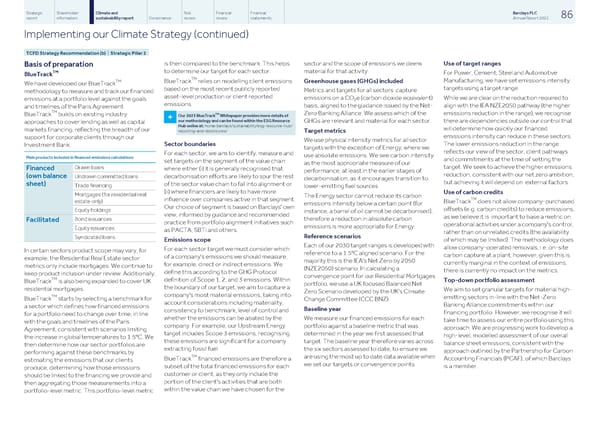

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 86 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 2 is then compared to the benchmark. This helps sector and the scope of emissions we deem Use of target ranges Basis of preparation TM to determine our target for each sector. material for that activity. For Power, Cement, Steel and Automotive BlueTrack TM Manufacturing, we have set emissions intensity TM BlueTrack relies on modelling client emissions Greenhouse gases (GHGs) included We have developed our BlueTrack targets using a target range. based on the most recent publicly reported Metrics and targets for all sectors capture methodology to measure and track our financed asset-level production or client reported emissions on a CO e (carbon dioxide equivalent) While we are clear on the reduction required to emissions at a portfolio level against the goals 2 emissions. basis, aligned to the guidance issued by the Net- align with the IEA NZE2050 pathway (the higher and timelines of the Paris Agreement. TM TM Zero Banking Alliance. We assess which of the emissions reduction in the range), we recognise BlueTrack builds on existing industry Our 2023 BlueTrack Whitepaper provides more details of + our methodology and can be found within the ESG Resource GHGs are relevant and material for each sector. there are dependencies outside our control that approaches to cover lending as well as capital Hub online at: home.barclays/sustainability/esg-resource-hub/ will determine how quickly our financed markets financing, reflecting the breadth of our reporting-and-disclosures/ Target metrics emissions intensity can reduce in these sectors. support for corporate clients through our We use physical intensity metrics for all sector The lower emissions reduction in the range Sector boundaries Investment Bank. targets with the exception of Energy, where we reflects our view of the sector, client pathways For each sector, we aim to identify, measure and use absolute emissions. We see carbon intensity Main products included in financed emissions calculations and commitments at the time of setting the set targets on the segment of the value chain as the most appropriate measure of our target. We seek to achieve the higher emissions Drawn loans Financed where either (i) it is generally recognised that performance, at least in the earlier stages of reduction, consistent with our net zero ambition, (own balance Undrawn committed loans decarbonisation efforts are likely to spur the rest decarbonisation, as it encourages transition to but achieving it will depend on external factors. sheet) of the sector value chain to fall into alignment or Trade financing lower-emitting fuel sources. (ii) where financiers are likely to have more Use of carbon credits Mortgages (for residential real The Energy sector cannot reduce its carbon TM influence over companies active in that segment. estate only) BlueTrack does not allow company-purchased emissions intensity below a certain point (for Our choice of segment is based on Barclays' own offsets (e.g. carbon credits) to reduce emissions, Equity holdings instance, a barrel of oil cannot be decarbonised), view, informed by guidance and recommended as we believe it is important to base a metric on therefore a reduction in absolute carbon Bond issuances Facilitated practice from portfolio alignment initiatives such operational activities under a company's control, emissions is more appropriate for Energy. Equity issuances as PACTA, SBTi and others. rather than on unrelated credits (the availability Reference scenarios Syndicated loans of which may be limited). The methodology does Emissions scope Each of our 2030 target ranges is developed with allow company-operated removals, i.e. on-site For each sector target we must consider which In certain sectors product scope may vary, for reference to a 1.5°C aligned scenario. For the carbon capture at a plant; however, given this is of a company's emissions we should measure, example, the Residential Real Estate sector majority this is the IEA's Net Zero by 2050 currently marginal in the context of emissions, for example, direct or indirect emissions. We metrics only include mortgages. We continue to (NZE2050) scenario. In calculating a there is currently no impact on the metrics. define this according to the GHG Protocol keep product inclusion under review. Additionally, convergence point for our Residential Mortgages TM definition of Scope 1, 2, and 3 emissions. Within Top-down portfolio assessment BlueTrack is also being expanded to cover UK portfolio, we use a UK focused Balanced Net the boundary of our target, we aim to capture a residential mortgages. We aim to set granular targets for material high- Zero Scenario developed by the UK's Climate company's most material emissions, taking into TM emitting sectors in-line with the Net-Zero BlueTrack starts by selecting a benchmark for Change Committee (CCC BNZ). account considerations including materiality, Banking Alliance commitments within our a sector which defines how financed emissions Baseline year consistency to benchmark, level of control and financing portfolio. However, we recognise it will for a portfolio need to change over time, in line whether the emissions can be abated by the We measure our financed emissions for each take time to assess our entire portfolio using this with the goals and timelines of the Paris company. For example, our Upstream Energy portfolio against a baseline metric that was approach. We are progressing work to develop a Agreement, consistent with scenarios limiting target includes Scope 3 emissions, recognising determined in the year we first assessed that high-level, modelled assessment of our overall the increase in global temperatures to 1.5°C. We these emissions are significant for a company target. The baseline year therefore varies across balance sheet emissions, consistent with the then determine how our sector portfolios are extracting fossil fuel. the six sectors assessed to date, to ensure we approach outlined by the Partnership for Carbon performing against these benchmarks by TM are using the most up to date data available when Accounting Financials (PCAF), of which Barclays BlueTrack financed emissions are therefore a estimating the emissions that our clients we set our targets or convergence points. is a member. subset of the total financed emissions for each produce, determining how those emissions customer or client, as they only include the should be linked to the financing we provide and portion of the client's activities that are both then aggregating those measurements into a within the value chain we have chosen for the portfolio-level metric. This portfolio-level metric

Barclays PLC - Annual Report - 2022 Page 87 Page 89

Barclays PLC - Annual Report - 2022 Page 87 Page 89