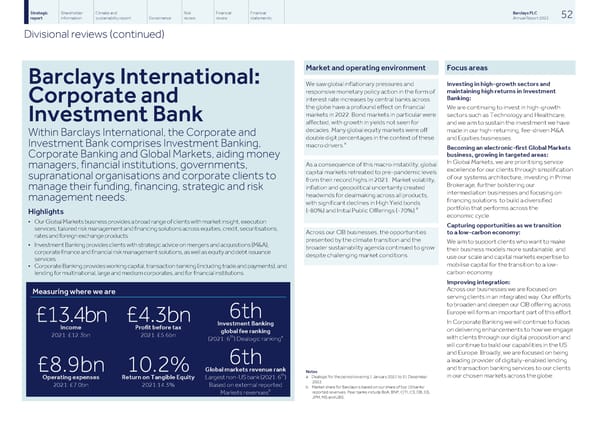

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 52 report information sustainability report Governance review review statements Annual Report 2022 Divisional reviews (continued) Market and operating environment Focus areas Barclays International: We saw global inflationary pressures and Investing in high-growth sectors and maintaining high returns in Investment responsive monetary policy action in the form of Banking: interest rate increases by central banks across Corporate and the globe have a profound effect on financial We are continuing to invest in high-growth markets in 2022. Bond markets in particular were sectors such as Technology and Healthcare, Investment Bank affected, with growth in yields not seen for and we aim to sustain the investment we have decades. Many global equity markets were off made in our high-returning, fee-driven M&A Within Barclays International, the Corporate and double digit percentages in the context of these and Equities businesses. a Investment Bank comprises Investment Banking, macro drivers. Becoming an electronic-first Global Markets business, growing in targeted areas: Corporate Banking and Global Markets, aiding money In Global Markets, we are prioritising service As a consequence of this macro instability, global managers, financial institutions, governments, excellence for our clients through simplification capital markets retreated to pre-pandemic levels supranational organisations and corporate clients to of our systems architecture, investing in Prime from their record highs in 2021. Market volatility, Brokerage, further bolstering our inflation and geopolitical uncertainty created manage their funding, financing, strategic and risk intermediation businesses and focusing on headwinds for dealmaking across all products, management needs. financing solutions to build a diversified with significant declines in High Yield bonds a portfolio that performs across the (-80%) and Initial Public Offerings (-70%). Highlights economic cycle. • Our Global Markets business provides a broad range of clients with market insight, execution Capturing opportunities as we transition services, tailored risk management and financing solutions across equities, credit, securitisations, Across our CIB businesses, the opportunities to a low-carbon economy: rates and foreign exchange products. presented by the climate transition and the We aim to support clients who want to make • Investment Banking provides clients with strategic advice on mergers and acquisitions (M&A), broader sustainability agenda continued to grow their business models more sustainable, and corporate finance and financial risk management solutions, as well as equity and debt issuance despite challenging market conditions. use our scale and capital markets expertise to services. mobilise capital for the transition to a low- • Corporate Banking provides working capital, transaction banking (including trade and payments), and carbon economy. lending for multinational, large and medium corporates, and for financial institutions. Improving integration: Across our businesses we are focused on Measuring where we are serving clients in an integrated way. Our efforts to broaden and deepen our CIB offering across Europe will form an important part of this effort. 6th £13.4bn £4.3bn In Corporate Banking we will continue to focus Investment Banking Income Profit before tax on delivering enhancements to how we engage global fee ranking 2021: £12.3bn 2021: £5.6bn th a with clients through our digital proposition and (2021: 6 ) Dealogic ranking will continue to build our capabilities in the US and Europe. Broadly, we are focused on being a leading provider of digitally-enabled lending 6th and transaction banking services to our clients Global markets revenue rank £8.9bn 10.2% Notes th in our chosen markets across the globe. a Dealogic for the period covering 1 January 2021 to 31 December Operating expenses Return on Tangible Equity Largest non-US bank (2021: 6 ) 2022. 2021: £7.0bn 2021:14.3% Based on external reported b Market share for Barclays is based on our share of top 10 banks' b reported revenues. Peer banks include BoA, BNP, CITI, CS, DB, GS, Markets revenues JPM, MS and UBS.

Barclays PLC - Annual Report - 2022 Page 53 Page 55

Barclays PLC - Annual Report - 2022 Page 53 Page 55