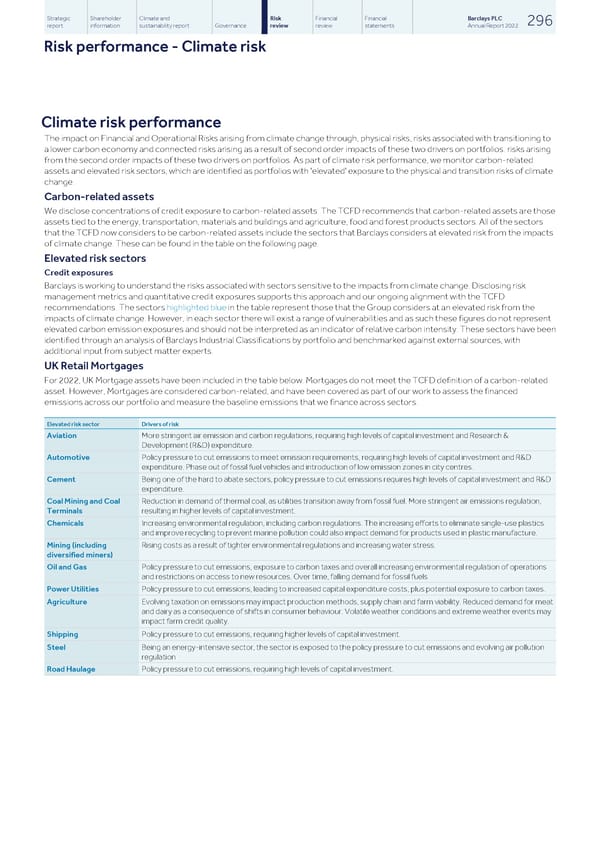

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 296 report information sustainability report Governance review review statements Annual Report 2022 Risk performance - Climate risk Climate risk performance The impact on Financial and Operational Risks arising from climate change through, physical risks, risks associated with transitioning to a lower carbon economy and connected risks arising as a result of second order impacts of these two drivers on portfolios. risks arising from the second order impacts of these two drivers on portfolios. As part of climate risk performance, we monitor carbon-related assets and elevated risk sectors, which are identified as portfolios with 'elevated' exposure to the physical and transition risks of climate change. Carbon-related assets We disclose concentrations of credit exposure to carbon-related assets. The TCFD recommends that carbon-related assets are those assets tied to the energy, transportation, materials and buildings and agriculture, food and forest products sectors. All of the sectors that the TCFD now considers to be carbon-related assets include the sectors that Barclays considers at elevated risk from the impacts of climate change. These can be found in the table on the following page. Elevated risk sectors Credit exposures Barclays is working to understand the risks associated with sectors sensitive to the impacts from climate change. Disclosing risk management metrics and quantitative credit exposures supports this approach and our ongoing alignment with the TCFD recommendations. The sectors highlighted blue in the table represent those that the Group considers at an elevated risk from the impacts of climate change. However, in each sector there will exist a range of vulnerabilities and as such these figures do not represent elevated carbon emission exposures and should not be interpreted as an indicator of relative carbon intensity. These sectors have been identified through an analysis of Barclays Industrial Classifications by portfolio and benchmarked against external sources, with additional input from subject matter experts. UK Retail Mortgages For 2022, UK Mortgage assets have been included in the table below. Mortgages do not meet the TCFD definition of a carbon-related asset. However, Mortgages are considered carbon-related, and have been covered as part of our work to assess the financed emissions across our portfolio and measure the baseline emissions that we finance across sectors. Elevated risk sector Drivers of risk Aviation More stringent air emission and carbon regulations, requiring high levels of capital investment and Research & Development (R&D) expenditure. Automotive Policy pressure to cut emissions to meet emission requirements, requiring high levels of capital investment and R&D expenditure. Phase out of fossil fuel vehicles and introduction of low emission zones in city centres. Cement Being one of the hard to abate sectors, policy pressure to cut emissions requires high levels of capital investment and R&D expenditure. Coal Mining and Coal Reduction in demand of thermal coal, as utilities transition away from fossil fuel. More stringent air emissions regulation, Terminals resulting in higher levels of capital investment. Chemicals Increasing environmental regulation, including carbon regulations. The increasing efforts to eliminate single-use plastics and improve recycling to prevent marine pollution could also impact demand for products used in plastic manufacture. Mining (including Rising costs as a result of tighter environmental regulations and increasing water stress. diversified miners) Oil and Gas Policy pressure to cut emissions, exposure to carbon taxes and overall increasing environmental regulation of operations and restrictions on access to new resources. Over time, falling demand for fossil fuels Power Utilities Policy pressure to cut emissions, leading to increased capital expenditure costs, plus potential exposure to carbon taxes. Agriculture Evolving taxation on emissions may impact production methods, supply chain and farm viability. Reduced demand for meat and dairy as a consequence of shifts in consumer behaviour. Volatile weather conditions and extreme weather events may impact farm credit quality. Shipping Policy pressure to cut emissions, requiring higher levels of capital investment. Steel Being an energy-intensive sector, the sector is exposed to the policy pressure to cut emissions and evolving air pollution regulation Road Haulage Policy pressure to cut emissions, requiring high levels of capital investment.

Barclays PLC - Annual Report - 2022 Page 297 Page 299

Barclays PLC - Annual Report - 2022 Page 297 Page 299