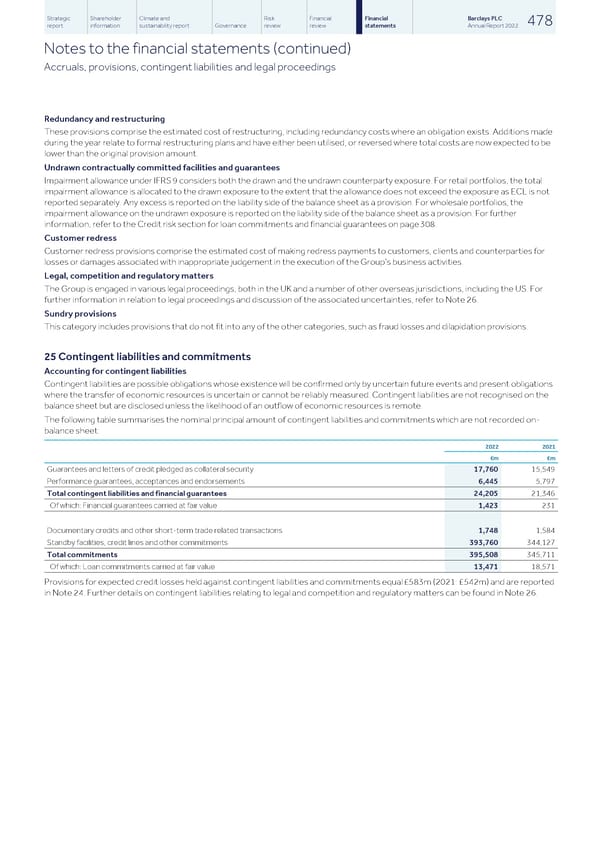

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 478 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Accruals, provisions, contingent liabilities and legal proceedings Redundancy and restructuring These provisions comprise the estimated cost of restructuring, including redundancy costs where an obligation exists. Additions made during the year relate to formal restructuring plans and have either been utilised, or reversed where total costs are now expected to be lower than the original provision amount. Undrawn contractually committed facilities and guarantees Impairment allowance under IFRS 9 considers both the drawn and the undrawn counterparty exposure. For retail portfolios, the total impairment allowance is allocated to the drawn exposure to the extent that the allowance does not exceed the exposure as ECL is not reported separately. Any excess is reported on the liability side of the balance sheet as a provision. For wholesale portfolios, the impairment allowance on the undrawn exposure is reported on the liability side of the balance sheet as a provision. For further information, refer to the Credit risk section for loan commitments and financial guarantees on page 308. Customer redress Customer redress provisions comprise the estimated cost of making redress payments to customers, clients and counterparties for losses or damages associated with inappropriate judgement in the execution of the Group’s business activities. Legal, competition and regulatory matters The Group is engaged in various legal proceedings, both in the UK and a number of other overseas jurisdictions, including the US. For further information in relation to legal proceedings and discussion of the associated uncertainties, refer to Note 26. Sundry provisions This category includes provisions that do not fit into any of the other categories, such as fraud losses and dilapidation provisions. 25 Contingent liabilities and commitments Accounting for contingent liabilities Contingent liabilities are possible obligations whose existence will be confirmed only by uncertain future events and present obligations where the transfer of economic resources is uncertain or cannot be reliably measured. Contingent liabilities are not recognised on the balance sheet but are disclosed unless the likelihood of an outflow of economic resources is remote. The following table summarises the nominal principal amount of contingent liabilities and commitments which are not recorded on- balance sheet: 2022 2021 £m £m Guarantees and letters of credit pledged as collateral security 17,760 15,549 Performance guarantees, acceptances and endorsements 6,445 5,797 Total contingent liabilities and financial guarantees 24,205 21,346 Of which: Financial guarantees carried at fair value 1,423 231 Documentary credits and other short-term trade related transactions 1,748 1,584 Standby facilities, credit lines and other commitments 393,760 344,127 Total commitments 395,508 345,711 Of which: Loan commitments carried at fair value 13,471 18,571 Provisions for expected credit losses held against contingent liabilities and commitments equal £583m (2021: £542m) and are reported in Note 24. Further details on contingent liabilities relating to legal and competition and regulatory matters can be found in Note 26.

Barclays PLC - Annual Report - 2022 Page 479 Page 481

Barclays PLC - Annual Report - 2022 Page 479 Page 481