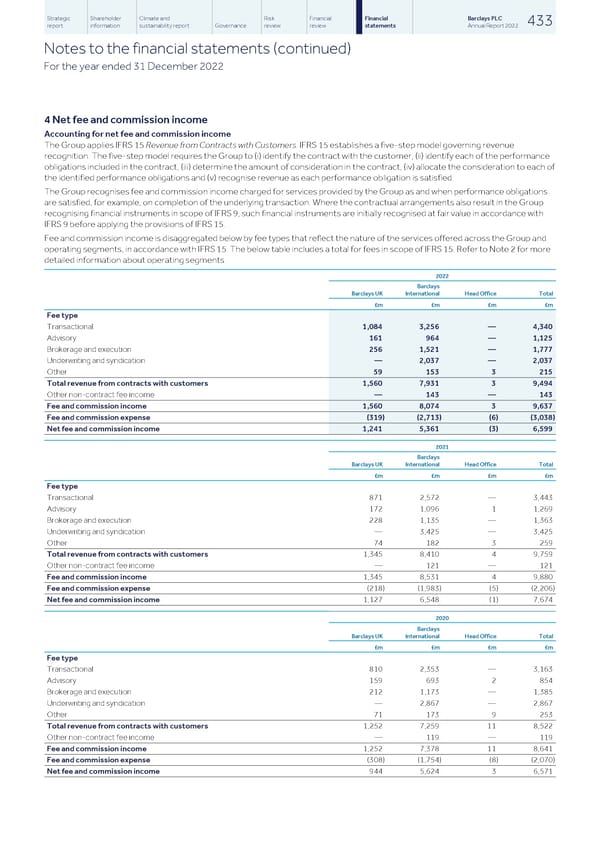

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 433 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 4 Net fee and commission income Accounting for net fee and commission income The Group applies IFRS 15 Revenue from Contracts with Customers. IFRS 15 establishes a five-step model governing revenue recognition. The five-step model requires the Group to (i) identify the contract with the customer, (ii) identify each of the performance obligations included in the contract, (iii) determine the amount of consideration in the contract, (iv) allocate the consideration to each of the identified performance obligations and (v) recognise revenue as each performance obligation is satisfied. The Group recognises fee and commission income charged for services provided by the Group as and when performance obligations are satisfied, for example, on completion of the underlying transaction. Where the contractual arrangements also result in the Group recognising financial instruments in scope of IFRS 9, such financial instruments are initially recognised at fair value in accordance with IFRS 9 before applying the provisions of IFRS 15. Fee and commission income is disaggregated below by fee types that reflect the nature of the services offered across the Group and operating segments, in accordance with IFRS 15. The below table includes a total for fees in scope of IFRS 15. Refer to Note 2 for more detailed information about operating segments. 2022 Barclays Barclays UK International Head Office Total £m £m £m £m Fee type Transactional 1,084 3,256 — 4,340 Advisory 161 964 — 1,125 Brokerage and execution 256 1,521 — 1,777 Underwriting and syndication — 2,037 — 2,037 Other 59 153 3 215 Total revenue from contracts with customers 1,560 7,931 3 9,494 Other non-contract fee income — 143 — 143 Fee and commission income 1,560 8,074 3 9,637 Fee and commission expense (319) (2,713) (6) (3,038) Net fee and commission income 1,241 5,361 (3) 6,599 2021 Barclays Barclays UK International Head Office Total £m £m £m £m Fee type Transactional 871 2,572 — 3,443 Advisory 172 1,096 1 1,269 Brokerage and execution 228 1,135 — 1,363 Underwriting and syndication — 3,425 — 3,425 Other 74 182 3 259 Total revenue from contracts with customers 1,345 8,410 4 9,759 Other non-contract fee income — 121 — 121 Fee and commission income 1,345 8,531 4 9,880 Fee and commission expense (218) (1,983) (5) (2,206) Net fee and commission income 1,127 6,548 (1) 7,674 2020 Barclays Barclays UK International Head Office Total £m £m £m £m Fee type Transactional 810 2,353 — 3,163 Advisory 159 693 2 854 Brokerage and execution 212 1,173 — 1,385 Underwriting and syndication — 2,867 — 2,867 Other 71 173 9 253 Total revenue from contracts with customers 1,252 7,259 11 8,522 Other non-contract fee income — 119 — 119 Fee and commission income 1,252 7,378 11 8,641 Fee and commission expense (308) (1,754) (8) (2,070) Net fee and commission income 944 5,624 3 6,571

Barclays PLC - Annual Report - 2022 Page 434 Page 436

Barclays PLC - Annual Report - 2022 Page 434 Page 436