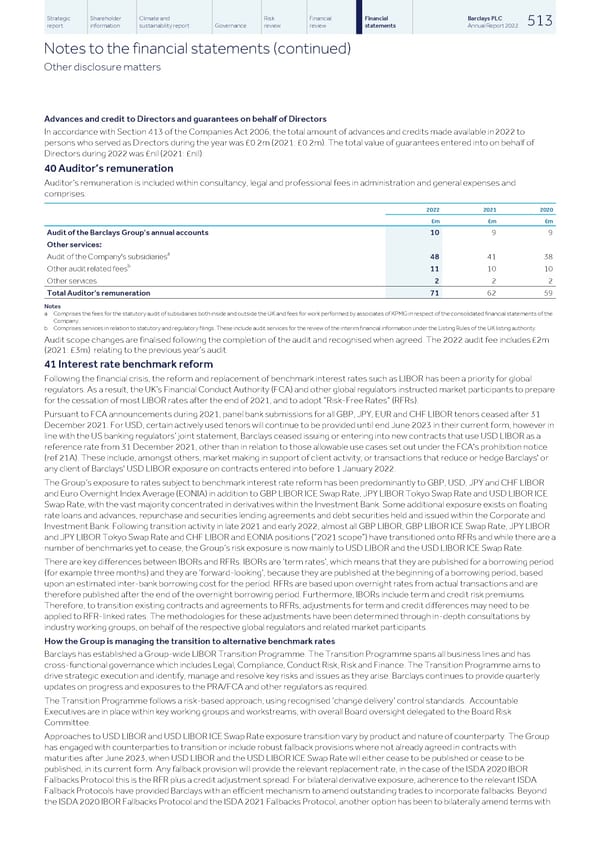

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 513 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Other disclosure matters Advances and credit to Directors and guarantees on behalf of Directors In accordance with Section 413 of the Companies Act 2006, the total amount of advances and credits made available in 2022 to persons who served as Directors during the year was £0.2m (2021: £0.2m). The total value of guarantees entered into on behalf of Directors during 2022 was £nil (2021: £nil). 40 Auditor’s remuneration Auditor’s remuneration is included within consultancy, legal and professional fees in administration and general expenses and comprises: 2022 2021 2020 £m £m £m Audit of the Barclays Group's annual accounts 10 9 9 Other services: a Audit of the Company's subsidiaries 48 41 38 b Other audit related fees 11 10 10 Other services 2 2 2 Total Auditor's remuneration 71 62 59 Notes a Comprises the fees for the statutory audit of subsidiaries both inside and outside the UK and fees for work performed by associates of KPMG in respect of the consolidated financial statements of the Company. b Comprises services in relation to statutory and regulatory filings. These include audit services for the review of the interim financial information under the Listing Rules of the UK listing authority. Audit scope changes are finalised following the completion of the audit and recognised when agreed. The 2022 audit fee includes £2m (2021: £3m) relating to the previous year’s audit. 41 Interest rate benchmark reform Following the financial crisis, the reform and replacement of benchmark interest rates such as LIBOR has been a priority for global regulators. As a result, the UK’s Financial Conduct Authority (FCA) and other global regulators instructed market participants to prepare for the cessation of most LIBOR rates after the end of 2021, and to adopt “Risk-Free Rates” (RFRs). Pursuant to FCA announcements during 2021, panel bank submissions for all GBP, JPY, EUR and CHF LIBOR tenors ceased after 31 December 2021. For USD, certain actively used tenors will continue to be provided until end June 2023 in their current form, however in line with the US banking regulators’ joint statement, Barclays ceased issuing or entering into new contracts that use USD LIBOR as a reference rate from 31 December 2021, other than in relation to those allowable use cases set out under the FCA's prohibition notice (ref 21A). These include, amongst others, market making in support of client activity; or transactions that reduce or hedge Barclays' or any client of Barclays' USD LIBOR exposure on contracts entered into before 1 January 2022. The Group’s exposure to rates subject to benchmark interest rate reform has been predominantly to GBP, USD, JPY and CHF LIBOR and Euro Overnight Index Average (EONIA) in addition to GBP LIBOR ICE Swap Rate, JPY LIBOR Tokyo Swap Rate and USD LIBOR ICE Swap Rate, with the vast majority concentrated in derivatives within the Investment Bank. Some additional exposure exists on floating rate loans and advances, repurchase and securities lending agreements and debt securities held and issued within the Corporate and Investment Bank. Following transition activity in late 2021 and early 2022, almost all GBP LIBOR, GBP LIBOR ICE Swap Rate, JPY LIBOR and JPY LIBOR Tokyo Swap Rate and CHF LIBOR and EONIA positions (“2021 scope”) have transitioned onto RFRs and while there are a number of benchmarks yet to cease, the Group’s risk exposure is now mainly to USD LIBOR and the USD LIBOR ICE Swap Rate. There are key differences between IBORs and RFRs. IBORs are ‘term rates’, which means that they are published for a borrowing period (for example three months) and they are ‘forward-looking’, because they are published at the beginning of a borrowing period, based upon an estimated inter-bank borrowing cost for the period. RFRs are based upon overnight rates from actual transactions and are therefore published after the end of the overnight borrowing period. Furthermore, IBORs include term and credit risk premiums. Therefore, to transition existing contracts and agreements to RFRs, adjustments for term and credit differences may need to be applied to RFR-linked rates. The methodologies for these adjustments have been determined through in-depth consultations by industry working groups, on behalf of the respective global regulators and related market participants. How the Group is managing the transition to alternative benchmark rates Barclays has established a Group-wide LIBOR Transition Programme. The Transition Programme spans all business lines and has cross-functional governance which includes Legal, Compliance, Conduct Risk, Risk and Finance. The Transition Programme aims to drive strategic execution and identify, manage and resolve key risks and issues as they arise. Barclays continues to provide quarterly updates on progress and exposures to the PRA/FCA and other regulators as required. The Transition Programme follows a risk-based approach, using recognised ‘change delivery’ control standards. Accountable Executives are in place within key working groups and workstreams, with overall Board oversight delegated to the Board Risk Committee. Approaches to USD LIBOR and USD LIBOR ICE Swap Rate exposure transition vary by product and nature of counterparty. The Group has engaged with counterparties to transition or include robust fallback provisions where not already agreed in contracts with maturities after June 2023, when USD LIBOR and the USD LIBOR ICE Swap Rate will either cease to be published or cease to be published, in its current form. Any fallback provision will provide the relevant replacement rate, in the case of the ISDA 2020 IBOR Fallbacks Protocol this is the RFR plus a credit adjustment spread. For bilateral derivative exposure, adherence to the relevant ISDA Fallback Protocols have provided Barclays with an efficient mechanism to amend outstanding trades to incorporate fallbacks. Beyond the ISDA 2020 IBOR Fallbacks Protocol and the ISDA 2021 Fallbacks Protocol, another option has been to bilaterally amend terms with

Barclays PLC - Annual Report - 2022 Page 514 Page 516

Barclays PLC - Annual Report - 2022 Page 514 Page 516