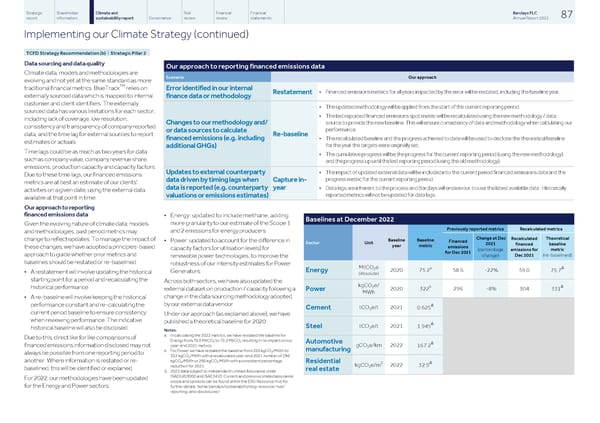

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 87 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 2 Data sourcing and data quality Our approach to reporting financed emissions data Climate data, models and methodologies are Scenario Our approach evolving and not yet at the same standard as more TM traditional financial metrics. BlueTrack relies on Error identified in our internal • Financed emissions metrics for all years impacted by the error will be restated, including the baseline year. Restatement externally sourced data which is mapped to internal finance data or methodology customer and client identifiers. The externally • The updated methodology will be applied from the start of the current reporting period. sourced data has various limitations for each sector, • The last reported financed emissions spot metric will be recalculated using the new methodology / data including lack of coverage, low resolution, Changes to our methodology and/ source to provide the new baseline. This will ensure consistency of data and methodology when calculating our consistency and transparency of company reported performance. or data sources to calculate data, and the time lag for external sources to report Re-baseline financed emissions (e.g. including • The recalculated baseline and the progress achieved to date will be used to disclose the theoretical baseline estimates or actuals. for the year the targets were originally set. additional GHGs) Time lags could be as much as two years for data • The cumulative progress will be the progress for the current reporting period (using the new methodology) such as company value, company revenue share, and the progress up until the last reporting period (using the old methodology). emissions, production capacity and capacity factors. Updates to external counterparty • The impact of updated external data will be included into the current period financed emissions data and the Due to these time lags, our financed emissions progress metric for the current reporting period. data driven by timing lags when Capture in- metrics are at best an estimate of our clients' data is reported (e.g. counterparty year • Data lags are inherent to the process and Barclays will endeavour to use the latest available data . Historically activities on a given date, using the external data reported metrics will not be updated for data lags. valuations or emissions estimates) available at that point in time. Our approach to reporting financed emissions data • Energy: updated to include methane, adding Baselines at December 2022 more granularity to our estimate of the Scope 1 Given the evolving nature of climate data, models Previously reported metrics Recalculated metrics and 2 emissions for energy producers and methodologies, past period metrics may Change at Dec Theoretical Recalculated change to reflect updates. To manage the impact of Baseline Baseline • Power: updated to account for the difference in Financed Sector Unit 2021 baseline financed year metric emissions these changes, we have adopted a principles-based capacity factors (or utilisation levels) for metric (percentage emissions for for Dec 2021 approach to guide whether prior metrics and Dec 2021 (re-baselined) change) renewable power technologies, to improve the baselines should be restated or re-baselined. robustness of our intensity estimates for Power MtCO e Δ a 2 2020 75.2 58.6 -22% 59.0 75.7 Energy Generators. • A restatement will involve updating the historical (Absolute) starting point for a period and recalculating the Across both sectors, we have also updated the kgCO e/ Δ b 2 historical performance 2020 322 296 -8% 304 external dataset on production / capacity following a 331 Power MWh change in the data sourcing methodology adopted • A re-baseline will involve keeping the historical by our external data vendor. Δ performance constant and re-calculating the tCO e/t 2021 0.625 Cement 2 current period baseline to ensure consistency Under our approach (as explained above), we have when reviewing performance. The indicative published a theoretical baseline for 2020. Δ tCO e/t 2021 1.945 Steel 2 historical baseline will also be disclosed. Notes: a In calculating the 2022 metrics, we have restated the baseline for Due to this, direct like for like comparisons of Energy from 75.0 MtCO to 75.2 MtCO resulting in no impact on our 2 2 Automotive Δ year-end 2021 metrics. gCO e/km 2022 financed emissions information disclosed may not 167.2 2 manufacturing b For Power we have restated the baseline from 320 kgCO /MWh to 2 always be possible from one reporting period to 322 kgCO /MWh with a recalculated year-end 2021 number of 296 2 kgCO /MWh vs 295 kgCO /MWh with a consistent percentage another. Where information is restated or re- 2 2 Residential Δ 2 kgCO e/m 2022 32.9 reduction for 2021. 2 baselined, this will be identified or explained. real estate Δ 2022 data subject to independent Limited Assurance under ISAE(UK)3000 and ISAE3410. Current and previous limited assurance For 2022, our methodologies have been updated scope and opinions can be found within the ESG Resource Hub for for the Energy and Power sectors: further details: home.barclays/sustainability/esg-resource-hub/ reporting-and-disclosures/

Barclays PLC - Annual Report - 2022 Page 88 Page 90

Barclays PLC - Annual Report - 2022 Page 88 Page 90