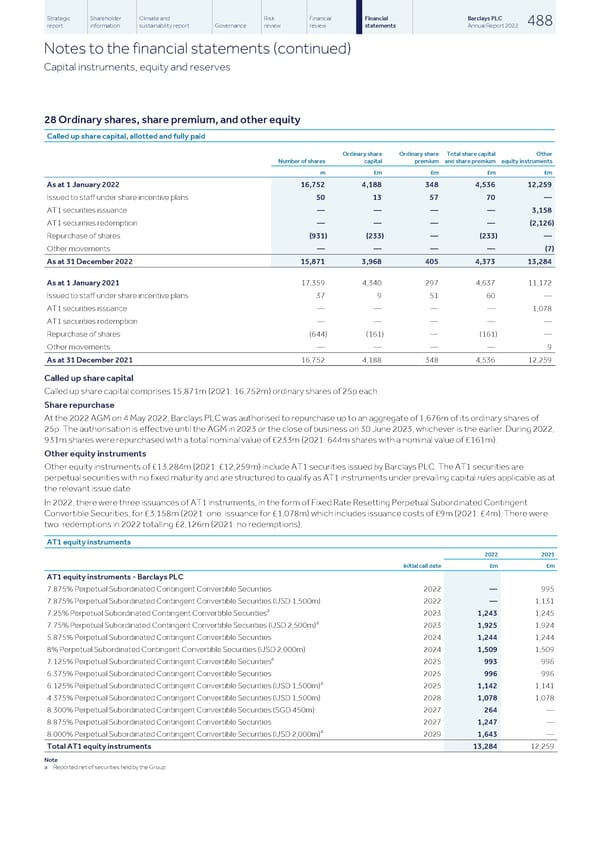

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 488 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Capital instruments, equity and reserves 28 Ordinary shares, share premium, and other equity Called up share capital, allotted and fully paid Ordinary share Ordinary share Total share capital Other Number of shares capital premium and share premium equity instruments m £m £m £m £m As at 1 January 2022 16,752 4,188 348 4,536 12,259 Issued to staff under share incentive plans 50 13 57 70 — AT1 securities issuance — — — — 3,158 AT1 securities redemption — — — — (2,126) Repurchase of shares (931) (233) — (233) — Other movements — — — — (7) As at 31 December 2022 15,871 3,968 405 4,373 13,284 As at 1 January 2021 17,359 4,340 297 4,637 11,172 Issued to staff under share incentive plans 37 9 51 60 — AT1 securities issuance — — — — 1,078 AT1 securities redemption — — — — — Repurchase of shares (644) (161) — (161) — Other movements — — — — 9 As at 31 December 2021 16,752 4,188 348 4,536 12,259 Called up share capital Called up share capital comprises 15,871m (2021: 16,752m) ordinary shares of 25p each. Share repurchase At the 2022 AGM on 4 May 2022, Barclays PLC was authorised to repurchase up to an aggregate of 1,676m of its ordinary shares of 25p. The authorisation is effective until the AGM in 2023 or the close of business on 30 June 2023, whichever is the earlier. During 2022, 931m shares were repurchased with a total nominal value of £233m (2021: 644m shares with a nominal value of £161m). Other equity instruments Other equity instruments of £13,284m (2021: £12,259m) include AT1 securities issued by Barclays PLC. The AT1 securities are perpetual securities with no fixed maturity and are structured to qualify as AT1 instruments under prevailing capital rules applicable as at the relevant issue date. In 2022, there were three issuances of AT1 instruments, in the form of Fixed Rate Resetting Perpetual Subordinated Contingent Convertible Securities, for £3,158m (2021: one issuance for £1,078m) which includes issuance costs of £9m (2021: £4m). There were two redemptions in 2022 totalling £2,126m (2021: no redemptions). AT1 equity instruments 2022 2021 Initial call date £m £m AT1 equity instruments - Barclays PLC — 7.875% Perpetual Subordinated Contingent Convertible Securities 2022 995 — 7.875% Perpetual Subordinated Contingent Convertible Securities (USD 1,500m) 2022 1,131 a 1,243 7.25% Perpetual Subordinated Contingent Convertible Securities 2023 1,245 a 1,925 7.75% Perpetual Subordinated Contingent Convertible Securities (USD 2,500m) 2023 1,924 1,244 5.875% Perpetual Subordinated Contingent Convertible Securities 2024 1,244 1,509 8% Perpetual Subordinated Contingent Convertible Securities (USD 2,000m) 2024 1,509 a 993 7.125% Perpetual Subordinated Contingent Convertible Securities 2025 996 996 6.375% Perpetual Subordinated Contingent Convertible Securities 2025 996 a 1,142 6.125% Perpetual Subordinated Contingent Convertible Securities (USD 1,500m) 2025 1,141 1,078 4.375% Perpetual Subordinated Contingent Convertible Securities (USD 1,500m) 2028 1,078 264 8.300% Perpetual Subordinated Contingent Convertible Securities (SGD 450m) 2027 — 1,247 8.875% Perpetual Subordinated Contingent Convertible Securities 2027 — a 8.000% Perpetual Subordinated Contingent Convertible Securities (USD 2,000m) 2029 1,643 — Total AT1 equity instruments 13,284 12,259 Note a Reported net of securities held by the Group.

Barclays PLC - Annual Report - 2022 Page 489 Page 491

Barclays PLC - Annual Report - 2022 Page 489 Page 491