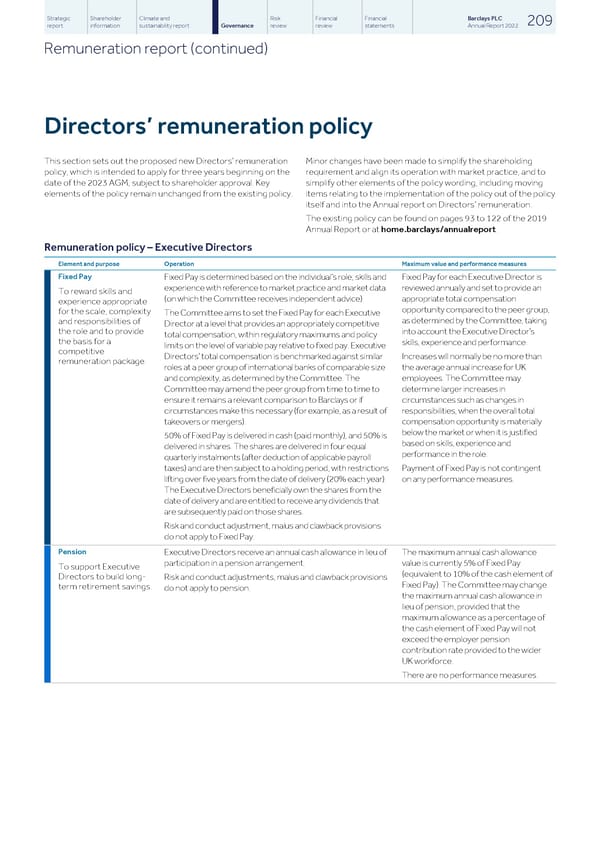

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 209 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Directors’ remuneration policy This section sets out the proposed new Directors’ remuneration Minor changes have been made to simplify the shareholding policy, which is intended to apply for three years beginning on the requirement and align its operation with market practice, and to date of the 2023 AGM, subject to shareholder approval. Key simplify other elements of the policy wording, including moving elements of the policy remain unchanged from the existing policy. items relating to the implementation of the policy out of the policy itself and into the Annual report on Directors’ remuneration. The existing policy can be found on pages 93 to 122 of the 2019 Annual Report or at home.barclays/annualreport. Remuneration policy – Executive Directors Element and purpose Operation Maximum value and performance measures Fixed Pay Fixed Pay is determined based on the individual’s role, skills and Fixed Pay for each Executive Director is experience with reference to market practice and market data reviewed annually and set to provide an To reward skills and (on which the Committee receives independent advice). appropriate total compensation experience appropriate opportunity compared to the peer group, for the scale, complexity The Committee aims to set the Fixed Pay for each Executive as determined by the Committee, taking and responsibilities of Director at a level that provides an appropriately competitive the role and to provide into account the Executive Director’s total compensation, within regulatory maximums and policy the basis for a skills, experience and performance. limits on the level of variable pay relative to fixed pay. Executive competitive Directors’ total compensation is benchmarked against similar Increases will normally be no more than remuneration package. roles at a peer group of international banks of comparable size the average annual increase for UK and complexity, as determined by the Committee. The employees. The Committee may Committee may amend the peer group from time to time to determine larger increases in ensure it remains a relevant comparison to Barclays or if circumstances such as changes in circumstances make this necessary (for example, as a result of responsibilities, when the overall total takeovers or mergers). compensation opportunity is materially below the market or when it is justified 50% of Fixed Pay is delivered in cash (paid monthly), and 50% is based on skills, experience and delivered in shares. The shares are delivered in four equal performance in the role. quarterly instalments (after deduction of applicable payroll taxes) and are then subject to a holding period, with restrictions Payment of Fixed Pay is not contingent lifting over five years from the date of delivery (20% each year). on any performance measures. The Executive Directors beneficially own the shares from the date of delivery and are entitled to receive any dividends that are subsequently paid on those shares. Risk and conduct adjustment, malus and clawback provisions do not apply to Fixed Pay. Pension Executive Directors receive an annual cash allowance in lieu of The maximum annual cash allowance participation in a pension arrangement. value is currently 5% of Fixed Pay To support Executive (equivalent to 10% of the cash element of Directors to build long- Risk and conduct adjustments, malus and clawback provisions Fixed Pay). The Committee may change term retirement savings. do not apply to pension. the maximum annual cash allowance in lieu of pension, provided that the maximum allowance as a percentage of the cash element of Fixed Pay will not exceed the employer pension contribution rate provided to the wider UK workforce. There are no performance measures.

Barclays PLC - Annual Report - 2022 Page 210 Page 212

Barclays PLC - Annual Report - 2022 Page 210 Page 212