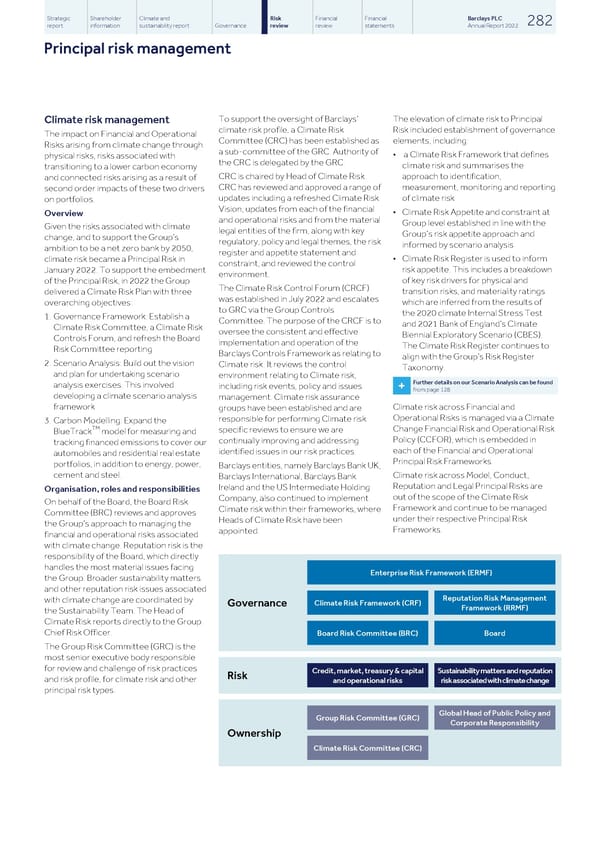

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 282 report information sustainability report Governance review review statements Annual Report 2022 Principal risk management To support the oversight of Barclays’ The elevation of climate risk to Principal Climate risk management climate risk profile, a Climate Risk Risk included establishment of governance The impact on Financial and Operational Committee (CRC) has been established as elements, including: Risks arising from climate change through a sub-committee of the GRC. Authority of • a Climate Risk Framework that defines physical risks, risks associated with the CRC is delegated by the GRC. climate risk and summarises the transitioning to a lower carbon economy CRC is chaired by Head of Climate Risk. approach to identification, and connected risks arising as a result of CRC has reviewed and approved a range of measurement, monitoring and reporting second order impacts of these two drivers updates including a refreshed Climate Risk of climate risk on portfolios. Vision, updates from each of the financial • Climate Risk Appetite and constraint at Overview and operational risks and from the material Group level established in line with the Given the risks associated with climate legal entities of the firm, along with key Group’s risk appetite approach and change, and to support the Group’s regulatory, policy and legal themes, the risk informed by scenario analysis ambition to be a net zero bank by 2050, register and appetite statement and • Climate Risk Register is used to inform climate risk became a Principal Risk in constraint, and reviewed the control risk appetite. This includes a breakdown January 2022. To support the embedment environment. of key risk drivers for physical and of the Principal Risk, in 2022 the Group The Climate Risk Control Forum (CRCF) transition risks, and materiality ratings delivered a Climate Risk Plan with three was established in July 2022 and escalates which are inferred from the results of overarching objectives: to GRC via the Group Controls the 2020 climate Internal Stress Test 1. Governance Framework: Establish a Committee. The purpose of the CRCF is to and 2021 Bank of England’s Climate Climate Risk Committee, a Climate Risk oversee the consistent and effective Biennial Exploratory Scenario (CBES). Controls Forum, and refresh the Board implementation and operation of the The Climate Risk Register continues to Risk Committee reporting Barclays Controls Framework as relating to align with the Group’s Risk Register 2. Scenario Analysis: Build out the vision Climate risk. It reviews the control Taxonomy. and plan for undertaking scenario environment relating to Climate risk, Further details on our Scenario Analysis can be found analysis exercises. This involved including risk events, policy and issues + from page 128 developing a climate scenario analysis management. Climate risk assurance framework Climate risk across Financial and groups have been established and are Operational Risks is managed via a Climate responsible for performing Climate risk 3. Carbon Modelling: Expand the TM Change Financial Risk and Operational Risk specific reviews to ensure we are BlueTrack model for measuring and Policy (CCFOR), which is embedded in continually improving and addressing tracking financed emissions to cover our each of the Financial and Operational identified issues in our risk practices. automobiles and residential real estate Principal Risk Frameworks. portfolios, in addition to energy, power, Barclays entities, namely Barclays Bank UK, cement and steel. Climate risk across Model, Conduct, Barclays International, Barclays Bank Reputation and Legal Principal Risks are Ireland and the US Intermediate Holding Organisation, roles and responsibilities out of the scope of the Climate Risk Company, also continued to implement On behalf of the Board, the Board Risk Framework and continue to be managed Climate risk within their frameworks, where Committee (BRC) reviews and approves under their respective Principal Risk Heads of Climate Risk have been the Group’s approach to managing the Frameworks. appointed. financial and operational risks associated with climate change. Reputation risk is the responsibility of the Board, which directly handles the most material issues facing Enterprise Risk Framework (ERMF) the Group. Broader sustainability matters and other reputation risk issues associated Reputation Risk Management with climate change are coordinated by Climate Risk Framework (CRF) Governance Framework (RRMF) the Sustainability Team. The Head of Climate Risk reports directly to the Group Chief Risk Officer. Board Risk Committee (BRC) Board The Group Risk Committee (GRC) is the most senior executive body responsible for review and challenge of risk practices Credit, market, treasury & capital Sustainability matters and reputation Risk and risk profile, for climate risk and other and operational risks risk associated with climate change principal risk types. Global Head of Public Policy and Group Risk Committee (GRC) Corporate Responsibility Ownership Climate Risk Committee (CRC)

Barclays PLC - Annual Report - 2022 Page 283 Page 285

Barclays PLC - Annual Report - 2022 Page 283 Page 285