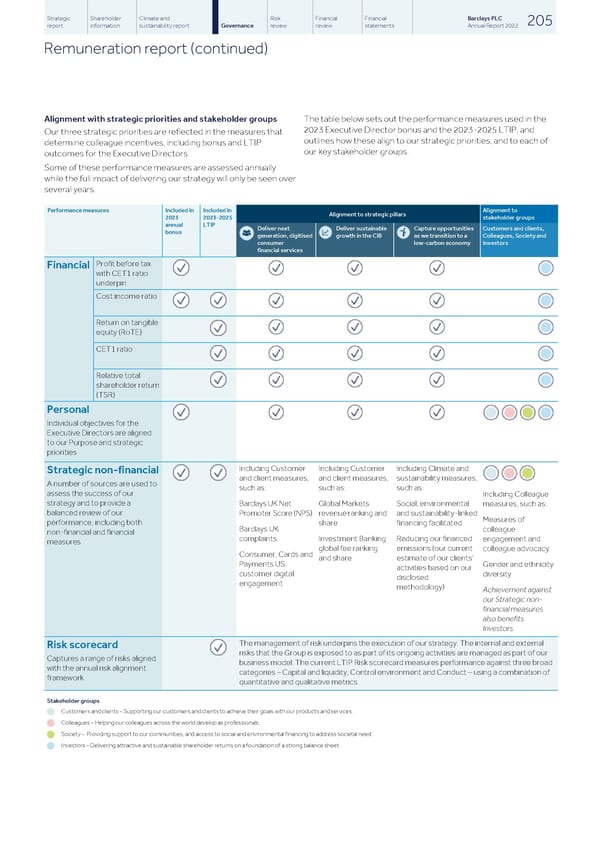

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 205 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Alignment with strategic priorities and stakeholder groups The table below sets out the performance measures used in the 2023 Executive Director bonus and the 2023-2025 LTIP, and Our three strategic priorities are reflected in the measures that outlines how these align to our strategic priorities, and to each of determine colleague incentives, including bonus and LTIP our key stakeholder groups. outcomes for the Executive Directors. Some of these performance measures are assessed annually while the full impact of delivering our strategy will only be seen over several years. Performance measures Included in Included in Alignment to Alignment to strategic pillars 2023 2023-2025 stakeholder groups annual LTIP Deliver next Deliver sustainable Capture opportunities Customers and clients, bonus generation, digitised growth in the CIB as we transition to a Colleagues, Society and consumer low-carbon economy Investors financial services Profit before tax Financial with CET1 ratio underpin Cost:income ratio Return on tangible equity (RoTE) CET1 ratio Relative total shareholder return (TSR) Personal Individual objectives for the Executive Directors are aligned to our Purpose and strategic priorities Including Customer Including Customer Including Climate and Strategic non-financial and client measures, and client measures, sustainability measures, A number of sources are used to such as: such as: such as: assess the success of our Including Colleague strategy and to provide a Barclays UK Net Global Markets Social, environmental measures, such as: balanced review of our Promoter Score (NPS) revenue ranking and and sustainability-linked Measures of performance, including both share financing facilitated Barclays UK colleague non-financial and financial complaints Investment Banking Reducing our financed engagement and measures global fee ranking emissions (our current colleague advocacy Consumer, Cards and and share estimate of our clients’ Payments US Gender and ethnicity activities based on our customer digital diversity disclosed engagement methodology) Achievement against our Strategic non- financial measures also benefits Investors The management of risk underpins the execution of our strategy. The internal and external Risk scorecard risks that the Group is exposed to as part of its ongoing activities are managed as part of our Captures a range of risks aligned business model. The current LTIP Risk scorecard measures performance against three broad with the annual risk alignment categories – Capital and liquidity, Control environment and Conduct – using a combination of framework quantitative and qualitative metrics Stakeholder groups Customers and clients – Supporting our customers and clients to achieve their goals with our products and services. Colleagues – Helping our colleagues across the world develop as professionals. Society – Providing support to our communities, and access to social and environmental financing to address societal need. Investors – Delivering attractive and sustainable shareholder returns on a foundation of a strong balance sheet.

Barclays PLC - Annual Report - 2022 Page 206 Page 208

Barclays PLC - Annual Report - 2022 Page 206 Page 208