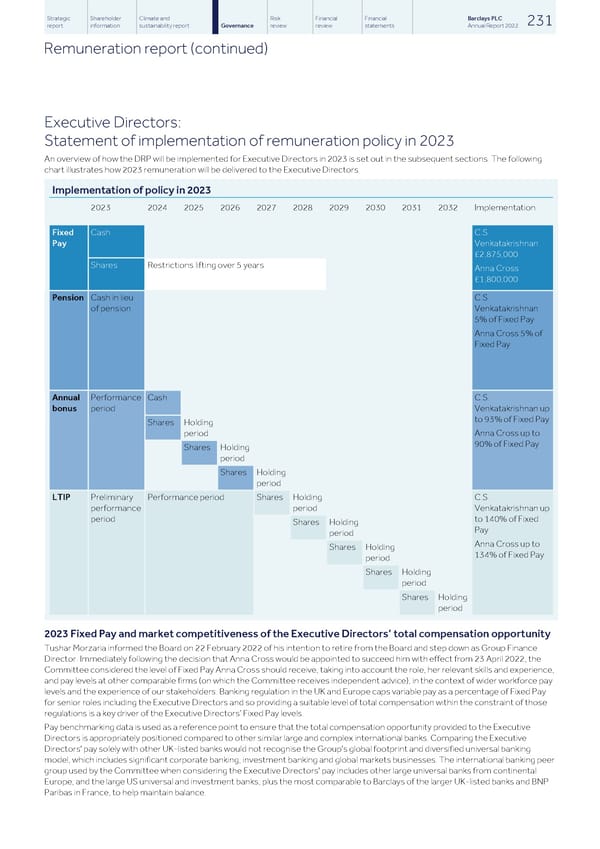

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 231 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Executive Directors: Statement of implementation of remuneration policy in 2023 An overview of how the DRP will be implemented for Executive Directors in 2023 is set out in the subsequent sections. The following chart illustrates how 2023 remuneration will be delivered to the Executive Directors. Implementation of policy in 2023 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 Implementation Fixed Cash C.S. Pay Venkatakrishnan £2,875,000 Shares Restrictions lifting over 5 years Anna Cross £1,800,000 Pension Cash in lieu C.S. of pension Venkatakrishnan 5% of Fixed Pay Anna Cross 5% of Fixed Pay Annual Performance Cash C.S. bonus period Venkatakrishnan up to 93% of Fixed Pay Shares Holding Anna Cross up to period 90% of Fixed Pay Shares Holding period Shares Holding period LTIP Preliminary Performance period Shares Holding C.S. performance period Venkatakrishnan up period to 140% of Fixed Shares Holding Pay period Anna Cross up to Shares Holding 134% of Fixed Pay period Shares Holding period Shares Holding period 2023 Fixed Pay and market competitiveness of the Executive Directors’ total compensation opportunity Tushar Morzaria informed the Board on 22 February 2022 of his intention to retire from the Board and step down as Group Finance Director. Immediately following the decision that Anna Cross would be appointed to succeed him with effect from 23 April 2022, the Committee considered the level of Fixed Pay Anna Cross should receive, taking into account the role, her relevant skills and experience, and pay levels at other comparable firms (on which the Committee receives independent advice), in the context of wider workforce pay levels and the experience of our stakeholders. Banking regulation in the UK and Europe caps variable pay as a percentage of Fixed Pay for senior roles including the Executive Directors and so providing a suitable level of total compensation within the constraint of those regulations is a key driver of the Executive Directors’ Fixed Pay levels. Pay benchmarking data is used as a reference point to ensure that the total compensation opportunity provided to the Executive Directors is appropriately positioned compared to other similar large and complex international banks. Comparing the Executive Directors' pay solely with other UK-listed banks would not recognise the Group's global footprint and diversified universal banking model, which includes significant corporate banking, investment banking and global markets businesses. The international banking peer group used by the Committee when considering the Executive Directors' pay includes other large universal banks from continental Europe, and the large US universal and investment banks, plus the most comparable to Barclays of the larger UK-listed banks and BNP Paribas in France, to help maintain balance.

Barclays PLC - Annual Report - 2022 Page 232 Page 234

Barclays PLC - Annual Report - 2022 Page 232 Page 234