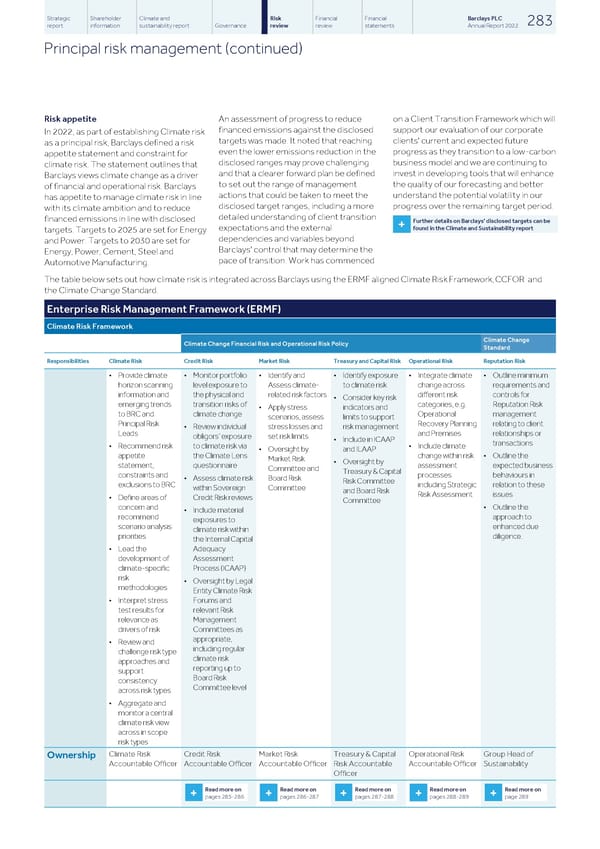

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 283 report information sustainability report Governance review review statements Annual Report 2022 Principal risk management (continued) Risk appetite An assessment of progress to reduce on a Client Transition Framework which will financed emissions against the disclosed support our evaluation of our corporate In 2022, as part of establishing Climate risk targets was made. It noted that reaching clients' current and expected future as a principal risk, Barclays defined a risk even the lower emissions reduction in the progress as they transition to a low-carbon appetite statement and constraint for disclosed ranges may prove challenging business model and we are continuing to climate risk. The statement outlines that and that a clearer forward plan be defined invest in developing tools that will enhance Barclays views climate change as a driver to set out the range of management the quality of our forecasting and better of financial and operational risk. Barclays actions that could be taken to meet the understand the potential volatility in our has appetite to manage climate risk in line disclosed target ranges, including a more progress over the remaining target period. with its climate ambition and to reduce detailed understanding of client transition financed emissions in line with disclosed Further details on Barclays' disclosed targets can be + found in the Climate and Sustainability report expectations and the external targets. Targets to 2025 are set for Energy dependencies and variables beyond and Power. Targets to 2030 are set for Barclays' control that may determine the Energy, Power, Cement, Steel and pace of transition. Work has commenced Automotive Manufacturing. The table below sets out how climate risk is integrated across Barclays using the ERMF aligned Climate Risk Framework, CCFOR and the Climate Change Standard. Enterprise Risk Management Framework (ERMF) Climate Risk Framework Climate Change Climate Change Financial Risk and Operational Risk Policy Standard Responsibilities Climate Risk Credit Risk Market Risk Treasury and Capital Risk Operational Risk Reputation Risk • Provide climate • Monitor portfolio • Identify and • Identify exposure • Integrate climate • Outline minimum horizon scanning level exposure to Assess climate- to climate risk change across requirements and information and the physical and related risk factors different risk controls for • Consider key risk emerging trends transition risks of categories, e.g. Reputation Risk • Apply stress indicators and to BRC and climate change Operational management scenarios, assess limits to support Principal Risk Recovery Planning relating to client • Review individual stress losses and risk management Leads and Premises relationships or obligors’ exposure set risk limits • Include in ICAAP transactions • Recommend risk to climate risk via • Include climate • Oversight by and ILAAP appetite the Climate Lens change within risk • Outline the Market Risk • Oversight by statement, questionnaire assessment expected business Committee and Treasury & Capital constraints and processes behaviours in • Assess climate risk Board Risk Risk Committee exclusions to BRC including Strategic relation to these within Sovereign Committee and Board Risk Risk Assessment issues • Define areas of Credit Risk reviews Committee concern and • Outline the • Include material recommend approach to exposures to scenario analysis enhanced due climate risk within priorities diligence. the Internal Capital • Lead the Adequacy development of Assessment climate-specific Process (ICAAP) risk • Oversight by Legal methodologies Entity Climate Risk • Interpret stress Forums and test results for relevant Risk relevance as Management drivers of risk Committees as appropriate, • Review and including regular challenge risk type climate risk approaches and reporting up to support Board Risk consistency Committee level across risk types • Aggregate and monitor a central climate risk view across in scope risk types Climate Risk Credit Risk Market Risk Treasury & Capital Operational Risk Group Head of Ownership Accountable Officer Accountable Officer Accountable Officer Risk Accountable Accountable Officer Sustainability Officer Read more on Read more on Read more on Read more on Read more on + + + + + pages 285-286 pages 286-287 pages 287-288 pages 288-289 page 289

Barclays PLC - Annual Report - 2022 Page 284 Page 286

Barclays PLC - Annual Report - 2022 Page 284 Page 286