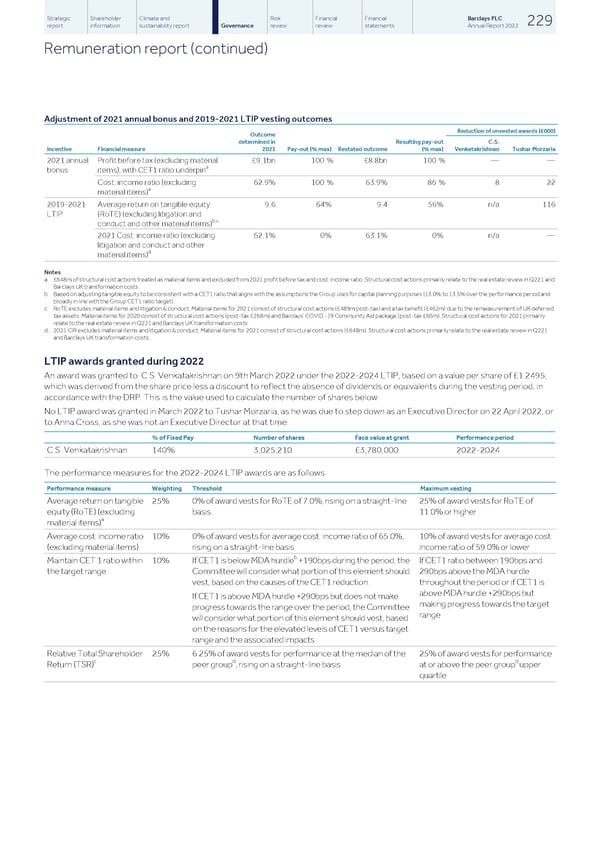

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 229 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Adjustment of 2021 annual bonus and 2019-2021 LTIP vesting outcomes Reduction of unvested awards (£000) Outcome determined in Resulting pay-out C.S. Incentive Financial measure 2021 Pay-out (% max) Restated outcome (% max) Venkatakrishnan Tushar Morzaria 2021 annual Profit before tax (excluding material £9.1bn 100 % £8.8bn 100 % — — a bonus items), with CET1 ratio underpin Cost: income ratio (excluding 62.9% 100 % 63.9% 86 % 8 22 a material items) 2019-2021 Average return on tangible equity 9.6 64% 9.4 56% n/a 116 LTIP (RoTE) (excluding litigation and b,c conduct and other material items) 2021 Cost: income ratio (excluding 62.1% 0% 63.1% 0% n/a — litigation and conduct and other d material items) Notes a £648m of structural cost actions treated as material items and excluded from 2021 profit before tax and cost: income ratio. Structural cost actions primarily relate to the real estate review in Q221 and Barclays UK transformation costs. b Based on adjusting tangible equity to be consistent with a CET1 ratio that aligns with the assumptions the Group uses for capital planning purposes (13.0% to 13.5% over the performance period and broadly in line with the Group CET1 ratio target). c RoTE excludes material items and litigation & conduct. Material items for 2021 consist of structural cost actions (£489m post-tax) and a tax benefit (£462m) due to the remeasurement of UK deferred tax assets. Material items for 2020 consist of structural cost actions (post-tax £268m) and Barclays’ COVID -19 Community Aid package (post-tax £66m). Structural cost actions for 2021 primarily relate to the real estate review in Q221 and Barclays UK transformation costs. d 2021 CIR excludes material items and litigation & conduct. Material items for 2021 consist of structural cost actions (£648m). Structural cost actions primarily relate to the real estate review in Q221 and Barclays UK transformation costs. LTIP awards granted during 2022 An award was granted to C.S. Venkatakrishnan on 9th March 2022 under the 2022-2024 LTIP, based on a value per share of £1.2495, which was derived from the share price less a discount to reflect the absence of dividends or equivalents during the vesting period, in accordance with the DRP. This is the value used to calculate the number of shares below. No LTIP award was granted in March 2022 to Tushar Morzaria, as he was due to step down as an Executive Director on 22 April 2022, or to Anna Cross, as she was not an Executive Director at that time. % of Fixed Pay Number of shares Face value at grant Performance period C.S. Venkatakrishnan 140% 3,025,210 £3,780,000 2022-2024 The performance measures for the 2022-2024 LTIP awards are as follows: Performance measure Weighting Threshold Maximum vesting Average return on tangible 25% 0% of award vests for RoTE of 7.0%, rising on a straight-line 25% of award vests for RoTE of equity (RoTE) (excluding basis 11.0% or higher a material items) Average cost: income ratio 10% 0% of award vests for average cost: income ratio of 65.0%, 10% of award vests for average cost: (excluding material items) rising on a straight-line basis income ratio of 59.0% or lower b Maintain CET 1 ratio within 10% If CET1 is below MDA hurdle +190bps during the period, the If CET1 ratio between 190bps and the target range Committee will consider what portion of this element should 290bps above the MDA hurdle vest, based on the causes of the CET1 reduction. throughout the period or if CET1 is above MDA hurdle +290bps but If CET1 is above MDA hurdle +290bps but does not make making progress towards the target progress towards the range over the period, the Committee range will consider what portion of this element should vest, based on the reasons for the elevated levels of CET1 versus target range and the associated impacts. Relative Total Shareholder 25% 6.25% of award vests for performance at the median of the 25% of award vests for performance c d d Return (TSR) peer group , rising on a straight-line basis at or above the peer group upper quartile

Barclays PLC - Annual Report - 2022 Page 230 Page 232

Barclays PLC - Annual Report - 2022 Page 230 Page 232