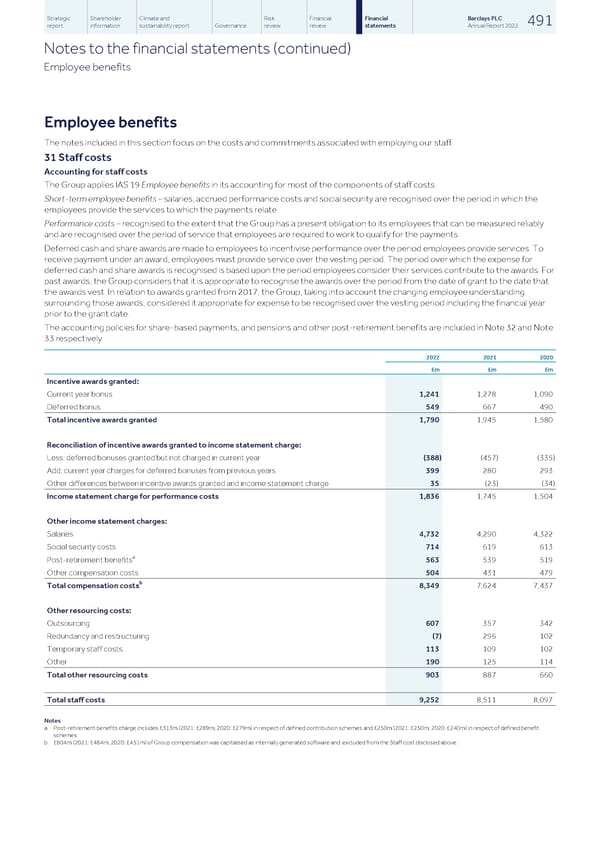

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 491 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Employee benefits Employee benefits The notes included in this section focus on the costs and commitments associated with employing our staff. 31 Staff costs Accounting for staff costs The Group applies IAS 19 Employee benefits in its accounting for most of the components of staff costs. Short-term employee benefits – salaries, accrued performance costs and social security are recognised over the period in which the employees provide the services to which the payments relate. Performance costs – recognised to the extent that the Group has a present obligation to its employees that can be measured reliably and are recognised over the period of service that employees are required to work to qualify for the payments. Deferred cash and share awards are made to employees to incentivise performance over the period employees provide services. To receive payment under an award, employees must provide service over the vesting period. The period over which the expense for deferred cash and share awards is recognised is based upon the period employees consider their services contribute to the awards. For past awards, the Group considers that it is appropriate to recognise the awards over the period from the date of grant to the date that the awards vest. In relation to awards granted from 2017, the Group, taking into account the changing employee understanding surrounding those awards, considered it appropriate for expense to be recognised over the vesting period including the financial year prior to the grant date. The accounting policies for share-based payments, and pensions and other post-retirement benefits are included in Note 32 and Note 33 respectively. 2022 2021 2020 £m £m £m Incentive awards granted: Current year bonus 1,241 1,278 1,090 Deferred bonus 549 667 490 Total incentive awards granted 1,790 1,945 1,580 Reconciliation of incentive awards granted to income statement charge: Less: deferred bonuses granted but not charged in current year (388) (457) (335) Add: current year charges for deferred bonuses from previous years 399 280 293 Other differences between incentive awards granted and income statement charge 35 (23) (34) Income statement charge for performance costs 1,836 1,745 1,504 Other income statement charges: Salaries 4,732 4,290 4,322 Social security costs 714 619 613 a Post-retirement benefits 563 539 519 Other compensation costs 504 431 479 b Total compensation costs 8,349 7,624 7,437 Other resourcing costs: Outsourcing 607 357 342 Redundancy and restructuring (7) 296 102 Temporary staff costs 113 109 102 Other 190 125 114 Total other resourcing costs 903 887 660 Total staff costs 9,252 8,511 8,097 Notes a Post-retirement benefits charge includes £313m (2021: £289m; 2020: £279m) in respect of defined contribution schemes and £250m (2021: £250m; 2020: £240m) in respect of defined benefit schemes. b £604m (2021: £484m; 2020: £451m) of Group compensation was capitalised as internally generated software and excluded from the Staff cost disclosed above .

Barclays PLC - Annual Report - 2022 Page 492 Page 494

Barclays PLC - Annual Report - 2022 Page 492 Page 494