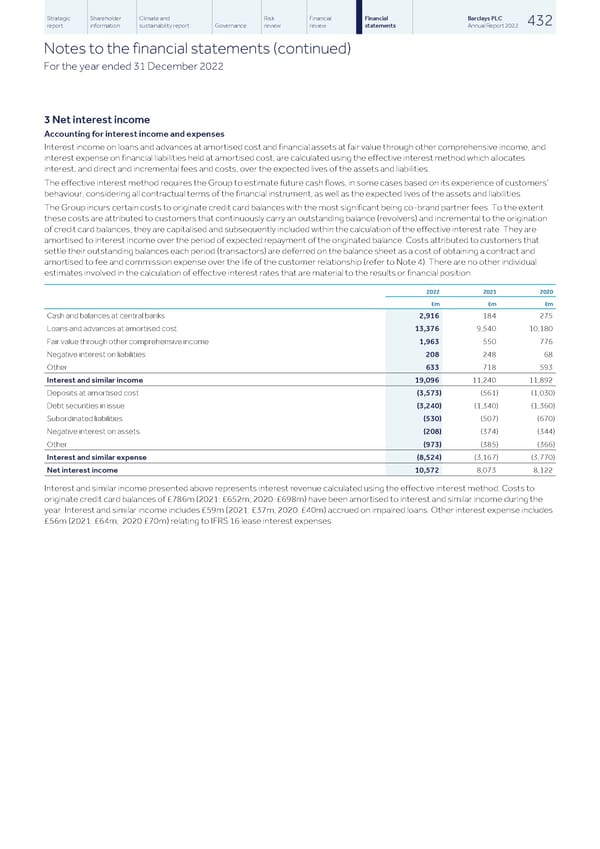

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 432 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) For the year ended 31 December 2022 3 Net interest income Accounting for interest income and expenses Interest income on loans and advances at amortised cost and financial assets at fair value through other comprehensive income, and interest expense on financial liabilities held at amortised cost, are calculated using the effective interest method which allocates interest, and direct and incremental fees and costs, over the expected lives of the assets and liabilities. The effective interest method requires the Group to estimate future cash flows, in some cases based on its experience of customers’ behaviour, considering all contractual terms of the financial instrument, as well as the expected lives of the assets and liabilities. The Group incurs certain costs to originate credit card balances with the most significant being co-brand partner fees. To the extent these costs are attributed to customers that continuously carry an outstanding balance (revolvers) and incremental to the origination of credit card balances, they are capitalised and subsequently included within the calculation of the effective interest rate. They are amortised to interest income over the period of expected repayment of the originated balance. Costs attributed to customers that settle their outstanding balances each period (transactors) are deferred on the balance sheet as a cost of obtaining a contract and amortised to fee and commission expense over the life of the customer relationship (refer to Note 4). There are no other individual estimates involved in the calculation of effective interest rates that are material to the results or financial position. 2022 2021 2020 £m £m £m Cash and balances at central banks 2,916 184 275 Loans and advances at amortised cost 13,376 9,540 10,180 Fair value through other comprehensive income 1,963 550 776 Negative interest on liabilities 208 248 68 Other 633 718 593 Interest and similar income 19,096 11,240 11,892 Deposits at amortised cost (3,573) (561) (1,030) Debt securities in issue (3,240) (1,340) (1,360) Subordinated liabilities (530) (507) (670) Negative interest on assets (208) (374) (344) Other (973) (385) (366) Interest and similar expense (8,524) (3,167) (3,770) Net interest income 10,572 8,073 8,122 Interest and similar income presented above represents interest revenue calculated using the effective interest method. Costs to originate credit card balances of £786m (2021: £652m; 2020: £698m) have been amortised to interest and similar income during the year. Interest and similar income includes £59m (2021: £37m; 2020: £40m) accrued on impaired loans. Other interest expense includes £56m (2021: £64m; 2020:£70m) relating to IFRS 16 lease interest expenses.

Barclays PLC - Annual Report - 2022 Page 433 Page 435

Barclays PLC - Annual Report - 2022 Page 433 Page 435