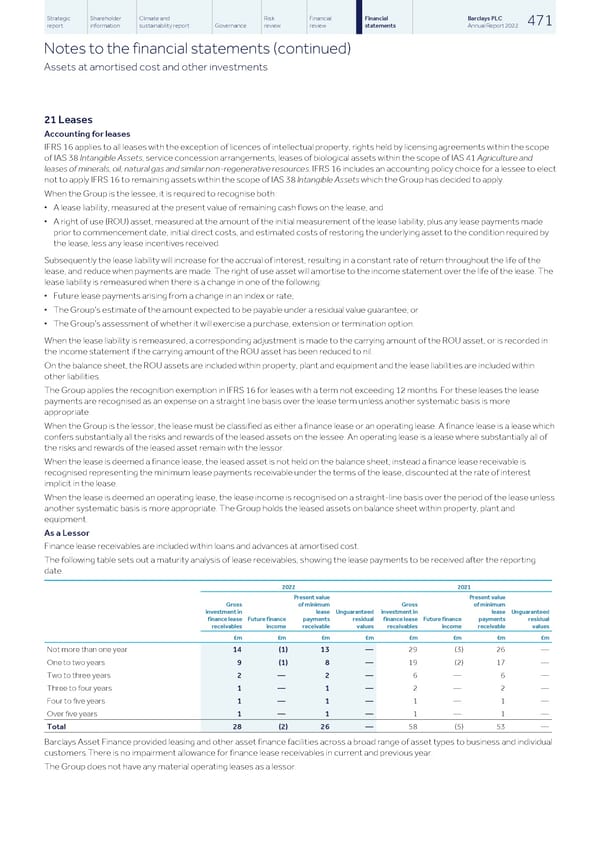

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 471 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Assets at amortised cost and other investments 21 Leases Accounting for leases IFRS 16 applies to all leases with the exception of licences of intellectual property, rights held by licensing agreements within the scope of IAS 38 Intangible Assets, service concession arrangements, leases of biological assets within the scope of IAS 41 Agriculture and leases of minerals, oil, natural gas and similar non-regenerative resources. IFRS 16 includes an accounting policy choice for a lessee to elect not to apply IFRS 16 to remaining assets within the scope of IAS 38 Intangible Assets which the Group has decided to apply. When the Group is the lessee, it is required to recognise both: ▪ A lease liability, measured at the present value of remaining cash flows on the lease, and ▪ A right of use (ROU) asset, measured at the amount of the initial measurement of the lease liability, plus any lease payments made prior to commencement date, initial direct costs, and estimated costs of restoring the underlying asset to the condition required by the lease, less any lease incentives received. Subsequently the lease liability will increase for the accrual of interest, resulting in a constant rate of return throughout the life of the lease, and reduce when payments are made. The right of use asset will amortise to the income statement over the life of the lease. The lease liability is remeasured when there is a change in one of the following: ▪ Future lease payments arising from a change in an index or rate; ▪ The Group’s estimate of the amount expected to be payable under a residual value guarantee; or ▪ The Group’s assessment of whether it will exercise a purchase, extension or termination option. When the lease liability is remeasured, a corresponding adjustment is made to the carrying amount of the ROU asset, or is recorded in the income statement if the carrying amount of the ROU asset has been reduced to nil. On the balance sheet, the ROU assets are included within property, plant and equipment and the lease liabilities are included within other liabilities. The Group applies the recognition exemption in IFRS 16 for leases with a term not exceeding 12 months. For these leases the lease payments are recognised as an expense on a straight line basis over the lease term unless another systematic basis is more appropriate. When the Group is the lessor, the lease must be classified as either a finance lease or an operating lease. A finance lease is a lease which confers substantially all the risks and rewards of the leased assets on the lessee. An operating lease is a lease where substantially all of the risks and rewards of the leased asset remain with the lessor. When the lease is deemed a finance lease, the leased asset is not held on the balance sheet; instead a finance lease receivable is recognised representing the minimum lease payments receivable under the terms of the lease, discounted at the rate of interest implicit in the lease. When the lease is deemed an operating lease, the lease income is recognised on a straight-line basis over the period of the lease unless another systematic basis is more appropriate. The Group holds the leased assets on balance sheet within property, plant and equipment. As a Lessor Finance lease receivables are included within loans and advances at amortised cost. The following table sets out a maturity analysis of lease receivables, showing the lease payments to be received after the reporting date. 2022 2021 Present value Present value Gross of minimum Gross of minimum investment in lease Unguaranteed investment in lease Unguaranteed finance lease Future finance payments residual finance lease Future finance payments residual receivables income receivable values receivables income receivable values £m £m £m £m £m £m £m £m Not more than one year 14 (1) 13 — 29 (3) 26 — One to two years 9 (1) 8 — 19 (2) 17 — Two to three years 2 — 2 — 6 — 6 — Three to four years 1 — 1 — 2 — 2 — Four to five years 1 — 1 — 1 — 1 — Over five years 1 — 1 — 1 — 1 — Total 28 (2) 26 — 58 (5) 53 — Barclays Asset Finance provided leasing and other asset finance facilities across a broad range of asset types to business and individual customers.There is no impairment allowance for finance lease receivables in current and previous year. The Group does not have any material operating leases as a lessor.

Barclays PLC - Annual Report - 2022 Page 472 Page 474

Barclays PLC - Annual Report - 2022 Page 472 Page 474