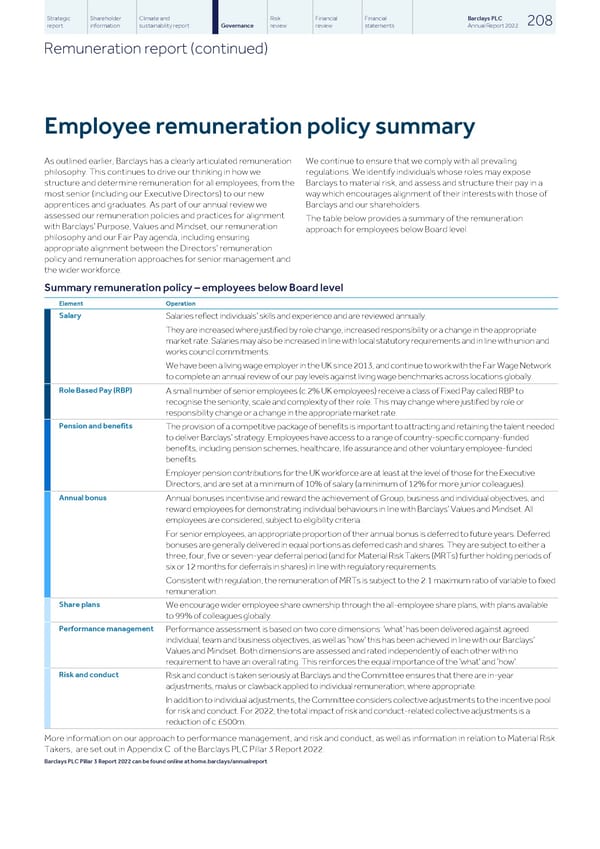

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 208 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Employee remuneration policy summary As outlined earlier, Barclays has a clearly articulated remuneration We continue to ensure that we comply with all prevailing philosophy. This continues to drive our thinking in how we regulations. We identify individuals whose roles may expose structure and determine remuneration for all employees, from the Barclays to material risk, and assess and structure their pay in a most senior (including our Executive Directors) to our new way which encourages alignment of their interests with those of apprentices and graduates. As part of our annual review we Barclays and our shareholders. assessed our remuneration policies and practices for alignment The table below provides a summary of the remuneration with Barclays’ Purpose, Values and Mindset, our remuneration approach for employees below Board level. philosophy and our Fair Pay agenda, including ensuring appropriate alignment between the Directors’ remuneration policy and remuneration approaches for senior management and the wider workforce. Summary remuneration policy – employees below Board level Element Operation Salary Salaries reflect individuals’ skills and experience and are reviewed annually. They are increased where justified by role change, increased responsibility or a change in the appropriate market rate. Salaries may also be increased in line with local statutory requirements and in line with union and works council commitments. We have been a living wage employer in the UK since 2013, and continue to work with the Fair Wage Network to complete an annual review of our pay levels against living wage benchmarks across locations globally. Role Based Pay (RBP) A small number of senior employees (c.2% UK employees) receive a class of Fixed Pay called RBP to recognise the seniority, scale and complexity of their role. This may change where justified by role or responsibility change or a change in the appropriate market rate. Pension and benefits The provision of a competitive package of benefits is important to attracting and retaining the talent needed to deliver Barclays’ strategy. Employees have access to a range of country-specific company-funded benefits, including pension schemes, healthcare, life assurance and other voluntary employee-funded benefits. Employer pension contributions for the UK workforce are at least at the level of those for the Executive Directors, and are set at a minimum of 10% of salary (a minimum of 12% for more junior colleagues). Annual bonus Annual bonuses incentivise and reward the achievement of Group, business and individual objectives, and reward employees for demonstrating individual behaviours in line with Barclays’ Values and Mindset. All employees are considered, subject to eligibility criteria. For senior employees, an appropriate proportion of their annual bonus is deferred to future years. Deferred bonuses are generally delivered in equal portions as deferred cash and shares. They are subject to either a three, four, five or seven-year deferral period (and for Material Risk Takers (MRTs) further holding periods of six or 12 months for deferrals in shares) in line with regulatory requirements. Consistent with regulation, the remuneration of MRTs is subject to the 2:1 maximum ratio of variable to fixed remuneration. Share plans We encourage wider employee share ownership through the all-employee share plans, with plans available to 99% of colleagues globally. Performance management Performance assessment is based on two core dimensions: ‘what’ has been delivered against agreed individual, team and business objectives, as well as ‘how’ this has been achieved in line with our Barclays’ Values and Mindset. Both dimensions are assessed and rated independently of each other with no requirement to have an overall rating. This reinforces the equal importance of the ‘what’ and ‘how’. Risk and conduct Risk and conduct is taken seriously at Barclays and the Committee ensures that there are in-year adjustments, malus or clawback applied to individual remuneration, where appropriate. In addition to individual adjustments, the Committee considers collective adjustments to the incentive pool for risk and conduct. For 2022, the total impact of risk and conduct-related collective adjustments is a reduction of c.£500m. More information on our approach to performance management, and risk and conduct, as well as information in relation to Material Risk Takers, are set out in Appendix C of the Barclays PLC Pillar 3 Report 2022. Barclays PLC Pillar 3 Report 2022 can be found online at home.barclays/annualreport

Barclays PLC - Annual Report - 2022 Page 209 Page 211

Barclays PLC - Annual Report - 2022 Page 209 Page 211