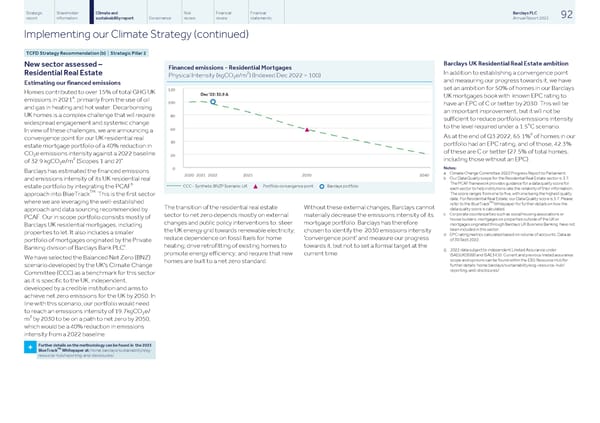

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 92 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 2 Barclays UK Residential Real Estate ambition New sector assessed – Financed emissions - Residential Mortgages 2 In addition to establishing a convergence point Residential Real Estate Physical Intensity (kgCO e/m ) (Indexed Dec 2022 = 100) 2 and measuring our progress towards it, we have Estimating our financed emissions set an ambition for 50% of homes in our Barclays Homes contributed to over 15% of total GHG UK UK mortgages book with known EPC rating to a emissions in 2021 , primarily from the use of oil have an EPC of C or better by 2030. This will be and gas in heating and hot water. Decarbonising an important improvement, but it will not be UK homes is a complex challenge that will require sufficient to reduce portfolio emissions intensity widespread engagement and systemic change. o to the level required under a 1.5 C scenario. In view of these challenges, we are announcing a d As at the end of Q3 2022, 65.1% of homes in our convergence point for our UK residential real portfolio had an EPC rating, and of those, 42.3% estate mortgage portfolio of a 40% reduction in of these are C or better (27.5% of total homes, COe emissions intensity against a 2022 baseline 2 2 including those without an EPC). of 32.9 kgCO e/m (Scopes 1 and 2)” 2 Notes: Barclays has estimated the financed emissions a Climate Change Committee 2022 Progress Report to Parliament. b Our Data Quality scope for the Residential Real Estate sector is 3.7. and emissions intensity of its UK residential real The PCAF framework provides guidance for a data quality score for b CCC - Synthetic BNZP Scenario: UK Portfolio convergence point Barclays portfolio estate portfolio by integrating the PCAF ▲ ¢ each sector to help institutions rate the reliability of their information. TM The score ranges from one to five, with one being the highest quality approach into BlueTrack . This is the first sector date. For Residential Real Estate, our Data Quality score is 3.7. Please TM where we are leveraging the well-established refer to the BlueTrack Whitepaper for further details on how the The transition of the residential real estate Without these external changes, Barclays cannot data quality score is calculated. approach and data sourcing recommended by c Corporate counterparties such as social housing associations or sector to net zero depends mostly on external materially decrease the emissions intensity of its PCAF. Our in scope portfolio consists mostly of house builders, mortgages on properties outside of the UK or changes and public policy interventions to: steer mortgage portfolio. Barclays has therefore mortgages originated through Barclays UK Business Banking have not Barclays UK residential mortgages, including been included in this sector. the UK energy grid towards renewable electricity; chosen to identify the 2030 emissions intensity properties to let. It also includes a smaller d EPC rating metrics calculated based on volume of accounts. Data as reduce dependence on fossil fuels for home 'convergence point' and measure our progress of 30 Sept 2022. portfolio of mortgages originated by the Private c heating; drive retrofitting of existing homes to towards it, but not to set a formal target at the Banking division of Barclays Bank PLC . Δ 2022 data subject to independent Limited Assurance under promote energy efficiency; and require that new current time. ISAE(UK)3000 and ISAE3410. Current and previous limited assurance We have selected the Balanced Net Zero (BNZ) scope and opinions can be found within the ESG Resource Hub for homes are built to a net zero standard. further details: home.barclays/sustainability/esg-resource-hub/ scenario developed by the UK's Climate Change reporting-and-disclosures/ Committee (CCC) as a benchmark for this sector as it is specific to the UK, independent, developed by a credible institution and aims to achieve net zero emissions for the UK by 2050. In line with this scenario, our portfolio would need to reach an emissions intensity of 19.7kgCO e/ 2 2 m by 2030 to be on a path to net zero by 2050, which would be a 40% reduction in emissions intensity from a 2022 baseline. Further details on the methodology can be found in the 2023 TM + BlueTrack Whitepaper at: home.barclays/sustainability/esg- resource-hub/reporting-and-disclosures/

Barclays PLC - Annual Report - 2022 Page 93 Page 95

Barclays PLC - Annual Report - 2022 Page 93 Page 95