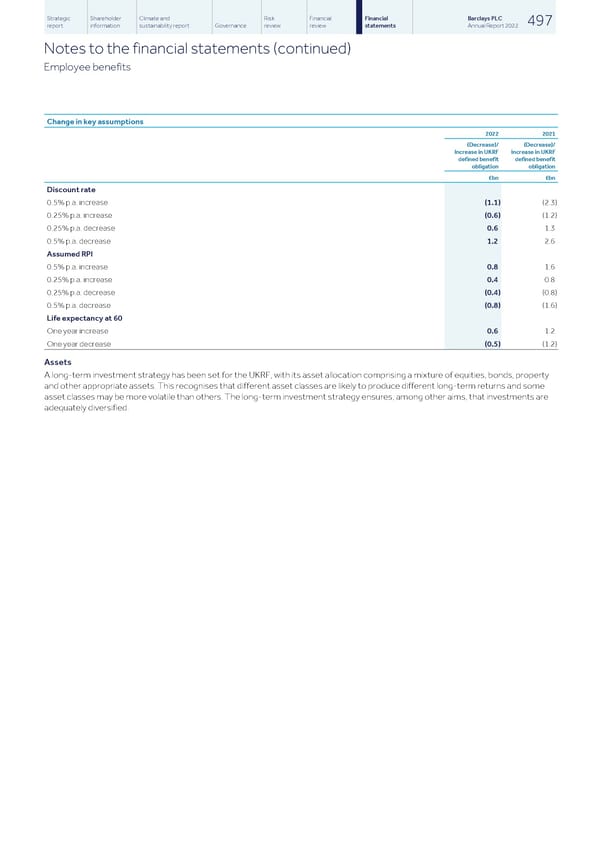

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 497 report information sustainability report Governance review review statements Annual Report 2022 Notes to the financial statements (continued) Employee benefits Change in key assumptions 2022 2021 (Decrease)/ (Decrease)/ Increase in UKRF Increase in UKRF defined benefit defined benefit obligation obligation £bn £bn Discount rate 0.5% p.a. increase (1.1) (2.3) 0.25% p.a. increase (0.6) (1.2) 0.25% p.a. decrease 0.6 1.3 0.5% p.a. decrease 1.2 2.6 Assumed RPI 0.5% p.a. increase 0.8 1.6 0.25% p.a. increase 0.4 0.8 0.25% p.a. decrease (0.4) (0.8) 0.5% p.a. decrease (0.8) (1.6) Life expectancy at 60 One year increase 0.6 1.2 One year decrease (0.5) (1.2) Assets A long-term investment strategy has been set for the UKRF, with its asset allocation comprising a mixture of equities, bonds, property and other appropriate assets. This recognises that different asset classes are likely to produce different long-term returns and some asset classes may be more volatile than others. The long-term investment strategy ensures, among other aims, that investments are adequately diversified.

Barclays PLC - Annual Report - 2022 Page 498 Page 500

Barclays PLC - Annual Report - 2022 Page 498 Page 500