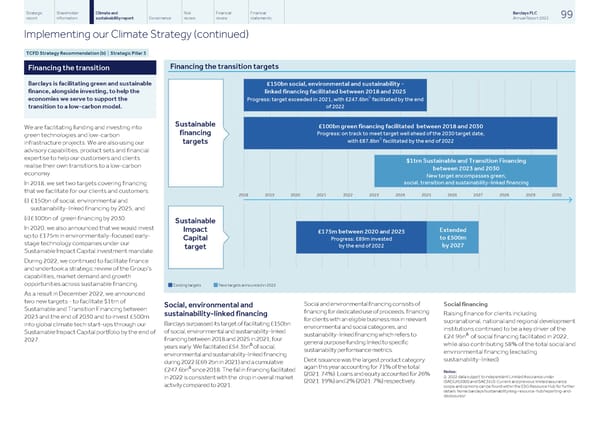

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 99 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 3 Financing the transition targets Financing the transition Barclays is facilitating green and sustainable £150bn social, environmental and sustainability - finance, alongside investing, to help the linked financing facilitated between 2018 and 2025 Δ economies we serve to support the Progress: target exceeded in 2021, with £247.6bn facilitated by the end of 2022 transition to a low-carbon model. Sustainable £100bn green financing facilitated between 2018 and 2030 We are facilitating funding and investing into financing Progress: on track to meet target well ahead of the 2030 target date, green technologies and low-carbon Δ with £87.8bn facilitated by the end of 2022 targets infrastructure projects. We are also using our advisory capabilities, product sets and financial expertise to help our customers and clients $1trn Sustainable and Transition Financing realise their own transitions to a low-carbon between 2023 and 2030 economy. New target encompasses green, social, transition and sustainability-linked financing In 2018, we set two targets covering financing that we facilitate for our clients and customers: (i) £150bn of social, environmental and sustainability-linked financing by 2025; and (ii) £100bn of green financing by 2030. Sustainable In 2020, we also announced that we would invest Impact Extended £175m between 2020 and 2025 up to £175m in environmentally-focused early- to £500m Capital Progress: £89m invested stage technology companies under our by 2027 by the end of 2022 target Sustainable Impact Capital investment mandate. During 2022, we continued to facilitate finance and undertook a strategic review of the Group’s capabilities, market demand and growth opportunities across sustainable financing. Existing targets New targets announced in 2022 As a result in December 2022, we announced two new targets - to facilitate $1trn of Social and environmental financing consists of Social financing Social, environmental and Sustainable and Transition Financing between financing for dedicated use of proceeds, financing Raising finance for clients including sustainability-linked financing 2023 and the end of 2030 and to invest £500m for clients with an eligible business mix in relevant supranational, national and regional development Barclays surpassed its target of facilitating £150bn into global climate tech start-ups through our environmental and social categories, and institutions continued to be a key driver of the of social, environmental and sustainability-linked Sustainable Impact Capital portfolio by the end of Δ sustainability-linked financing which refers to £24.9bn of social financing facilitated in 2022, financing between 2018 and 2025 in 2021, four 2027. general purpose funding linked to specific Δ while also contributing 58% of the total social and years early. We facilitated £54.3bn of social, sustainability performance metrics. environmental financing (excluding environmental and sustainability-linked financing sustainability-linked). Debt issuance was the largest product category during 2022 (£69.2bn in 2021) and a cumulative Δ again this year accounting for 71% of the total £247.6bn since 2018. The fall in financing facilitated Notes: (2021: 74%). Loans and equity accounted for 26% Δ 2022 data subject to independent Limited Assurance under in 2022 is consistent with the drop in overall market (2021: 19%) and 2% (2021: 7%) respectively. ISAE(UK)3000 and ISAE3410. Current and previous limited assurance activity compared to 2021. scope and opinions can be found within the ESG Resource Hub for further details: home.barclays/sustainability/esg-resource-hub/reporting-and- disclosures/

Barclays PLC - Annual Report - 2022 Page 100 Page 102

Barclays PLC - Annual Report - 2022 Page 100 Page 102