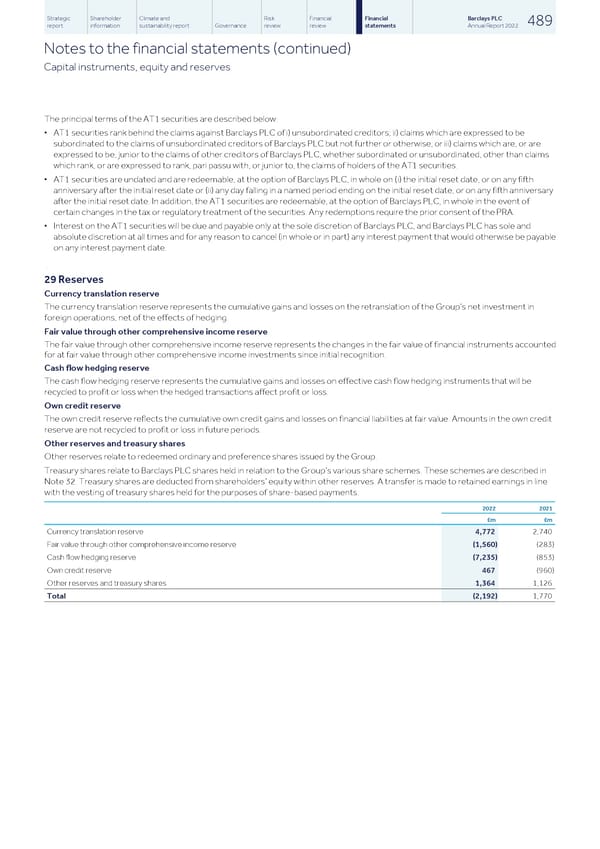

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 489 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Capital instruments, equity and reserves The principal terms of the AT1 securities are described below: ▪ AT1 securities rank behind the claims against Barclays PLC of i) unsubordinated creditors; ii) claims which are expressed to be subordinated to the claims of unsubordinated creditors of Barclays PLC but not further or otherwise; or iii) claims which are, or are expressed to be, junior to the claims of other creditors of Barclays PLC, whether subordinated or unsubordinated, other than claims which rank, or are expressed to rank, pari passu with, or junior to, the claims of holders of the AT1 securities. ▪ AT1 securities are undated and are redeemable, at the option of Barclays PLC, in whole on (i) the initial reset date, or on any fifth anniversary after the initial reset date or (ii) any day falling in a named period ending on the initial reset date, or on any fifth anniversary after the initial reset date. In addition, the AT1 securities are redeemable, at the option of Barclays PLC, in whole in the event of certain changes in the tax or regulatory treatment of the securities. Any redemptions require the prior consent of the PRA. ▪ Interest on the AT1 securities will be due and payable only at the sole discretion of Barclays PLC, and Barclays PLC has sole and absolute discretion at all times and for any reason to cancel (in whole or in part) any interest payment that would otherwise be payable on any interest payment date. . 29 Reserves Currency translation reserve The currency translation reserve represents the cumulative gains and losses on the retranslation of the Group’s net investment in foreign operations, net of the effects of hedging. Fair value through other comprehensive income reserve The fair value through other comprehensive income reserve represents the changes in the fair value of financial instruments accounted for at fair value through other comprehensive income investments since initial recognition. Cash flow hedging reserve The cash flow hedging reserve represents the cumulative gains and losses on effective cash flow hedging instruments that will be recycled to profit or loss when the hedged transactions affect profit or loss. Own credit reserve The own credit reserve reflects the cumulative own credit gains and losses on financial liabilities at fair value. Amounts in the own credit reserve are not recycled to profit or loss in future periods. Other reserves and treasury shares Other reserves relate to redeemed ordinary and preference shares issued by the Group. Treasury shares relate to Barclays PLC shares held in relation to the Group’s various share schemes. These schemes are described in Note 32. Treasury shares are deducted from shareholders’ equity within other reserves. A transfer is made to retained earnings in line with the vesting of treasury shares held for the purposes of share-based payments. 2022 2021 £m £m Currency translation reserve 4,772 2,740 Fair value through other comprehensive income reserve (1,560) (283) Cash flow hedging reserve (7,235) (853) Own credit reserve 467 (960) Other reserves and treasury shares 1,364 1,126 Total (2,192) 1,770

Barclays PLC - Annual Report - 2022 Page 490 Page 492

Barclays PLC - Annual Report - 2022 Page 490 Page 492