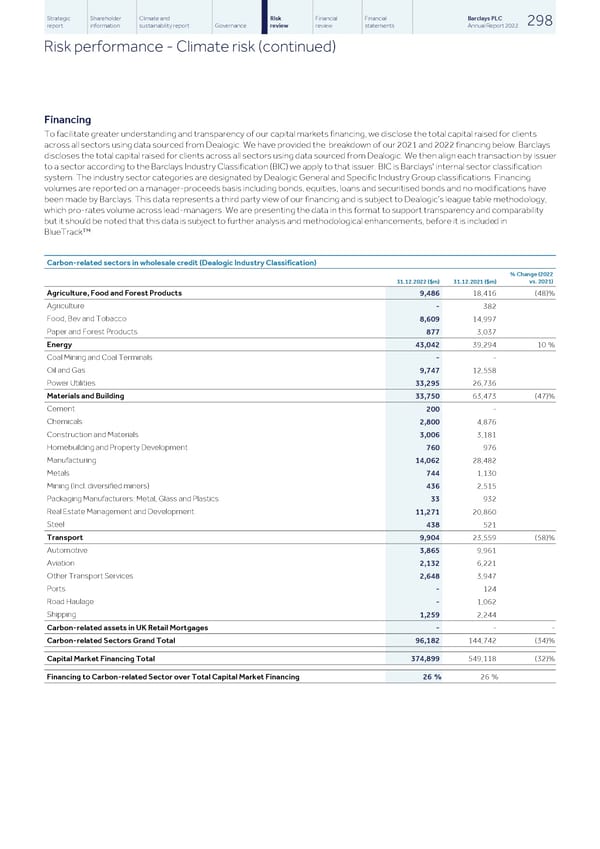

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 298 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Climate risk (continued) Financing To facilitate greater understanding and transparency of our capital markets financing, we disclose the total capital raised for clients across all sectors using data sourced from Dealogic. We have provided the breakdown of our 2021 and 2022 financing below. Barclays discloses the total capital raised for clients across all sectors using data sourced from Dealogic. We then align each transaction by issuer to a sector according to the Barclays Industry Classification (BIC) we apply to that issuer. BIC is Barclays' internal sector classification system. The industry sector categories are designated by Dealogic General and Specific Industry Group classifications. Financing volumes are reported on a manager-proceeds basis including bonds, equities, loans and securitised bonds and no modifications have been made by Barclays. This data represents a third party view of our financing and is subject to Dealogic’s league table methodology, which pro-rates volume across lead-managers. We are presenting the data in this format to support transparency and comparability but it should be noted that this data is subject to further analysis and methodological enhancements, before it is included in BlueTrack™. Carbon-related sectors in wholesale credit (Dealogic Industry Classification) % Change (2022 vs. 2021) 31.12.2022 ($m) 31.12.2021 ($m) Agriculture, Food and Forest Products 9,486 18,416 (48) % Agriculture - 382 Food, Bev and Tobacco 8,609 14,997 Paper and Forest Products 877 3,037 Energy 43,042 39,294 10 % Coal Mining and Coal Terminals - - Oil and Gas 9,747 12,558 Power Utilities 33,295 26,736 Materials and Building 33,750 63,473 (47) % Cement 200 - Chemicals 2,800 4,876 Construction and Materials 3,006 3,181 Homebuilding and Property Development 760 976 Manufacturing 14,062 28,482 Metals 744 1,130 Mining (Incl. diversified miners) 436 2,515 Packaging Manufacturers: Metal, Glass and Plastics 33 932 Real Estate Management and Development 11,271 20,860 Steel 438 521 Transport 9,904 23,559 (58) % Automotive 3,865 9,961 Aviation 2,132 6,221 Other Transport Services 2,648 3,947 Ports - 124 Road Haulage - 1,062 Shipping 1,259 2,244 Carbon-related assets in UK Retail Mortgages - - - Carbon-related Sectors Grand Total 96,182 144,742 (34) % Capital Market Financing Total 374,899 549,118 (32) % Financing to Carbon-related Sector over Total Capital Market Financing 26 % 26 %

Barclays PLC - Annual Report - 2022 Page 299 Page 301

Barclays PLC - Annual Report - 2022 Page 299 Page 301