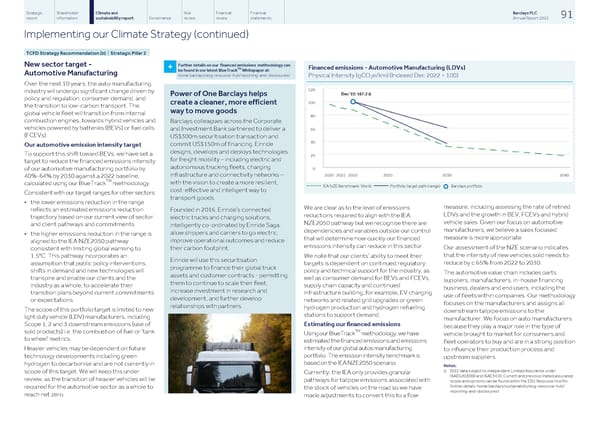

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 91 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 2 Further details on our financed emissions methodology can New sector target - Financed emissions - Automotive Manufacturing (LDVs) TM + be found in our latest BlueTrack Whitepaper at: Automotive Manufacturing home.barclays/esg-resource-hub/reporting-and-disclosures/ Physical Intensity (gCO e/km) (Indexed Dec 2022 = 100) 2 Over the next 10 years, the auto manufacturing industry will undergo significant change driven by Power of One Barclays helps policy and regulation, consumer demand, and create a cleaner, more efficient the transition to low-carbon transport. The way to move goods global vehicle fleet will transition from internal combustion engines, towards hybrid vehicles and Barclays colleagues across the Corporate vehicles powered by batteries (BEVs) or fuel cells and Investment Bank partnered to deliver a (FCEVs). US$300m securitisation transaction and commit US$150m of financing. Einride Our automotive emission intensity target designs, develops and deploys technologies To support this shift toward BEVs, we have set a for freight mobility – including electric and target to reduce the financed emissions intensity autonomous trucking fleets, charging of our automotive manufacturing portfolio by infrastructure and connectivity networks – 40%-64% by 2030 against a 2022 baseline, TM with the vision to create a more resilient, calculated using our BlueTrack methodology. IEA NZE Benchmark: World Portfolio target path (range) Barclays portfolio ¢ cost-effective and intelligent way to Consistent with our target ranges for other sectors: transport goods. • the lower emissions reduction in the range measure, including assessing the rate of retired We are clear as to the level of emissions reflects an estimated emissions reduction Founded in 2016, Einride’s connected LDVs and the growth in BEV, FCEVs and hybrid reductions required to align with the IEA trajectory based on our current view of sector electric trucks and charging solutions, vehicle sales. Given our focus on automotive NZE2050 pathway but we recognise there are and client pathways and commitments intelligently co-ordinated by Einride Saga, manufacturers, we believe a sales focused dependencies and variables outside our control allow shippers and carriers to go electric, • the higher emissions reduction in the range is measure is more appropriate. that will determine how quickly our financed improve operational outcomes and reduce aligned to the IEA NZE2050 pathway emissions intensity can reduce in this sector. Our assessment of the NZE scenario indicates their carbon footprint. consistent with limiting global warming to that the intensity of new vehicles sold needs to 1.5°C. This pathway incorporates an We note that our clients’ ability to meet their Einride will use this securitisation reduce by c.65% from 2022 to 2030. assumption that public policy interventions, targets is dependent on continued regulatory, programme to finance their global truck shifts in demand and new technologies will policy and technical support for the industry, as The automotive value chain includes parts assets and customer contracts - permitting transpire and enable our clients and the well as consumer demand for BEVs and FCEVs, suppliers, manufacturers, in-house financing them to continue to scale their fleet, industry as a whole, to accelerate their supply chain capacity and continued business, dealers and end users, including the increase investment in research and transition plans beyond current commitments infrastructure building, for example, EV charging use of fleets within companies. Our methodology development, and further develop or expectations. networks and related grid upgrades or green focuses on the manufacturers and assigns all relationships with partners. hydrogen production and hydrogen refuelling The scope of this portfolio target is limited to new downstream tailpipe emissions to the stations to support demand. light duty vehicle (LDV) manufacturers, including manufacturer. We focus on auto manufacturers Scope 1, 2 and 3 downstream emissions (use of Estimating our financed emissions because they play a major role in the type of TM sold products) i.e. the combustion of fuel or ‘tank Using our BlueTrack methodology, we have vehicle brought to market for consumers and to wheel’ metrics. estimated the financed emissions and emissions fleet operators to buy and are in a strong position intensity of our global autos manufacturing Heavier vehicles may be dependent on future to influence their production process and portfolio. The emission intensity benchmark is technology developments including green upstream suppliers. based on the IEA NZE2050 scenario. hydrogen to decarbonise and are not currently in Notes: Δ 2022 data subject to independent Limited Assurance under scope of this target. We will keep this under Currently, the IEA only provides granular ISAE(UK)3000 and ISAE3410. Current and previous limited assurance review, as the transition of heavier vehicles will be pathways for tailpipe emissions associated with scope and opinions can be found within the ESG Resource Hub for further details: home.barclays/sustainability/esg-resource-hub/ required for the automotive sector as a whole to the stock of vehicles on the road so we have reporting-and-disclosures/ reach net zero. made adjustments to convert this to a flow

Barclays PLC - Annual Report - 2022 Page 92 Page 94

Barclays PLC - Annual Report - 2022 Page 92 Page 94