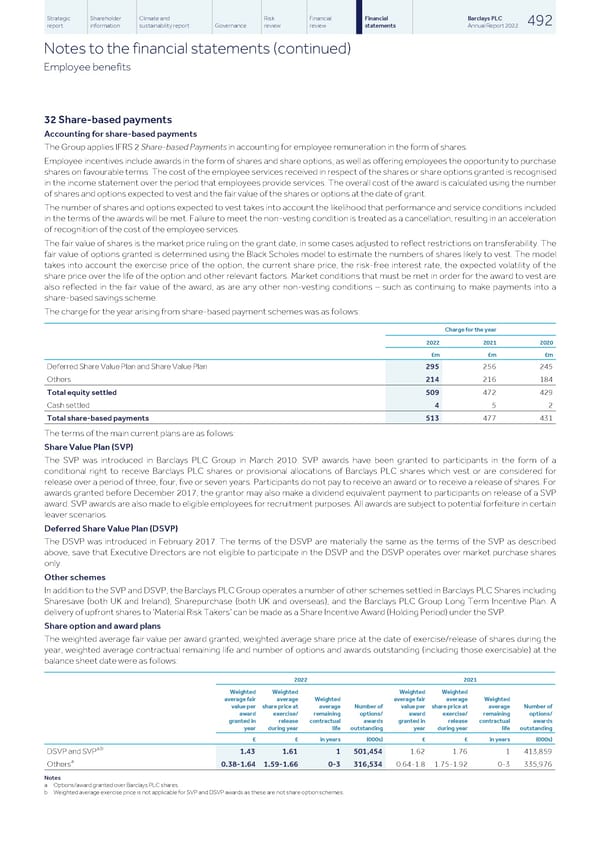

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 492 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Employee benefits 32 Share-based payments Accounting for share-based payments The Group applies IFRS 2 Share-based Payments in accounting for employee remuneration in the form of shares. Employee incentives include awards in the form of shares and share options, as well as offering employees the opportunity to purchase shares on favourable terms. The cost of the employee services received in respect of the shares or share options granted is recognised in the income statement over the period that employees provide services. The overall cost of the award is calculated using the number of shares and options expected to vest and the fair value of the shares or options at the date of grant. The number of shares and options expected to vest takes into account the likelihood that performance and service conditions included in the terms of the awards will be met. Failure to meet the non-vesting condition is treated as a cancellation, resulting in an acceleration of recognition of the cost of the employee services. The fair value of shares is the market price ruling on the grant date, in some cases adjusted to reflect restrictions on transferability. The fair value of options granted is determined using the Black Scholes model to estimate the numbers of shares likely to vest. The model takes into account the exercise price of the option, the current share price, the risk-free interest rate, the expected volatility of the share price over the life of the option and other relevant factors. Market conditions that must be met in order for the award to vest are also reflected in the fair value of the award, as are any other non-vesting conditions – such as continuing to make payments into a share-based savings scheme. The charge for the year arising from share-based payment schemes was as follows: Charge for the year 2022 2021 2020 £m £m £m Deferred Share Value Plan and Share Value Plan 295 256 245 Others 214 216 184 Total equity settled 509 472 429 Cash settled 4 5 2 Total share-based payments 513 477 431 The terms of the main current plans are as follows: Share Value Plan (SVP) The SVP was introduced in Barclays PLC Group in March 2010. SVP awards have been granted to participants in the form of a conditional right to receive Barclays PLC shares or provisional allocations of Barclays PLC shares which vest or are considered for release over a period of three, four, five or seven years. Participants do not pay to receive an award or to receive a release of shares. For awards granted before December 2017, the grantor may also make a dividend equivalent payment to participants on release of a SVP award. SVP awards are also made to eligible employees for recruitment purposes. All awards are subject to potential forfeiture in certain leaver scenarios. Deferred Share Value Plan (DSVP) The DSVP was introduced in February 2017. The terms of the DSVP are materially the same as the terms of the SVP as described above, save that Executive Directors are not eligible to participate in the DSVP and the DSVP operates over market purchase shares only. Other schemes In addition to the SVP and DSVP, the Barclays PLC Group operates a number of other schemes settled in Barclays PLC Shares including Sharesave (both UK and Ireland), Sharepurchase (both UK and overseas), and the Barclays PLC Group Long Term Incentive Plan. A delivery of upfront shares to ‘Material Risk Takers’ can be made as a Share Incentive Award (Holding Period) under the SVP. Share option and award plans The weighted average fair value per award granted, weighted average share price at the date of exercise/release of shares during the year, weighted average contractual remaining life and number of options and awards outstanding (including those exercisable) at the balance sheet date were as follows: 2022 2021 Weighted Weighted Weighted Weighted average fair average Weighted average fair average Weighted value per share price at average Number of value per share price at average Number of award exercise/ remaining options/ award exercise/ remaining options/ granted in release contractual awards granted in release contractual awards year during year life outstanding year during year life outstanding £ £ in years (000s) £ £ in years (000s) a,b DSVP and SVP 1.43 1.61 1 501,454 1.62 1.76 1 413,859 a Others 0.38-1.64 1.59-1.66 0-3 316,534 0.64-1.8 1.75-1.92 0-3 335,976 Notes a Options/award granted over Barclays PLC shares. b Weighted average exercise price is not applicable for SVP and DSVP awards as these are not share option schemes.

Barclays PLC - Annual Report - 2022 Page 493 Page 495

Barclays PLC - Annual Report - 2022 Page 493 Page 495