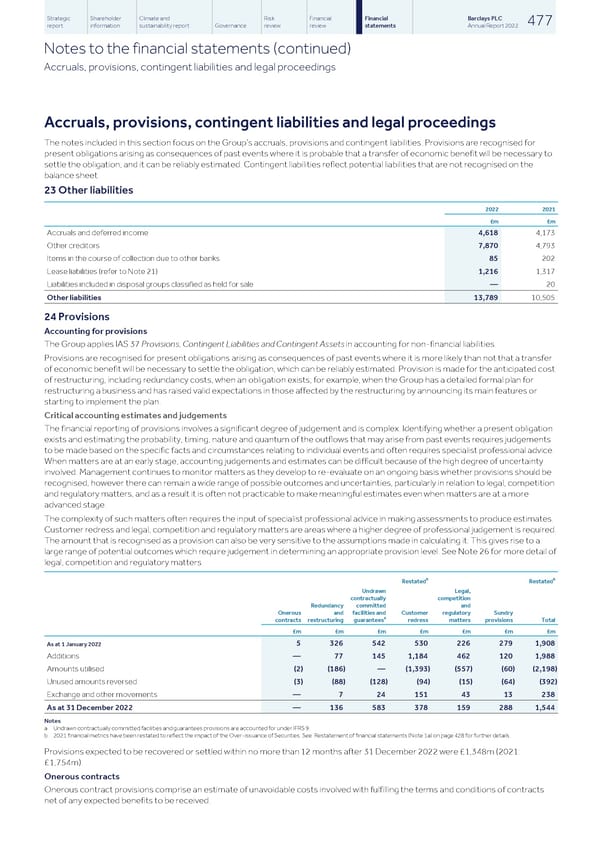

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 477 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Accruals, provisions, contingent liabilities and legal proceedings Accruals, provisions, contingent liabilities and legal proceedings The notes included in this section focus on the Group’s accruals, provisions and contingent liabilities. Provisions are recognised for present obligations arising as consequences of past events where it is probable that a transfer of economic benefit will be necessary to settle the obligation, and it can be reliably estimated. Contingent liabilities reflect potential liabilities that are not recognised on the balance sheet. 23 Other liabilities 2022 2021 £m £m Accruals and deferred income 4,618 4,173 Other creditors 7,870 4,793 Items in the course of collection due to other banks 85 202 Lease liabilities (refer to Note 21) 1,216 1,317 Liabilities included in disposal groups classified as held for sale — 20 Other liabilities 13,789 10,505 24 Provisions Accounting for provisions The Group applies IAS 37 Provisions, Contingent Liabilities and Contingent Assets in accounting for non-financial liabilities. Provisions are recognised for present obligations arising as consequences of past events where it is more likely than not that a transfer of economic benefit will be necessary to settle the obligation, which can be reliably estimated. Provision is made for the anticipated cost of restructuring, including redundancy costs, when an obligation exists; for example, when the Group has a detailed formal plan for restructuring a business and has raised valid expectations in those affected by the restructuring by announcing its main features or starting to implement the plan. Critical accounting estimates and judgements The financial reporting of provisions involves a significant degree of judgement and is complex. Identifying whether a present obligation exists and estimating the probability, timing, nature and quantum of the outflows that may arise from past events requires judgements to be made based on the specific facts and circumstances relating to individual events and often requires specialist professional advice. When matters are at an early stage, accounting judgements and estimates can be difficult because of the high degree of uncertainty involved. Management continues to monitor matters as they develop to re-evaluate on an ongoing basis whether provisions should be recognised, however there can remain a wide range of possible outcomes and uncertainties, particularly in relation to legal, competition and regulatory matters, and as a result it is often not practicable to make meaningful estimates even when matters are at a more advanced stage. The complexity of such matters often requires the input of specialist professional advice in making assessments to produce estimates. Customer redress and legal, competition and regulatory matters are areas where a higher degree of professional judgement is required. The amount that is recognised as a provision can also be very sensitive to the assumptions made in calculating it. This gives rise to a large range of potential outcomes which require judgement in determining an appropriate provision level. See Note 26 for more detail of legal, competition and regulatory matters. b b Restated Restated Undrawn Legal, contractually competition Redundancy committed and Onerous and facilities and Customer regulatory Sundry a contracts restructuring guarantees redress matters provisions Total £m £m £m £m £m £m £m 5 326 542 530 226 279 1,908 As at 1 January 2022 Additions — 77 145 1,184 462 120 1,988 Amounts utilised (2) (186) — (1,393) (557) (60) (2,198) Unused amounts reversed (3) (88) (128) (94) (15) (64) (392) Exchange and other movements — 7 24 151 43 13 238 As at 31 December 2022 — 136 583 378 159 288 1,544 Notes a Undrawn contractually committed facilities and guarantees provisions are accounted for under IFRS 9. b 2021 financial metrics have been restated to reflect the impact of the Over-issuance of Securities. See Restatement of financial statements (Note 1a) on page 428 for further details. Provisions expected to be recovered or settled within no more than 12 months after 31 December 2022 were £1,348m (2021: £1,754m). Onerous contracts Onerous contract provisions comprise an estimate of unavoidable costs involved with fulfilling the terms and conditions of contracts net of any expected benefits to be received.

Barclays PLC - Annual Report - 2022 Page 478 Page 480

Barclays PLC - Annual Report - 2022 Page 478 Page 480