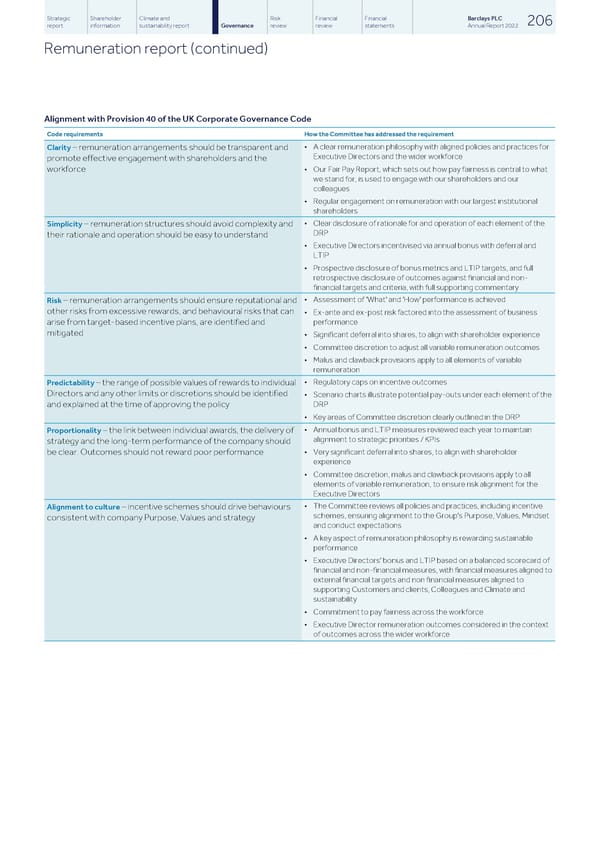

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 206 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Alignment with Provision 40 of the UK Corporate Governance Code Code requirements How the Committee has addressed the requirement • A clear remuneration philosophy with aligned policies and practices for Clarity – remuneration arrangements should be transparent and Executive Directors and the wider workforce promote effective engagement with shareholders and the • Our Fair Pay Report, which sets out how pay fairness is central to what workforce we stand for, is used to engage with our shareholders and our colleagues • Regular engagement on remuneration with our largest institutional shareholders • Clear disclosure of rationale for and operation of each element of the Simplicity – remuneration structures should avoid complexity and DRP their rationale and operation should be easy to understand • Executive Directors incentivised via annual bonus with deferral and LTIP • Prospective disclosure of bonus metrics and LTIP targets, and full retrospective disclosure of outcomes against financial and non- financial targets and criteria, with full supporting commentary • Assessment of 'What' and 'How' performance is achieved Risk – remuneration arrangements should ensure reputational and other risks from excessive rewards, and behavioural risks that can • Ex-ante and ex-post risk factored into the assessment of business performance arise from target-based incentive plans, are identified and mitigated • Significant deferral into shares, to align with shareholder experience • Committee discretion to adjust all variable remuneration outcomes • Malus and clawback provisions apply to all elements of variable remuneration • Regulatory caps on incentive outcomes Predictability – the range of possible values of rewards to individual Directors and any other limits or discretions should be identified • Scenario charts illustrate potential pay-outs under each element of the DRP and explained at the time of approving the policy • Key areas of Committee discretion clearly outlined in the DRP • Annual bonus and LTIP measures reviewed each year to maintain Proportionality – the link between individual awards, the delivery of alignment to strategic priorities / KPIs strategy and the long-term performance of the company should • Very significant deferral into shares, to align with shareholder be clear. Outcomes should not reward poor performance experience • Committee discretion, malus and clawback provisions apply to all elements of variable remuneration, to ensure risk alignment for the Executive Directors • The Committee reviews all policies and practices, including incentive Alignment to culture – incentive schemes should drive behaviours schemes, ensuring alignment to the Group's Purpose, Values, Mindset consistent with company Purpose, Values and strategy and conduct expectations • A key aspect of remuneration philosophy is rewarding sustainable performance • Executive Directors' bonus and LTIP based on a balanced scorecard of financial and non-financial measures, with financial measures aligned to external financial targets and non financial measures aligned to supporting Customers and clients, Colleagues and Climate and sustainability • Commitment to pay fairness across the workforce • Executive Director remuneration outcomes considered in the context of outcomes across the wider workforce

Barclays PLC - Annual Report - 2022 Page 207 Page 209

Barclays PLC - Annual Report - 2022 Page 207 Page 209