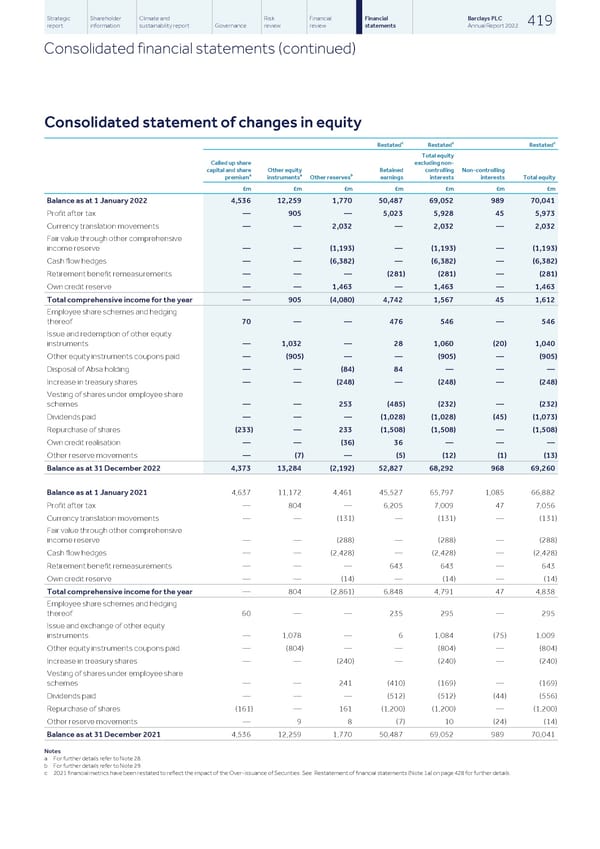

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 419 report information sustainability report Governance review review statements Annual Report 2022 Consolidated financial statements (continued) Consolidated statement of changes in equity c c c Restated Restated Restated Total equity Called up share excluding non- capital and share Other equity Retained controlling Non-controlling a a b premium instruments Other reserves earnings interests interests Total equity £m £m £m £m £m £m £m Balance as at 1 January 2022 4,536 12,259 1,770 50,487 69,052 989 70,041 Profit after tax — 905 — 5,023 5,928 45 5,973 Currency translation movements — — 2,032 — 2,032 — 2,032 Fair value through other comprehensive income reserve — — (1,193) — (1,193) — (1,193) Cash flow hedges — — (6,382) — (6,382) — (6,382) Retirement benefit remeasurements — — — (281) (281) — (281) Own credit reserve — — 1,463 — 1,463 — 1,463 Total comprehensive income for the year — 905 (4,080) 4,742 1,567 45 1,612 Employee share schemes and hedging thereof 70 — — 476 546 — 546 Issue and redemption of other equity instruments — 1,032 — 28 1,060 (20) 1,040 Other equity instruments coupons paid — (905) — — (905) — (905) Disposal of Absa holding — — (84) 84 — — — Increase in treasury shares — — (248) — (248) — (248) Vesting of shares under employee share schemes — — 253 (485) (232) — (232) Dividends paid — — — (1,028) (1,028) (45) (1,073) Repurchase of shares (233) — 233 (1,508) (1,508) — (1,508) Own credit realisation — — (36) 36 — — — Other reserve movements — (7) — (5) (12) (1) (13) Balance as at 31 December 2022 4,373 13,284 (2,192) 52,827 68,292 968 69,260 Balance as at 1 January 2021 4,637 11,172 4,461 45,527 65,797 1,085 66,882 Profit after tax — 804 — 6,205 7,009 47 7,056 Currency translation movements — — (131) — (131) — (131) Fair value through other comprehensive income reserve — — (288) — (288) — (288) Cash flow hedges — — (2,428) — (2,428) — (2,428) Retirement benefit remeasurements — — — 643 643 — 643 Own credit reserve — — (14) — (14) — (14) Total comprehensive income for the year — 804 (2,861) 6,848 4,791 47 4,838 Employee share schemes and hedging thereof 60 — — 235 295 — 295 Issue and exchange of other equity instruments — 1,078 — 6 1,084 (75) 1,009 Other equity instruments coupons paid — (804) — — (804) — (804) Increase in treasury shares — — (240) — (240) — (240) Vesting of shares under employee share schemes — — 241 (410) (169) — (169) Dividends paid — — — (512) (512) (44) (556) Repurchase of shares (161) — 161 (1,200) (1,200) — (1,200) Other reserve movements — 9 8 (7) 10 (24) (14) Balance as at 31 December 2021 4,536 12,259 1,770 50,487 69,052 989 70,041 Notes a For further details refer to Note 28. b For further details refer to Note 29. c 2021 financial metrics have been restated to reflect the impact of the Over-issuance of Securities. See Restatement of financial statements (Note 1a) on page 428 for further details.

Barclays PLC - Annual Report - 2022 Page 420 Page 422

Barclays PLC - Annual Report - 2022 Page 420 Page 422