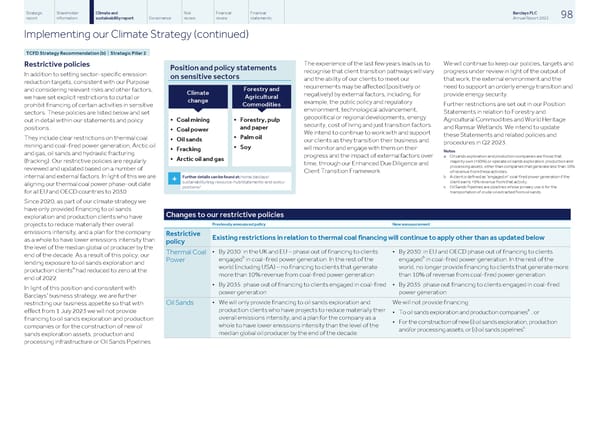

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 98 report information sustainability report Governance review review statements Annual Report 2022 Implementing our Climate Strategy (continued) TCFD Strategy Recommendation (b) | Strategic Pillar 2 The experience of the last few years leads us to We will continue to keep our policies, targets and Restrictive policies Position and policy statements recognise that client transition pathways will vary progress under review in light of the output of In addition to setting sector-specific emission on sensitive sectors and the ability of our clients to meet our that work, the external environment and the reduction targets, consistent with our Purpose requirements may be affected (positively or need to support an orderly energy transition and Forestry and and considering relevant risks and other factors, Climate negatively) by external factors, including, for provide energy security. Agricultural we have set explicit restrictions to curtail or change example, the public policy and regulatory Further restrictions are set out in our Position Commodities prohibit financing of certain activities in sensitive environment, technological advancement, Statements in relation to Forestry and sectors. These policies are listed below and set geopolitical or regional developments, energy Agricultural Commodities and World Heritage • Coal mining • Forestry, pulp out in detail within our statements and policy security, cost of living and just transition factors. and Ramsar Wetlands. We intend to update and paper positions . • Coal power We intend to continue to work with and support these Statements and related policies and • Palm oil They include clear restrictions on thermal coal • Oil sands our clients as they transition their business and procedures in Q2 2023. mining and coal-fired power generation, Arctic oil • Soy will monitor and engage with them on their • Fracking Notes and gas, oil sands and hydraulic fracturing progress and the impact of external factors over a Oil sands exploration and production companies are those that • Arctic oil and gas majority own (>50%) or operate oil sands exploration, production and (fracking). Our restrictive policies are regularly time, through our Enhanced Due Diligence and processing assets, other than companies that generate less than 10% reviewed and updated based on a number of Client Transition Framework. of revenue from these activities. b A client is defined as "engaged in" coal-fired power generation if the internal and external factors. In light of this we are Further details can be found at: home.barclays/ + client earns >5% revenue from that activity. sustainability/esg-resource-hub/statements-and-policy- aligning our thermal coal power phase-out date c Oil Sands Pipelines are pipelines whose primary use is for the positions/ transportation of crude oil extracted from oil sands. for all EU and OECD countries to 2030. Since 2020, as part of our climate strategy we have only provided financing to oil sands Changes to our restrictive policies exploration and production clients who have Previously announced policy New announcement projects to reduce materially their overall emissions intensity, and a plan for the company Restrictive Existing restrictions in relation to thermal coal financing will continue to apply other than as updated below as a whole to have lower emissions intensity than policy the level of the median global oil producer by the • By 2030: in the UK and EU – phase out of financing to clients • By 2030: in EU and OECD phase out of financing to clients Thermal Coal end of the decade. As a result of this policy, our b b engaged in coal-fired power generation. In the rest of the engaged in coal-fired power generation. In the rest of the Power lending exposure to oil sands exploration and world (including USA) – no financing to clients that generate world, no longer provide financing to clients that generate more a production clients had reduced to zero at the more than 10% revenue from coal-fired power generation than 10% of revenue from coal-fired power generation end of 2022. • By 2035: phase out of financing to clients engaged in coal-fired • By 2035: phase out financing to clients engaged in coal-fired In light of this position and consistent with power generation power generation Barclays’ business strategy, we are further • We will only provide financing to oil sands exploration and We will not provide financing: Oil Sands restricting our business appetite so that with a production clients who have projects to reduce materially their effect from 1 July 2023 we will not provide • To oil sands exploration and production companies ; or overall emissions intensity, and a plan for the company as a financing to oil sands exploration and production • For the construction of new (i) oil sands exploration, production whole to have lower emissions intensity than the level of the companies or for the construction of new oil c and/or processing assets; or (ii) oil sands pipelines . median global oil producer by the end of the decade. sands exploration assets, production and processing infrastructure or Oil Sands Pipelines.

Barclays PLC - Annual Report - 2022 Page 99 Page 101

Barclays PLC - Annual Report - 2022 Page 99 Page 101