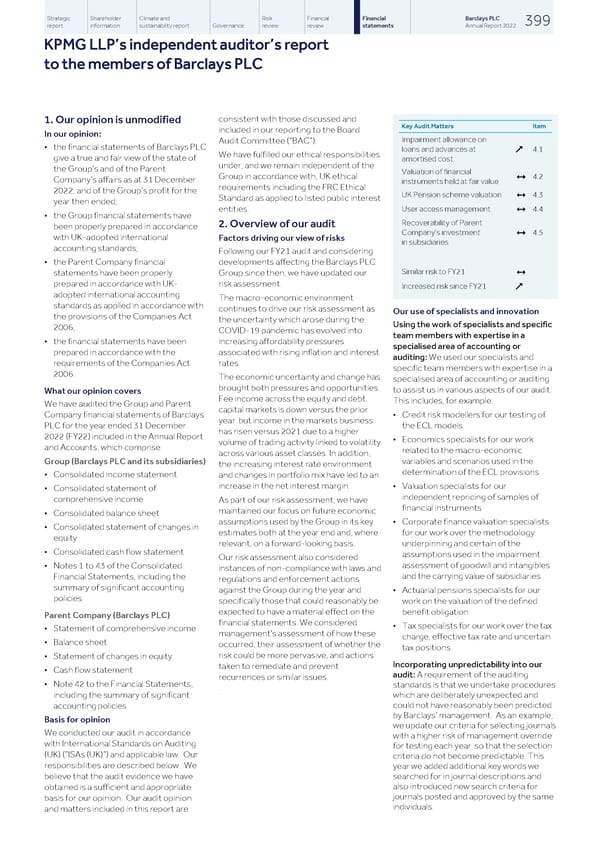

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 399 report information sustainability report Governance review review statements Annual Report 2022 KPMG LLP’s independent auditor’s report to the members of Barclays PLC consistent with those discussed and 1. Our opinion is unmodified Key Audit Matters Item included in our reporting to the Board In our opinion: Impairment allowance on Audit Committee (“BAC”). • the financial statements of Barclays PLC loans and advances at 4.1 & We have fulfilled our ethical responsibilities give a true and fair view of the state of amortised cost under, and we remain independent of the the Group’s and of the Parent Valuation of financial 4.2 Group in accordance with, UK ethical 1 Company’s affairs as at 31 December instruments held at fair value requirements including the FRC Ethical 2022, and of the Group’s profit for the UK Pension scheme valuation 4.3 1 Standard as applied to listed public interest year then ended; User access management 4.4 entities. 1 • the Group financial statements have Recoverability of Parent 2. Overview of our audit been properly prepared in accordance Company’s investment 4.5 1 with UK-adopted international Factors driving our view of risks in subsidiaries accounting standards; Following our FY21 audit and considering • the Parent Company financial developments affecting the Barclays PLC Similar risk to FY21 statements have been properly Group since then, we have updated our 1 prepared in accordance with UK- risk assessment. Increased risk since FY21 & adopted international accounting The macro-economic environment standards as applied in accordance with continues to drive our risk assessment as Our use of specialists and innovation the provisions of the Companies Act the uncertainty which arose during the Using the work of specialists and specific 2006; COVID-19 pandemic has evolved into team members with expertise in a • the financial statements have been increasing affordability pressures specialised area of accounting or prepared in accordance with the associated with rising inflation and interest auditing: We used our specialists and requirements of the Companies Act rates. specific team members with expertise in a 2006. The economic uncertainty and change has specialised area of accounting or auditing brought both pressures and opportunities. to assist us in various aspects of our audit. What our opinion covers Fee income across the equity and debt This includes, for example: We have audited the Group and Parent capital markets is down versus the prior • Credit risk modellers for our testing of Company financial statements of Barclays year but income in the markets business the ECL models PLC for the year ended 31 December has risen versus 2021 due to a higher 2022 (FY22) included in the Annual Report • Economics specialists for our work volume of trading activity linked to volatility and Accounts, which comprise: related to the macro-economic across various asset classes. In addition, variables and scenarios used in the Group (Barclays PLC and its subsidiaries) the increasing interest rate environment determination of the ECL provisions • Consolidated income statement and changes in portfolio mix have led to an increase in the net interest margin. • Valuation specialists for our • Consolidated statement of independent repricing of samples of comprehensive income As part of our risk assessment, we have financial instruments maintained our focus on future economic • Consolidated balance sheet assumptions used by the Group in its key • Corporate finance valuation specialists • Consolidated statement of changes in estimates both at the year end and, where for our work over the methodology equity relevant, on a forward-looking basis. underpinning and certain of the • Consolidated cash flow statement assumptions used in the impairment Our risk assessment also considered assessment of goodwill and intangibles • Notes 1 to 43 of the Consolidated instances of non-compliance with laws and and the carrying value of subsidiaries Financial Statements, including the regulations and enforcement actions summary of significant accounting against the Group during the year and • Actuarial pensions specialists for our policies specifically those that could reasonably be work on the valuation of the defined expected to have a material effect on the benefit obligation Parent Company (Barclays PLC) financial statements. We considered • Tax specialists for our work over the tax • Statement of comprehensive income management’s assessment of how these charge, effective tax rate and uncertain • Balance sheet occurred, their assessment of whether the tax positions. risk could be more pervasive, and actions • Statement of changes in equity Incorporating unpredictability into our taken to remediate and prevent • Cash flow statement audit: A requirement of the auditing recurrences or similar issues. • Note 42 to the Financial Statements, standards is that we undertake procedures : including the summary of significant which are deliberately unexpected and could not have reasonably been predicted accounting policies by Barclays’ management. As an example, Basis for opinion we update our criteria for selecting journals We conducted our audit in accordance with a higher risk of management override with International Standards on Auditing for testing each year so that the selection (UK) (“ISAs (UK)”) and applicable law. Our criteria do not become predictable. This responsibilities are described below. We year we added additional key words we searched for in journal descriptions and believe that the audit evidence we have also introduced new search criteria for obtained is a sufficient and appropriate journals posted and approved by the same basis for our opinion. Our audit opinion individuals. and matters included in this report are

Barclays PLC - Annual Report - 2022 Page 400 Page 402

Barclays PLC - Annual Report - 2022 Page 400 Page 402