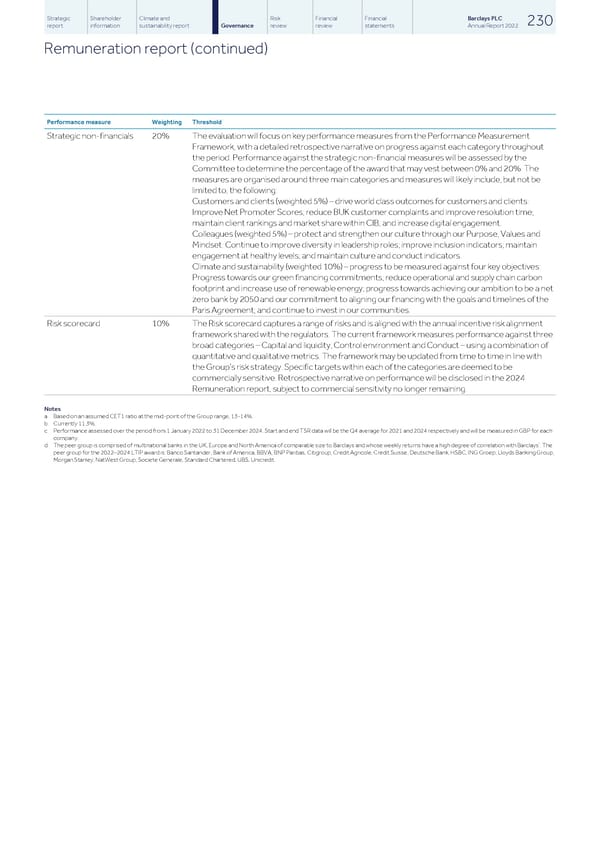

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 230 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Performance measure Weighting Threshold Strategic non-financials 20% The evaluation will focus on key performance measures from the Performance Measurement Framework, with a detailed retrospective narrative on progress against each category throughout the period. Performance against the strategic non-financial measures will be assessed by the Committee to determine the percentage of the award that may vest between 0% and 20%. The measures are organised around three main categories and measures will likely include, but not be limited to, the following: Customers and clients (weighted 5%) – drive world class outcomes for customers and clients: Improve Net Promoter Scores; reduce BUK customer complaints and improve resolution time; maintain client rankings and market share within CIB; and increase digital engagement. Colleagues (weighted 5%) – protect and strengthen our culture through our Purpose, Values and Mindset: Continue to improve diversity in leadership roles; improve inclusion indicators; maintain engagement at healthy levels; and maintain culture and conduct indicators. Climate and sustainability (weighted 10%) – progress to be measured against four key objectives: Progress towards our green financing commitments; reduce operational and supply chain carbon footprint and increase use of renewable energy; progress towards achieving our ambition to be a net zero bank by 2050 and our commitment to aligning our financing with the goals and timelines of the Paris Agreement; and continue to invest in our communities. Risk scorecard 10% The Risk scorecard captures a range of risks and is aligned with the annual incentive risk alignment framework shared with the regulators. The current framework measures performance against three broad categories – Capital and liquidity, Control environment and Conduct – using a combination of quantitative and qualitative metrics. The framework may be updated from time to time in line with the Group’s risk strategy. Specific targets within each of the categories are deemed to be commercially sensitive. Retrospective narrative on performance will be disclosed in the 2024 Remuneration report, subject to commercial sensitivity no longer remaining. Notes a Based on an assumed CET1 ratio at the mid-point of the Group range, 13-14%. b Currently 11.3%. c Performance assessed over the period from 1 January 2022 to 31 December 2024. Start and end TSR data will be the Q4 average for 2021 and 2024 respectively and will be measured in GBP for each company. d The peer group is comprised of multinational banks in the UK, Europe and North America of comparable size to Barclays and whose weekly returns have a high degree of correlation with Barclays’. The peer group for the 2022–2024 LTIP award is: Banco Santander, Bank of America, BBVA, BNP Paribas, Citigroup, Credit Agricole, Credit Suisse, Deutsche Bank, HSBC, ING Groep, Lloyds Banking Group, Morgan Stanley, NatWest Group, Societe Generale, Standard Chartered, UBS, Unicredit.

Barclays PLC - Annual Report - 2022 Page 231 Page 233

Barclays PLC - Annual Report - 2022 Page 231 Page 233