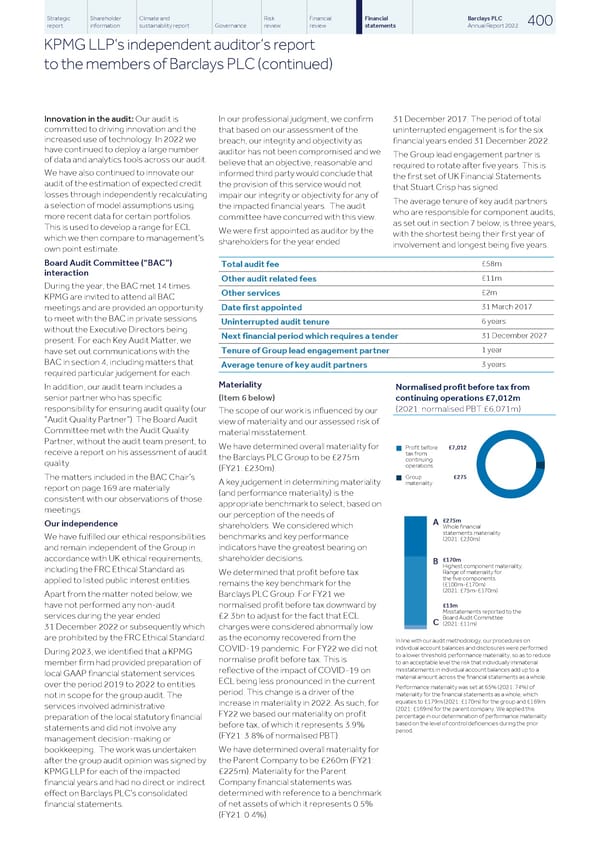

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 400 report information sustainability report Governance review review statements Annual Report 2022 KPMG LLP’s independent auditor’s report to the members of Barclays PLC (continued) Innovation in the audit: Our audit is In our professional judgment, we confirm 31 December 2017. The period of total committed to driving innovation and the that based on our assessment of the uninterrupted engagement is for the six increased use of technology. In 2022 we breach, our integrity and objectivity as financial years ended 31 December 2022. have continued to deploy a large number auditor has not been compromised and we The Group lead engagement partner is of data and analytics tools across our audit. believe that an objective, reasonable and required to rotate after five years. This is We have also continued to innovate our informed third party would conclude that the first set of UK Financial Statements audit of the estimation of expected credit the provision of this service would not that Stuart Crisp has signed. losses through independently recalculating impair our integrity or objectivity for any of The average tenure of key audit partners a selection of model assumptions using the impacted financial years. The audit who are responsible for component audits, more recent data for certain portfolios. committee have concurred with this view. as set out in section 7 below, is three years, This is used to develop a range for ECL We were first appointed as auditor by the with the shortest being their first year of which we then compare to management’s shareholders for the year ended involvement and longest being five years. own point estimate. Board Audit Committee (“BAC”) £58m Total audit fee interaction £11m Other audit related fees During the year, the BAC met 14 times. £2m Other services KPMG are invited to attend all BAC 31 March 2017 Date first appointed meetings and are provided an opportunity to meet with the BAC in private sessions 6 years Uninterrupted audit tenure without the Executive Directors being 31 December 2027 Next financial period which requires a tender present. For each Key Audit Matter, we 1 year Tenure of Group lead engagement partner have set out communications with the BAC in section 4, including matters that 3 years Average tenure of key audit partners required particular judgement for each. Materiality In addition, our audit team includes a Normalised profit before tax from (Item 6 below) senior partner who has specific continuing operations £7,012m responsibility for ensuring audit quality (our (2021: normalised PBT:£6,071m) The scope of our work is influenced by our “Audit Quality Partner”). The Board Audit view of materiality and our assessed risk of Committee met with the Audit Quality material misstatement. Partner, without the audit team present, to We have determined overall materiality for Profit before £7,012 n receive a report on his assessment of audit tax from the Barclays PLC Group to be £275m continuing quality. operations (FY21: £230m). Group £275 The matters included in the BAC Chair’s n A key judgement in determining materiality materiality report on page 169 are materially (and performance materiality) is the consistent with our observations of those appropriate benchmark to select, based on meetings. our perception of the needs of £275m A Our independence shareholders. We considered which Whole financial statements materiality benchmarks and key performance We have fulfilled our ethical responsibilities (2021: £230m) indicators have the greatest bearing on and remain independent of the Group in shareholder decisions. accordance with UK ethical requirements, £170m B Highest component materiality. including the FRC Ethical Standard as Range of materiality for We determined that profit before tax the five components applied to listed public interest entities. remains the key benchmark for the (£100m-£170m) (2021: £75m-£170m) Barclays PLC Group. For FY21 we Apart from the matter noted below, we £13m normalised profit before tax downward by have not performed any non-audit Misstatements reported to the £2.3bn to adjust for the fact that ECL services during the year ended Board Audit Committee C (2021: £11m) charges were considered abnormally low 31 December 2022 or subsequently which as the economy recovered from the are prohibited by the FRC Ethical Standard. In line with our audit methodology, our procedures on individual account balances and disclosures were performed COVID-19 pandemic. For FY22 we did not During 2023, we identified that a KPMG to a lower threshold, performance materiality, so as to reduce normalise profit before tax. This is to an acceptable level the risk that individually immaterial member firm had provided preparation of misstatements in individual account balances add up to a reflective of the impact of COVID-19 on local GAAP financial statement services material amount across the financial statements as a whole. ECL being less pronounced in the current over the period 2019 to 2022 to entities Performance materiality was set at 65% (2021: 74%) of period. This change is a driver of the materiality for the financial statements as a whole, which not in scope for the group audit. The equates to £179m (2021: £170m) for the group and £169m increase in materiality in 2022. As such, for services involved administrative (2021: £169m) for the parent company. We applied this FY22 we based our materiality on profit percentage in our determination of performance materiality preparation of the local statutory financial based on the level of control deficiencies during the prior before tax, of which it represents 3.9% statements and did not involve any period. (FY21: 3.8% of normalised PBT). management decision-making or We have determined overall materiality for bookkeeping. The work was undertaken the Parent Company to be £260m (FY21: after the group audit opinion was signed by £225m). Materiality for the Parent KPMG LLP for each of the impacted Company financial statements was financial years and had no direct or indirect determined with reference to a benchmark effect on Barclays PLC’s consolidated of net assets of which it represents 0.5% financial statements. (FY21: 0.4%).

Barclays PLC - Annual Report - 2022 Page 401 Page 403

Barclays PLC - Annual Report - 2022 Page 401 Page 403