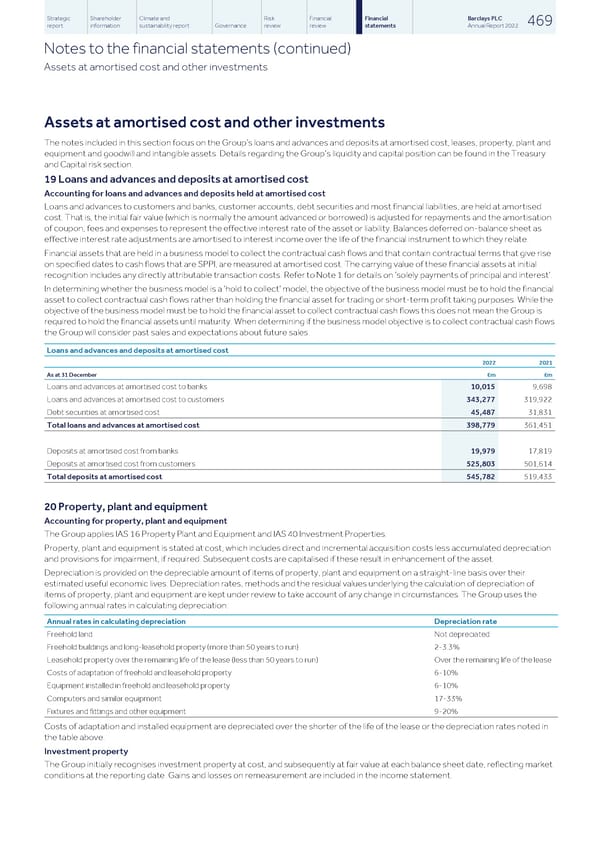

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 469 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Assets at amortised cost and other investments Assets at amortised cost and other investments The notes included in this section focus on the Group’s loans and advances and deposits at amortised cost, leases, property, plant and equipment and goodwill and intangible assets. Details regarding the Group’s liquidity and capital position can be found in the Treasury and Capital risk section. 19 Loans and advances and deposits at amortised cost Accounting for loans and advances and deposits held at amortised cost Loans and advances to customers and banks, customer accounts, debt securities and most financial liabilities, are held at amortised cost. That is, the initial fair value (which is normally the amount advanced or borrowed) is adjusted for repayments and the amortisation of coupon, fees and expenses to represent the effective interest rate of the asset or liability. Balances deferred on-balance sheet as effective interest rate adjustments are amortised to interest income over the life of the financial instrument to which they relate. Financial assets that are held in a business model to collect the contractual cash flows and that contain contractual terms that give rise on specified dates to cash flows that are SPPI, are measured at amortised cost. The carrying value of these financial assets at initial recognition includes any directly attributable transaction costs. Refer to Note 1 for details on ‘solely payments of principal and interest’. In determining whether the business model is a ‘hold to collect’ model, the objective of the business model must be to hold the financial asset to collect contractual cash flows rather than holding the financial asset for trading or short-term profit taking purposes. While the objective of the business model must be to hold the financial asset to collect contractual cash flows this does not mean the Group is required to hold the financial assets until maturity. When determining if the business model objective is to collect contractual cash flows the Group will consider past sales and expectations about future sales. Loans and advances and deposits at amortised cost 2022 2021 As at 31 December £m £m Loans and advances at amortised cost to banks 10,015 9,698 Loans and advances at amortised cost to customers 343,277 319,922 Debt securities at amortised cost 45,487 31,831 Total loans and advances at amortised cost 398,779 361,451 Deposits at amortised cost from banks 19,979 17,819 Deposits at amortised cost from customers 525,803 501,614 Total deposits at amortised cost 545,782 519,433 20 Property, plant and equipment Accounting for property, plant and equipment The Group applies IAS 16 Property Plant and Equipment and IAS 40 Investment Properties. Property, plant and equipment is stated at cost, which includes direct and incremental acquisition costs less accumulated depreciation and provisions for impairment, if required. Subsequent costs are capitalised if these result in enhancement of the asset. Depreciation is provided on the depreciable amount of items of property, plant and equipment on a straight-line basis over their estimated useful economic lives. Depreciation rates, methods and the residual values underlying the calculation of depreciation of items of property, plant and equipment are kept under review to take account of any change in circumstances. The Group uses the following annual rates in calculating depreciation: Annual rates in calculating depreciation Depreciation rate Freehold land Not depreciated Freehold buildings and long-leasehold property (more than 50 years to run) 2-3.3% Leasehold property over the remaining life of the lease (less than 50 years to run) Over the remaining life of the lease Costs of adaptation of freehold and leasehold property 6-10% Equipment installed in freehold and leasehold property 6-10% Computers and similar equipment 17-33% Fixtures and fittings and other equipment 9-20% Costs of adaptation and installed equipment are depreciated over the shorter of the life of the lease or the depreciation rates noted in the table above. Investment property The Group initially recognises investment property at cost, and subsequently at fair value at each balance sheet date, reflecting market conditions at the reporting date. Gains and losses on remeasurement are included in the income statement.

Barclays PLC - Annual Report - 2022 Page 470 Page 472

Barclays PLC - Annual Report - 2022 Page 470 Page 472