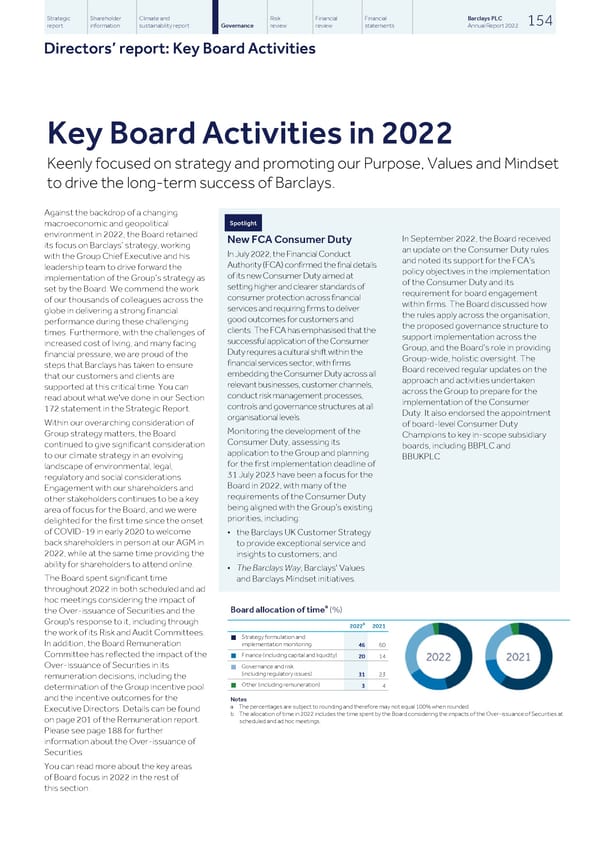

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 154 report information sustainability report Governance review review statements Annual Report 2022 Directors’ report: Key Board Activities Key Board Activities in 2022 Keenly focused on strategy and promoting our Purpose, Values and Mindset to drive the long-term success of Barclays. Against the backdrop of a changing Spotlight macroeconomic and geopolitical environment in 2022, the Board retained In September 2022, the Board received New FCA Consumer Duty its focus on Barclays’ strategy, working an update on the Consumer Duty rules In July 2022, the Financial Conduct with the Group Chief Executive and his and noted its support for the FCA’s Authority (FCA) confirmed the final details leadership team to drive forward the policy objectives in the implementation of its new Consumer Duty aimed at implementation of the Group’s strategy as of the Consumer Duty and its setting higher and clearer standards of set by the Board. We commend the work requirement for board engagement consumer protection across financial of our thousands of colleagues across the within firms. The Board discussed how services and requiring firms to deliver globe in delivering a strong financial the rules apply across the organisation, good outcomes for customers and performance during these challenging the proposed governance structure to clients. The FCA has emphasised that the times. Furthermore, with the challenges of support implementation across the successful application of the Consumer increased cost of living, and many facing Group, and the Board’s role in providing Duty requires a cultural shift within the financial pressure, we are proud of the Group-wide, holistic oversight. The financial services sector, with firms steps that Barclays has taken to ensure Board received regular updates on the embedding the Consumer Duty across all that our customers and clients are approach and activities undertaken relevant businesses, customer channels, supported at this critical time. You can across the Group to prepare for the conduct risk management processes, read about what we've done in our Section implementation of the Consumer controls and governance structures at all 172 statement in the Strategic Report. Duty. It also endorsed the appointment organisational levels. Within our overarching consideration of of board-level Consumer Duty Monitoring the development of the Group strategy matters, the Board Champions to key in-scope subsidiary Consumer Duty, assessing its continued to give significant consideration boards, including BBPLC and application to the Group and planning to our climate strategy in an evolving BBUKPLC. for the first implementation deadline of landscape of environmental, legal, 31 July 2023 have been a focus for the regulatory and social considerations. Board in 2022, with many of the Engagement with our shareholders and requirements of the Consumer Duty other stakeholders continues to be a key being aligned with the Group’s existing area of focus for the Board, and we were priorities, including: delighted for the first time since the onset of COVID-19 in early 2020 to welcome • the Barclays UK Customer Strategy back shareholders in person at our AGM in to provide exceptional service and 2022, while at the same time providing the insights to customers; and ability for shareholders to attend online. • The Barclays Way, Barclays' Values The Board spent significant time and Barclays Mindset initiatives. throughout 2022 in both scheduled and ad hoc meetings considering the impact of a Board allocation of time (%) the Over-issuance of Securities and the Group's response to it, including through b 2022 2021 the work of its Risk and Audit Committees. Strategy formulation and n implementation monitoring In addition, the Board Remuneration 46 60 Finance (including capital and liquidity) Committee has reflected the impact of the 20 14 n Over-issuance of Securities in its Governance and risk n (including regulatory issues) 31 23 remuneration decisions, including the Other (including remuneration) 3 4 n determination of the Group incentive pool and the incentive outcomes for the Notes a The percentages are subject to rounding and therefore may not equal 100% when rounded. Executive Directors. Details can be found b The allocation of time in 2022 includes the time spent by the Board considering the impacts of the Over-issuance of Securities at on page 201 of the Remuneration report. scheduled and ad hoc meetings. Please see page 188 for further information about the Over-issuance of Securities. You can read more about the key areas of Board focus in 2022 in the rest of this section.

Barclays PLC - Annual Report - 2022 Page 155 Page 157

Barclays PLC - Annual Report - 2022 Page 155 Page 157