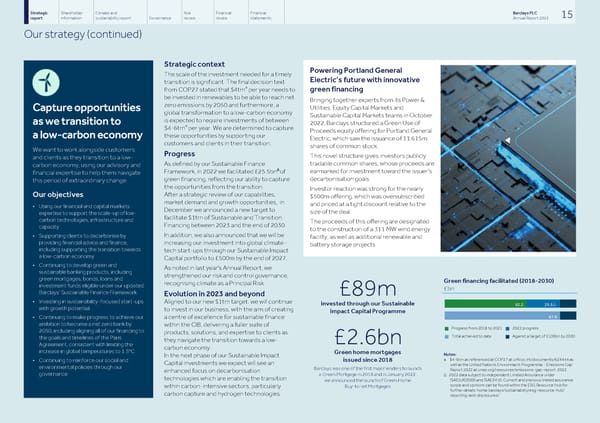

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 15 report information sustainability report Governance review review statements Annual Report 2022 Our strategy (continued) Strategic context Powering Portland General The scale of the investment needed for a timely Electric’s future with innovative transition is significant. The final decision text a green financing from COP27 stated that $4trn per year needs to be invested in renewables to be able to reach net Bringing together experts from its Power & zero emissions by 2050 and furthermore, a Utilities, Equity Capital Markets and Capture opportunities global transformation to a low-carbon economy Sustainable Capital Markets teams in October is expected to require investments of between as we transition to 2022, Barclays structured a Green Use of a $4-6trn per year. We are determined to capture Proceeds equity offering for Portland General these opportunities by supporting our a low-carbon economy Electric, which saw the issuance of 11.615m customers and clients in their transition. shares of common stock. We want to work alongside customers Progress This novel structure gives investors publicly and clients as they transition to a low- tradable common shares, whose proceeds are As defined by our Sustainable Finance carbon economy, using our advisory and Δ earmarked for investment toward the issuer's Framework, in 2022 we facilitated £25.5bn of financial expertise to help them navigate decarbonisation goals. green financing, reflecting our ability to capture this period of extraordinary change. the opportunities from the transition. Investor reaction was strong for the nearly After a strategic review of our capabilities, Our objectives $500m offering, which was oversubscribed market demand and growth opportunities, in and priced at a tight discount relative to the • Using our financial and capital markets December we announced a new target to size of the deal. expertise to support the scale-up of low- facilitate $1trn of Sustainable and Transition carbon technologies, infrastructure and The proceeds of this offering are designated Financing between 2023 and the end of 2030. capacity to the construction of a 311 MW wind energy In addition, we also announced that we will be • Supporting clients to decarbonise by facility, as well as additional renewable and providing financial advice and finance, increasing our investment into global climate- battery storage projects. including supporting the transition towards tech start-ups through our Sustainable Impact a low-carbon economy Capital portfolio to £500m by the end of 2027, • Continuing to develop green and As noted in last year's Annual Report, we sustainable banking products, including strengthened our risk and control governance, green mortgages, bonds, loans and Green financing facilitated (2018-2030) recognising climate as a Principal Risk. investment funds eligible under our updated £bn Barclays’ Sustainable Finance Framework £89m Evolution in 2023 and beyond • Investing in sustainability-focused start-ups Aligned to our new $1trn target, we will continue invested through our Sustainable 62.2 25.5△ with growth potential to invest in our business, with the aim of creating Impact Capital Programme 87.8 • Continuing to make progress to achieve our a centre of excellence for sustainable finance ambition to become a net zero bank by within the CIB, delivering a fuller suite of Progress from 2018 to 2021 2022 progress n n 2050, including aligning all of our financing to products, solutions, and expertise to clients as Total achieved to date Against a target of £100bn by 2030 n n the goals and timelines of the Paris they navigate the transition towards a low- £2.6bn Agreement, consistent with limiting the carbon economy. increase in global temperatures to 1.5°C Green home mortgages Notes: In the next phase of our Sustainable Impact a $4-6trn as referenced at COP27 at unfccc.int/documents/624444 as issued since 2018 • Continuing to reinforce our social and Capital investments we expect will see an well as the United Nations Environment Programme - Emissions Gap environmental policies through our Barclays was one of the first major lenders to launch Report 2022 at unep.org/resources/emissions-gap-report-2022. enhanced focus on decarbonisation governance a Green Mortgage in 2018 and in January 2022, Δ 2022 data subject to independent Limited Assurance under technologies which are enabling the transition ISAE(UK)3000 and ISAE3410. Current and previous limited assurance we announced the launch of Green Home scope and opinions can be found within the ESG Resource Hub for Buy-to-let Mortgages within carbon-intensive sectors, particularly further details: home.barclays/sustainability/esg-resource-hub/ carbon capture and hydrogen technologies. reporting-and-disclosures/

Barclays PLC - Annual Report - 2022 Page 16 Page 18

Barclays PLC - Annual Report - 2022 Page 16 Page 18