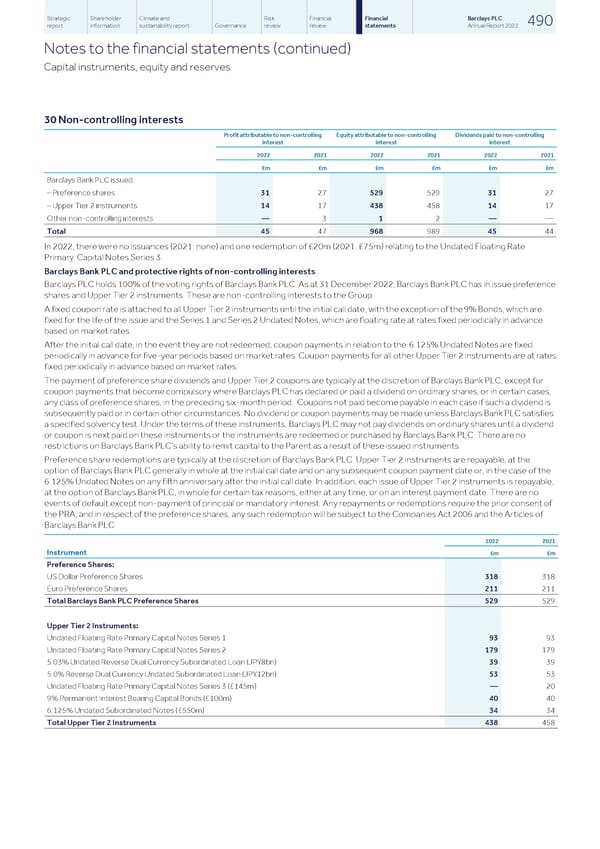

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 490 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Capital instruments, equity and reserves 30 Non-controlling interests Profit attributable to non-controlling Equity attributable to non-controlling Dividends paid to non-controlling interest interest interest 2022 2021 2022 2021 2022 2021 £m £m £m £m £m £m Barclays Bank PLC issued: – Preference shares 31 27 529 529 31 27 – Upper Tier 2 instruments 14 17 438 458 14 17 Other non-controlling interests — 3 1 2 — — Total 45 47 968 989 45 44 In 2022, there were no issuances (2021: none) and one redemption of £20m (2021: £75m) relating to the Undated Floating Rate Primary Capital Notes Series 3. Barclays Bank PLC and protective rights of non-controlling interests Barclays PLC holds 100% of the voting rights of Barclays Bank PLC. As at 31 December 2022, Barclays Bank PLC has in issue preference shares and Upper Tier 2 instruments. These are non-controlling interests to the Group. A fixed coupon rate is attached to all Upper Tier 2 instruments until the initial call date, with the exception of the 9% Bonds, which are fixed for the life of the issue and the Series 1 and Series 2 Undated Notes, which are floating rate at rates fixed periodically in advance based on market rates. After the initial call date, in the event they are not redeemed, coupon payments in relation to the 6.125% Undated Notes are fixed periodically in advance for five-year periods based on market rates. Coupon payments for all other Upper Tier 2 instruments are at rates fixed periodically in advance based on market rates. The payment of preference share dividends and Upper Tier 2 coupons are typically at the discretion of Barclays Bank PLC, except for coupon payments that become compulsory where Barclays PLC has declared or paid a dividend on ordinary shares, or in certain cases, any class of preference shares, in the preceding six-month period. Coupons not paid become payable in each case if such a dividend is subsequently paid or in certain other circumstances. No dividend or coupon payments may be made unless Barclays Bank PLC satisfies a specified solvency test. Under the terms of these instruments, Barclays PLC may not pay dividends on ordinary shares until a dividend or coupon is next paid on these instruments or the instruments are redeemed or purchased by Barclays Bank PLC. There are no restrictions on Barclays Bank PLC’s ability to remit capital to the Parent as a result of these issued instruments. Preference share redemptions are typically at the discretion of Barclays Bank PLC. Upper Tier 2 instruments are repayable, at the option of Barclays Bank PLC generally in whole at the initial call date and on any subsequent coupon payment date or, in the case of the 6.125% Undated Notes on any fifth anniversary after the initial call date. In addition, each issue of Upper Tier 2 instruments is repayable, at the option of Barclays Bank PLC, in whole for certain tax reasons, either at any time, or on an interest payment date. There are no events of default except non-payment of principal or mandatory interest. Any repayments or redemptions require the prior consent of the PRA, and in respect of the preference shares, any such redemption will be subject to the Companies Act 2006 and the Articles of Barclays Bank PLC. 2022 2021 Instrument £m £m Preference Shares: US Dollar Preference Shares 318 318 Euro Preference Shares 211 211 Total Barclays Bank PLC Preference Shares 529 529 Upper Tier 2 Instruments: Undated Floating Rate Primary Capital Notes Series 1 93 93 Undated Floating Rate Primary Capital Notes Series 2 179 179 5.03% Undated Reverse Dual Currency Subordinated Loan (JPY8bn) 39 39 5.0% Reverse Dual Currency Undated Subordinated Loan (JPY12bn) 53 53 Undated Floating Rate Primary Capital Notes Series 3 (£145m) — 20 9% Permanent Interest Bearing Capital Bonds (£100m) 40 40 6.125% Undated Subordinated Notes (£550m) 34 34 Total Upper Tier 2 Instruments 438 458

Barclays PLC - Annual Report - 2022 Page 491 Page 493

Barclays PLC - Annual Report - 2022 Page 491 Page 493