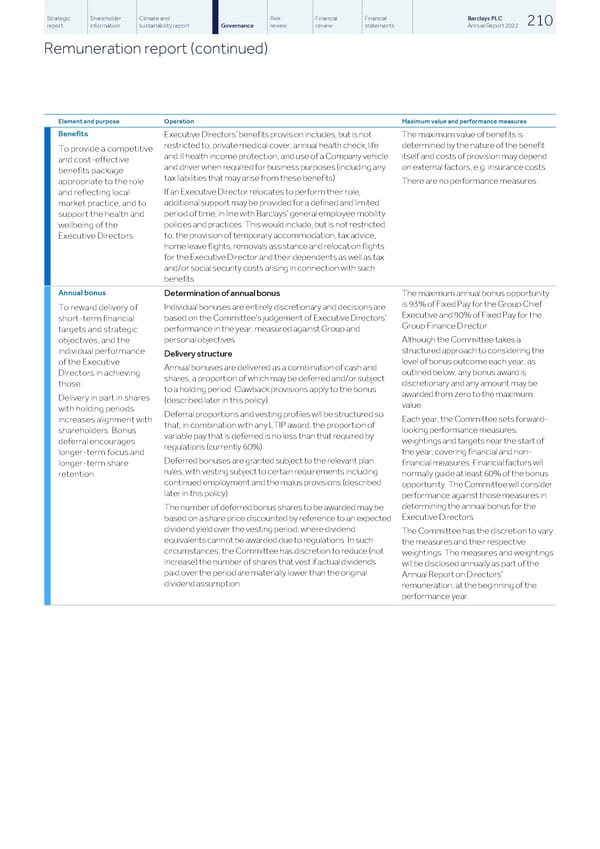

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 210 report information sustainability report Governance review review statements Annual Report 2022 Remuneration report (continued) Element and purpose Operation Maximum value and performance measures Benefits Executive Directors’ benefits provision includes, but is not The maximum value of benefits is restricted to, private medical cover, annual health check, life determined by the nature of the benefit To provide a competitive and ill health income protection, and use of a Company vehicle itself and costs of provision may depend and cost-effective and driver when required for business purposes (including any on external factors, e.g. insurance costs. benefits package tax liabilities that may arise from these benefits). There are no performance measures. appropriate to the role If an Executive Director relocates to perform their role, and reflecting local additional support may be provided for a defined and limited market practice, and to period of time, in line with Barclays’ general employee mobility support the health and policies and practices. This would include, but is not restricted wellbeing of the to, the provision of temporary accommodation, tax advice, Executive Directors. home leave flights, removals assistance and relocation flights for the Executive Director and their dependents as well as tax and/or social security costs arising in connection with such benefits. Annual bonus Determination of annual bonus The maximum annual bonus opportunity is 93% of Fixed Pay for the Group Chief Individual bonuses are entirely discretionary and decisions are To reward delivery of Executive and 90% of Fixed Pay for the based on the Committee’s judgement of Executive Directors’ short-term financial Group Finance Director. performance in the year, measured against Group and targets and strategic personal objectives. Although the Committee takes a objectives, and the structured approach to considering the individual performance Delivery structure level of bonus outcome each year, as of the Executive Annual bonuses are delivered as a combination of cash and outlined below, any bonus award is Directors in achieving shares, a proportion of which may be deferred and/or subject discretionary and any amount may be those. to a holding period. Clawback provisions apply to the bonus awarded from zero to the maximum Delivery in part in shares (described later in this policy). value. with holding periods Deferral proportions and vesting profiles will be structured so Each year, the Committee sets forward- increases alignment with that, in combination with any LTIP award, the proportion of looking performance measures, shareholders. Bonus variable pay that is deferred is no less than that required by weightings and targets near the start of deferral encourages regulations (currently 60%). the year, covering financial and non- longer-term focus and Deferred bonuses are granted subject to the relevant plan financial measures. Financial factors will longer-term share rules, with vesting subject to certain requirements including normally guide at least 60% of the bonus retention. continued employment and the malus provisions (described opportunity. The Committee will consider later in this policy). performance against those measures in determining the annual bonus for the The number of deferred bonus shares to be awarded may be Executive Directors. based on a share price discounted by reference to an expected dividend yield over the vesting period, where dividend The Committee has the discretion to vary equivalents cannot be awarded due to regulations. In such the measures and their respective circumstances, the Committee has discretion to reduce (not weightings. The measures and weightings increase) the number of shares that vest if actual dividends will be disclosed annually as part of the paid over the period are materially lower than the original Annual Report on Directors’ dividend assumption. remuneration, at the beginning of the performance year.

Barclays PLC - Annual Report - 2022 Page 211 Page 213

Barclays PLC - Annual Report - 2022 Page 211 Page 213