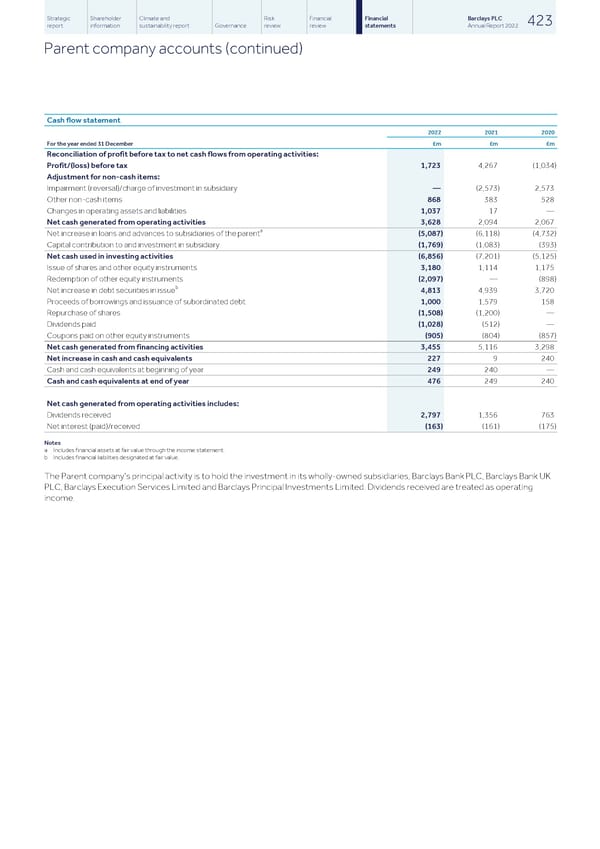

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 423 report information sustainability report Governance review review statements Annual Report 2022 Parent company accounts (continued) Cash flow statement 2022 2021 2020 For the year ended 31 December £m £m £m Reconciliation of profit before tax to net cash flows from operating activities: Profit/(loss) before tax 1,723 4,267 (1,034) Adjustment for non-cash items: Impairment (reversal)/charge of investment in subsidiary — (2,573) 2,573 Other non-cash items 868 383 528 Changes in operating assets and liabilities 1,037 17 — Net cash generated from operating activities 3,628 2,094 2,067 a Net increase in loans and advances to subsidiaries of the parent (5,087) (6,118) (4,732) Capital contribution to and investment in subsidiary (1,769) (1,083) (393) Net cash used in investing activities (6,856) (7,201) (5,125) Issue of shares and other equity instruments 3,180 1,114 1,175 Redemption of other equity instruments (2,097) — (898) b Net increase in debt securities in issue 4,813 4,939 3,720 Proceeds of borrowings and issuance of subordinated debt 1,000 1,579 158 Repurchase of shares (1,508) (1,200) — Dividends paid (1,028) (512) — Coupons paid on other equity instruments (905) (804) (857) Net cash generated from financing activities 3,455 5,116 3,298 Net increase in cash and cash equivalents 227 9 240 Cash and cash equivalents at beginning of year 249 240 — Cash and cash equivalents at end of year 476 249 240 Net cash generated from operating activities includes: Dividends received 2,797 1,356 763 Net interest (paid)/received (163) (161) (175) Notes a Includes financial assets at fair value through the income statement. b Includes financial liabilities designated at fair value. The Parent company’s principal activity is to hold the investment in its wholly-owned subsidiaries, Barclays Bank PLC, Barclays Bank UK PLC, Barclays Execution Services Limited and Barclays Principal Investments Limited. Dividends received are treated as operating income.

Barclays PLC - Annual Report - 2022 Page 424 Page 426

Barclays PLC - Annual Report - 2022 Page 424 Page 426