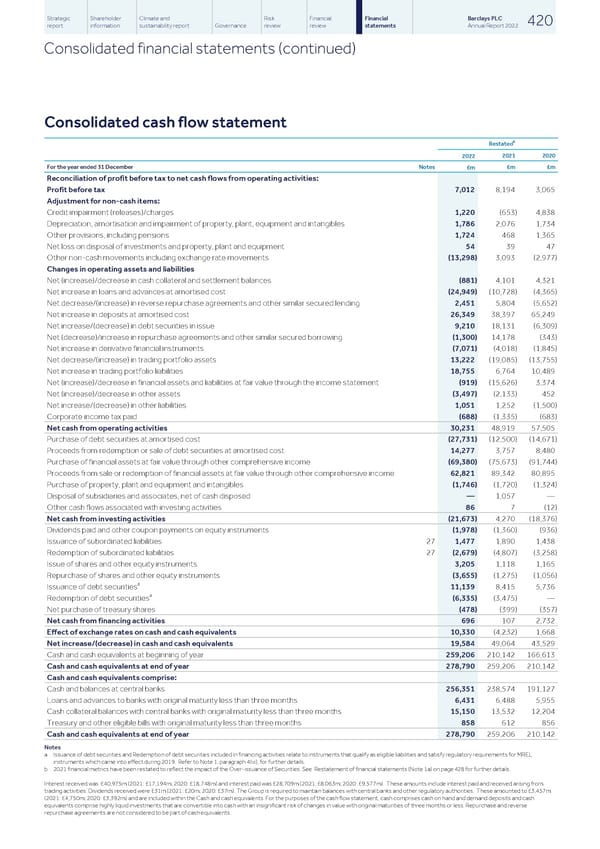

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 420 report information sustainability report Governance review review statements Annual Report 2022 Consolidated financial statements (continued) Consolidated cash flow statement b Restated 2021 2020 2022 For the year ended 31 December Notes £m £m £m Reconciliation of profit before tax to net cash flows from operating activities: Profit before tax 7,012 8,194 3,065 Adjustment for non-cash items: Credit impairment (releases)/charges 1,220 (653) 4,838 Depreciation, amortisation and impairment of property, plant, equipment and intangibles 1,786 2,076 1,734 Other provisions, including pensions 1,724 468 1,365 Net loss on disposal of investments and property, plant and equipment 54 39 47 Other non-cash movements including exchange rate movements (13,298) 3,093 (2,977) Changes in operating assets and liabilities Net (increase)/decrease in cash collateral and settlement balances (881) 4,101 4,321 Net increase in loans and advances at amortised cost (24,949) (10,728) (4,365) Net decrease/(increase) in reverse repurchase agreements and other similar secured lending 2,451 5,804 (5,652) Net increase in deposits at amortised cost 26,349 38,397 65,249 Net increase/(decrease) in debt securities in issue 9,210 18,131 (6,309) Net (decrease)/increase in repurchase agreements and other similar secured borrowing (1,300) 14,178 (343) Net increase in derivative financial instruments (7,071) (4,018) (1,845) Net decrease/(increase) in trading portfolio assets 13,222 (19,085) (13,755) Net increase in trading portfolio liabilities 18,755 6,764 10,489 Net (increase)/decrease in financial assets and liabilities at fair value through the income statement (919) (15,626) 3,374 Net (increase)/decrease in other assets (3,497) (2,133) 452 Net increase/(decrease) in other liabilities 1,051 1,252 (1,500) Corporate income tax paid (688) (1,335) (683) Net cash from operating activities 30,231 48,919 57,505 Purchase of debt securities at amortised cost (27,731) (12,500) (14,671) Proceeds from redemption or sale of debt securities at amortised cost 14,277 3,757 8,480 Purchase of financial assets at fair value through other comprehensive income (69,380) (75,673) (91,744) Proceeds from sale or redemption of financial assets at fair value through other comprehensive income 62,821 89,342 80,895 Purchase of property, plant and equipment and intangibles (1,746) (1,720) (1,324) Disposal of subsidiaries and associates, net of cash disposed — 1,057 — Other cash flows associated with investing activities 86 7 (12) Net cash from investing activities (21,673) 4,270 (18,376) Dividends paid and other coupon payments on equity instruments (1,978) (1,360) (936) Issuance of subordinated liabilities 27 1,477 1,890 1,438 Redemption of subordinated liabilities 27 (2,679) (4,807) (3,258) Issue of shares and other equity instruments 3,205 1,118 1,165 Repurchase of shares and other equity instruments (3,655) (1,275) (1,056) a Issuance of debt securities 11,139 8,415 5,736 a Redemption of debt securities (6,335) (3,475) — Net purchase of treasury shares (478) (399) (357) Net cash from financing activities 696 107 2,732 Effect of exchange rates on cash and cash equivalents 10,330 (4,232) 1,668 Net increase/(decrease) in cash and cash equivalents 19,584 49,064 43,529 Cash and cash equivalents at beginning of year 259,206 210,142 166,613 Cash and cash equivalents at end of year 278,790 259,206 210,142 Cash and cash equivalents comprise: Cash and balances at central banks 256,351 238,574 191,127 Loans and advances to banks with original maturity less than three months 6,431 6,488 5,955 Cash collateral balances with central banks with original maturity less than three months 15,150 13,532 12,204 Treasury and other eligible bills with original maturity less than three months 858 612 856 Cash and cash equivalents at end of year 278,790 259,206 210,142 Notes a Issuance of debt securities and Redemption of debt securities included in financing activities relate to instruments that qualify as eligible liabilities and satisfy regulatory requirements for MREL instruments which came into effect during 2019. Refer to Note 1, paragraph 4(vi), for further details. b 2021 financial metrics have been restated to reflect the impact of the Over-issuance of Securities. See Restatement of financial statements (Note 1a) on page 428 for further details. Interest received was £40,975m (2021: £17,194m; 2020: £18,748m) and interest paid was £28,709m (2021: £8,063m; 2020: £9,577m). These amounts include interest paid and received arising from trading activities. Dividends received were £31m (2021: £20m; 2020: £37m). The Group is required to maintain balances with central banks and other regulatory authorities. These amounted to £3,457m (2021: £4,750m; 2020: £3,392m) and are included within the Cash and cash equivalents. For the purposes of the cash flow statement, cash comprises cash on hand and demand deposits and cash equivalents comprise highly liquid investments that are convertible into cash with an insignificant risk of changes in value with original maturities of three months or less. Repurchase and reverse repurchase agreements are not considered to be part of cash equivalents.

Barclays PLC - Annual Report - 2022 Page 421 Page 423

Barclays PLC - Annual Report - 2022 Page 421 Page 423