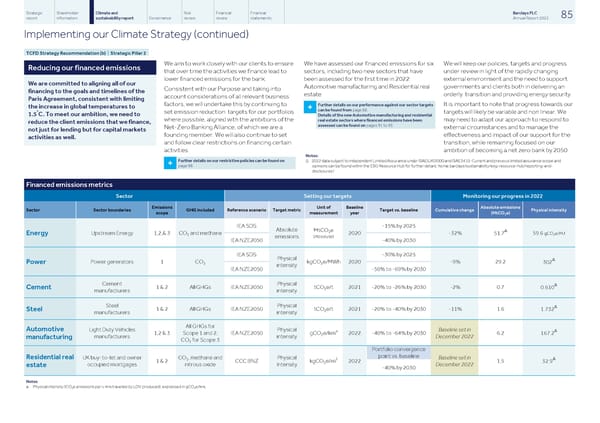

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 85 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 2 We aim to work closely with our clients to ensure We have assessed our financed emissions for six We will keep our policies, targets and progress Reducing our financed emissions that over time the activities we finance lead to sectors, including two new sectors that have under review in light of the rapidly changing lower financed emissions for the bank. been assessed for the first time in 2022: external environment and the need to support We are committed to aligning all of our Automotive manufacturing and Residential real governments and clients both in delivering an Consistent with our Purpose and taking into financing to the goals and timelines of the estate. orderly transition and providing energy security. account considerations of all relevant business Paris Agreement, consistent with limiting factors, we will undertake this by continuing to It is important to note that progress towards our Further details on our performance against our sector targets the increase in global temperatures to + can be found from page 88. ° set emission reduction targets for our portfolios targets will likely be variable and non linear. We 1.5C. To meet our ambition, we need to Details of the new Automotive manufacturing and residential where possible, aligned with the ambitions of the may need to adapt our approach to respond to real estate sectors where financed emissions have been reduce the client emissions that we finance, assessed can be found on pages 91 to 93. Net-Zero Banking Alliance, of which we are a external circumstances and to manage the not just for lending but for capital markets founding member. We will also continue to set effectiveness and impact of our support for the activities as well. and follow clear restrictions on financing certain transition, while remaining focused on our activities. ambition of becoming a net zero bank by 2050. Notes: Further details on our restrictive policies can be found on Δ 2022 data subject to independent Limited Assurance under ISAE(UK)3000 and ISAE3410. Current and previous limited assurance scope and + page 98. opinions can be found within the ESG Resource Hub for further details: home.barclays/sustainability/esg-resource-hub/reporting-and- disclosures/ Financed emissions metrics Sector Setting our targets Monitoring our progress in 2022 Emissions Unit of Baseline Absolute emissions Sector Sector boundaries GHG included Reference scenario Target metric Target vs. baseline Cumulative change Physical intensity scope measurement year (MtCO e) 2 IEA SDS -15% by 2025 Absolute MtCO e Δ 2 Upstream Energy 1,2,& 3 CO and methane 2020 -32% 59.6 gCO e/MJ 51.7 Energy 2 2 (Absolute) emissions IEA NZE2050 -40% by 2030 IEA SDS -30% by 2025 Physical Δ Power generators 1 CO kgCO e/MWh 2020 -9% 29.2 302 Power 2 2 intensity IEA NZE2050 -50% to -69% by 2030 Cement Physical Δ 1 & 2 All GHGs IEA NZE2050 tCO e/t 2021 -20% to -26% by 2030 -2% 0.7 0.610 Cement 2 manufacturers intensity Steel Physical Δ 1 & 2 All GHGs IEA NZE2050 tCO e/t 2021 -20% to -40% by 2030 -11% 1.6 1.732 Steel 2 manufacturers intensity All GHGs for Automotive Light Duty Vehicles Physical Baseline set in Δ a 1,2 & 3 Scope 1 and 2; IEA NZE2050 gCO e/km 2022 -40% to -64% by 2030 6.2 167.2 2 manufacturers intensity December 2022 manufacturing CO for Scope 3 2 Portfolio convergence point vs. baseline Residential real UK buy-to-let and owner CO, methane and Physical Baseline set in Δ 2 2 1 & 2 CCC BNZ kgCO e/m 2022 1.5 32.9 2 occupied mortgages nitrous oxide Intensity December 2022 estate -40% by 2030 Notes a Physical intensity (CO e emissions per v-km travelled by LDV produced), expressed in gCO e/km. 2 2

Barclays PLC - Annual Report - 2022 Page 86 Page 88

Barclays PLC - Annual Report - 2022 Page 86 Page 88