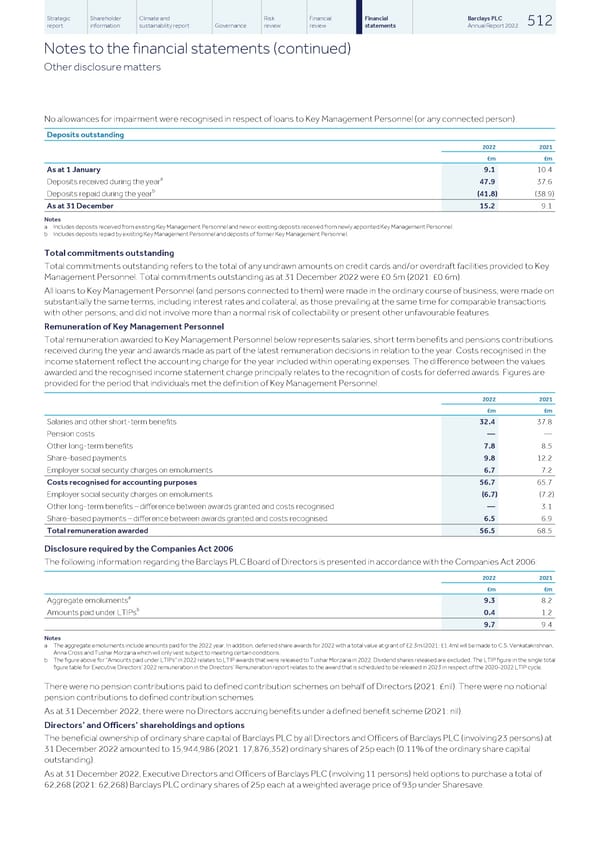

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 512 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Other disclosure matters No allowances for impairment were recognised in respect of loans to Key Management Personnel (or any connected person). Deposits outstanding 2022 2021 £m £m As at 1 January 9.1 10.4 a Deposits received during the year 47.9 37.6 b Deposits repaid during the year (41.8) (38.9) As at 31 December 15.2 9.1 Notes a Includes deposits received from existing Key Management Personnel and new or existing deposits received from newly appointed Key Management Personnel. b Includes deposits repaid by existing Key Management Personnel and deposits of former Key Management Personnel. Total commitments outstanding Total commitments outstanding refers to the total of any undrawn amounts on credit cards and/or overdraft facilities provided to Key Management Personnel. Total commitments outstanding as at 31 December 2022 were £0.5m (2021: £0.6m). All loans to Key Management Personnel (and persons connected to them) were made in the ordinary course of business; were made on substantially the same terms, including interest rates and collateral, as those prevailing at the same time for comparable transactions with other persons; and did not involve more than a normal risk of collectability or present other unfavourable features. Remuneration of Key Management Personnel Total remuneration awarded to Key Management Personnel below represents salaries, short term benefits and pensions contributions received during the year and awards made as part of the latest remuneration decisions in relation to the year. Costs recognised in the income statement reflect the accounting charge for the year included within operating expenses. The difference between the values awarded and the recognised income statement charge principally relates to the recognition of costs for deferred awards. Figures are provided for the period that individuals met the definition of Key Management Personnel. 2022 2021 £m £m Salaries and other short-term benefits 32.4 37.8 Pension costs — — Other long-term benefits 7.8 8.5 Share-based payments 9.8 12.2 Employer social security charges on emoluments 6.7 7.2 Costs recognised for accounting purposes 56.7 65.7 Employer social security charges on emoluments (6.7) (7.2) Other long-term benefits – difference between awards granted and costs recognised — 3.1 Share-based payments – difference between awards granted and costs recognised 6.5 6.9 Total remuneration awarded 56.5 68.5 Disclosure required by the Companies Act 2006 The following information regarding the Barclays PLC Board of Directors is presented in accordance with the Companies Act 2006: 2022 2021 £m £m a Aggregate emoluments 9.3 8.2 b Amounts paid under LTIPs 0.4 1.2 9.7 9.4 Notes a The aggregate emoluments include amounts paid for the 2022 year. In addition, deferred share awards for 2022 with a total value at grant of £2.3m (2021: £1.4m) will be made to C.S. Venkatakrishnan, Anna Cross and Tushar Morzaria which will only vest subject to meeting certain conditions. b The figure above for "Amounts paid under LTIPs" in 2022 relates to LTIP awards that were released to Tushar Morzaria in 2022. Dividend shares released are excluded. The LTIP figure in the single total figure table for Executive Directors' 2022 remuneration in the Directors' Remuneration report relates to the award that is scheduled to be released in 2023 in respect of the 2020-2022 LTIP cycle. There were no pension contributions paid to defined contribution schemes on behalf of Directors (2021: £nil). There were no notional pension contributions to defined contribution schemes. As at 31 December 2022, there were no Directors accruing benefits under a defined benefit scheme (2021: nil). Directors’ and Officers’ shareholdings and options The beneficial ownership of ordinary share capital of Barclays PLC by all Directors and Officers of Barclays PLC (involving 23 persons) at 31 December 2022 amounted to 15,944,986 (2021: 17,876,352) ordinary shares of 25p each (0.11% of the ordinary share capital outstanding). As at 31 December 2022, Executive Directors and Officers of Barclays PLC (involving 11 persons) held options to purchase a total of 62,268 (2021: 62,268) Barclays PLC ordinary shares of 25p each at a weighted average price of 93p under Sharesave.

Barclays PLC - Annual Report - 2022 Page 513 Page 515

Barclays PLC - Annual Report - 2022 Page 513 Page 515