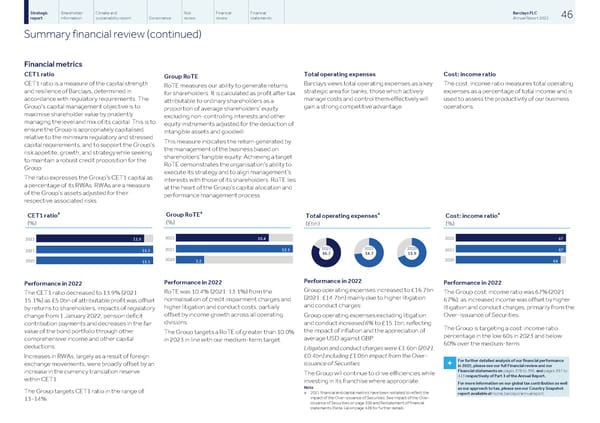

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 46 report information sustainability report Governance review review statements Annual Report 2022 Summary financial review (continued) Financial metrics CET1 ratio Total operating expenses Cost: income ratio Group RoTE CET1 ratio is a measure of the capital strength Barclays views total operating expenses as a key The cost: income ratio measures total operating RoTE measures our ability to generate returns and resilience of Barclays, determined in strategic area for banks; those which actively expenses as a percentage of total income and is for shareholders. It is calculated as profit after tax accordance with regulatory requirements. The manage costs and control them effectively will used to assess the productivity of our business attributable to ordinary shareholders as a Group’s capital management objective is to gain a strong competitive advantage. operations. proportion of average shareholders’ equity maximise shareholder value by prudently excluding non-controlling interests and other managing the level and mix of its capital. This is to equity instruments adjusted for the deduction of ensure the Group is appropriately capitalised intangible assets and goodwill. relative to the minimum regulatory and stressed This measure indicates the return generated by capital requirements, and to support the Group’s the management of the business based on risk appetite, growth, and strategy while seeking shareholders’ tangible equity. Achieving a target to maintain a robust credit proposition for the RoTE demonstrates the organisation’s ability to Group. execute its strategy and to align management’s The ratio expresses the Group’s CET1 capital as interests with those of its shareholders. RoTE lies a percentage of its RWAs. RWAs are a measure at the heart of the Group’s capital allocation and of the Group’s assets adjusted for their performance management process. respective associated risks. a a a a Group RoTE CET1 ratio Total operating expenses Cost: income ratio (%) (%) (£bn) (%) . 2022 2022 10.4 67 2022 13.9 2021 13.1 67 2021 15.1 2021 2020 2020 2020 3.2 64 15.1 Performance in 2022 Performance in 2022 Performance in 2022 Performance in 2022 Group operating expenses increased to £16.7bn RoTE was 10.4% (2021: 13.1%) from the The Group cost: income ratio was 67% (2021: The CET1 ratio decreased to 13.9% (2021: (2021: £14.7bn) mainly due to higher litigation normalisation of credit impairment charges and 67%), as increased income was offset by higher 15.1%) as £5.0bn of attributable profit was offset and conduct charges: higher litigation and conduct costs, partially litigation and conduct charges, primarily from the by returns to shareholders, impacts of regulatory offset by income growth across all operating Over-issuance of Securities. Group operating expenses excluding litigation change from 1 January 2022, pension deficit divisions. and conduct increased 6% to £15.1bn, reflecting contribution payments and decreases in the fair The Group is targeting a cost: income ratio the impact of inflation and the appreciation of value of the bond portfolio through other The Group targets a RoTE of greater than 10.0% percentage in the low 60s in 2023 and below average USD against GBP. comprehensive income and other capital in 2023 in line with our medium-term target. 60% over the medium-term. deductions. Litigation and conduct charges were £1.6bn (2021: £0.4bn) including £1.0bn impact from the Over- Increases in RWAs, largely as a result of foreign For further detailed analysis of our financial performance issuance of Securities. exchange movements, were broadly offset by an + in 2022, please see our full Financial review and our Financial statements on pages 378 to 396, and pages 397 to increase in the currency translation reserve The Group will continue to drive efficiencies while 423 respectively of Part 3 of the Annual Report. within CET1. investing in its franchise where appropriate. For more information on our global tax contribution as well Note as our approach to tax, please see our Country Snapshot The Group targets CET1 ratio in the range of a 2021 financial and capital metrics have been restated to reflect the report available at home.barclays/annualreport impact of the Over-issuance of Securities. See Impact of the Over- 13-14%. issuance of Securities on page 356 and Restatement of financial statements (Note 1a) on page 428 for further details.

Barclays PLC - Annual Report - 2022 Page 47 Page 49

Barclays PLC - Annual Report - 2022 Page 47 Page 49