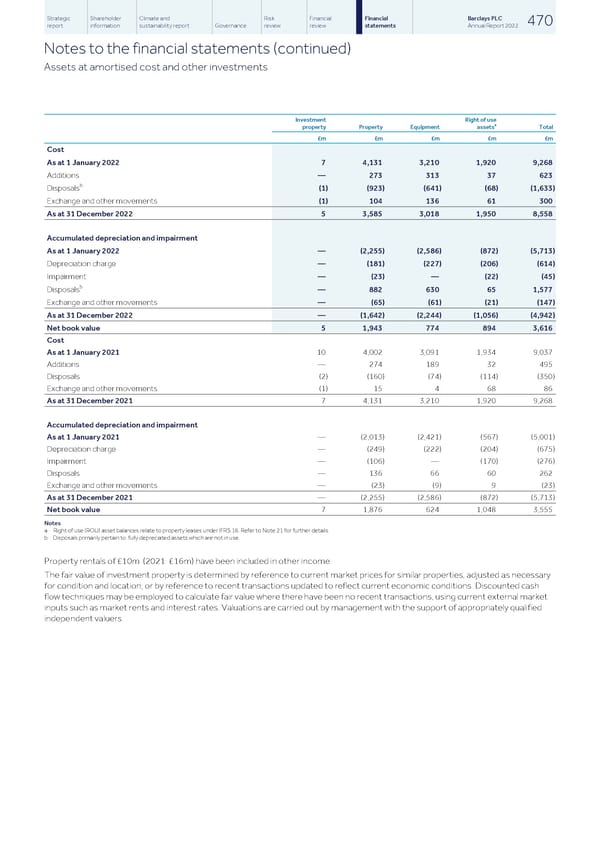

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 470 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Assets at amortised cost and other investments Investment Right of use a property Property Equipment assets Total £m £m £m £m £m Cost As at 1 January 2022 7 4,131 3,210 1,920 9,268 Additions — 273 313 37 623 b Disposals (1) (923) (641) (68) (1,633) Exchange and other movements (1) 104 136 61 300 As at 31 December 2022 5 3,585 3,018 1,950 8,558 Accumulated depreciation and impairment As at 1 January 2022 — (2,255) (2,586) (872) (5,713) Depreciation charge — (181) (227) (206) (614) Impairment — (23) — (22) (45) b Disposals — 882 630 65 1,577 Exchange and other movements — (65) (61) (21) (147) As at 31 December 2022 — (1,642) (2,244) (1,056) (4,942) Net book value 5 1,943 774 894 3,616 Cost As at 1 January 2021 10 4,002 3,091 1,934 9,037 Additions — 274 189 32 495 Disposals (2) (160) (74) (114) (350) Exchange and other movements (1) 15 4 68 86 As at 31 December 2021 7 4,131 3,210 1,920 9,268 Accumulated depreciation and impairment As at 1 January 2021 — (2,013) (2,421) (567) (5,001) Depreciation charge — (249) (222) (204) (675) Impairment — (106) — (170) (276) Disposals — 136 66 60 262 Exchange and other movements — (23) (9) 9 (23) As at 31 December 2021 — (2,255) (2,586) (872) (5,713) Net book value 7 1,876 624 1,048 3,555 Notes a Right of use (ROU) asset balances relate to property leases under IFRS 16. Refer to Note 21 for further details. b Disposals primarily pertain to fully depreciated assets which are not in use. Property rentals of £10m (2021: £16m) have been included in other income. The fair value of investment property is determined by reference to current market prices for similar properties, adjusted as necessary for condition and location, or by reference to recent transactions updated to reflect current economic conditions. Discounted cash flow techniques may be employed to calculate fair value where there have been no recent transactions, using current external market inputs such as market rents and interest rates. Valuations are carried out by management with the support of appropriately qualified independent valuers.

Barclays PLC - Annual Report - 2022 Page 471 Page 473

Barclays PLC - Annual Report - 2022 Page 471 Page 473