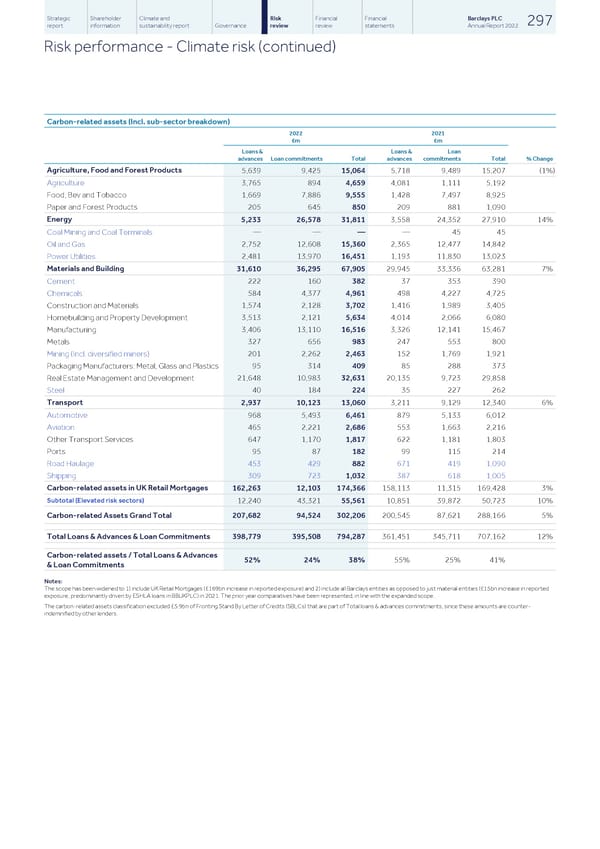

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 297 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Climate risk (continued) Carbon-related assets (Incl. sub-sector breakdown) 2022 2021 £m £m Loans & Loans & Loan advances Loan commitments Total advances commitments Total % Change Agriculture, Food and Forest Products 5,639 9,425 15,064 5,718 9,489 15,207 (1%) 3,765 894 4,659 4,081 1,111 5,192 Agriculture 1,669 7,886 9,555 1,428 7,497 8,925 Food, Bev and Tobacco 205 645 850 209 881 1,090 Paper and Forest Products Energy 5,233 26,578 31,811 3,558 24,352 27,910 14% — — — — 45 45 Coal Mining and Coal Terminals 2,752 12,608 15,360 2,365 12,477 14,842 Oil and Gas 2,481 13,970 16,451 1,193 11,830 13,023 Power Utilities Materials and Building 31,610 36,295 67,905 29,945 33,336 63,281 7% 222 160 382 37 353 390 Cement 584 4,377 4,961 498 4,227 4,725 Chemicals 1,574 2,128 3,702 1,416 1,989 3,405 Construction and Materials 3,513 2,121 5,634 4,014 2,066 6,080 Homebuilding and Property Development 3,406 13,110 16,516 3,326 12,141 15,467 Manufacturing 327 656 983 247 553 800 Metals 201 2,262 2,463 152 1,769 1,921 Mining (Incl. diversified miners) 95 314 409 85 288 373 Packaging Manufacturers: Metal, Glass and Plastics 21,648 10,983 32,631 20,135 9,723 29,858 Real Estate Management and Development 40 184 224 35 227 262 Steel Transport 2,937 10,123 13,060 3,211 9,129 12,340 6% 968 5,493 6,461 879 5,133 6,012 Automotive 465 2,221 2,686 553 1,663 2,216 Aviation 647 1,170 1,817 622 1,181 1,803 Other Transport Services 95 87 182 99 115 214 Ports 453 429 882 671 419 1,090 Road Haulage 309 723 1,032 387 618 1,005 Shipping Carbon-related assets in UK Retail Mortgages 162,263 12,103 174,366 158,113 11,315 169,428 3% Subtotal (Elevated risk sectors) 12,240 43,321 55,561 10,851 39,872 50,723 10% Carbon-related Assets Grand Total 207,682 94,524 302,206 200,545 87,621 288,166 5% Total Loans & Advances & Loan Commitments 398,779 395,508 794,287 361,451 345,711 707,162 12% Carbon-related assets / Total Loans & Advances 52% 24% 38% 55% 25% 41% & Loan Commitments Notes: The scope has been widened to 1) include UK Retail Mortgages (£169bn increase in reported exposure) and 2) include all Barclays entities as opposed to just material entities (£15bn increase in reported exposure, predominantly driven by ESHLA loans in BBUKPLC) in 2021. The prior year comparatives have been represented, in line with the expanded scope. The carbon-related assets classification excluded £5.9bn of Fronting Stand By Letter of Credits (SBLCs) that are part of Total loans & advances commitments, since these amounts are counter- indemnified by other lenders.

Barclays PLC - Annual Report - 2022 Page 298 Page 300

Barclays PLC - Annual Report - 2022 Page 298 Page 300